Micron Stock Forecast: 13.61% Gain Since Bullish Forecast

Micron Stock Forecast: 13.61% Gain Since Bullish Forecast

Micron Technology, Inc. is a global leader in advanced semiconductor systems founded in 1978 with headquarters in Boise, Idaho. On October 23rd, I Know First published an article titled “Micron Stock Forecast: Why The Algorithm Still Forecasts A Bullish Signal For Micron Stock” on Seeking Alpha. The algorithm had a signal strength of 33.08 and a predictability indicator of 0.38. Since that time, the stock price has increased 13.61% in accordance with the algorithm’s prediction.

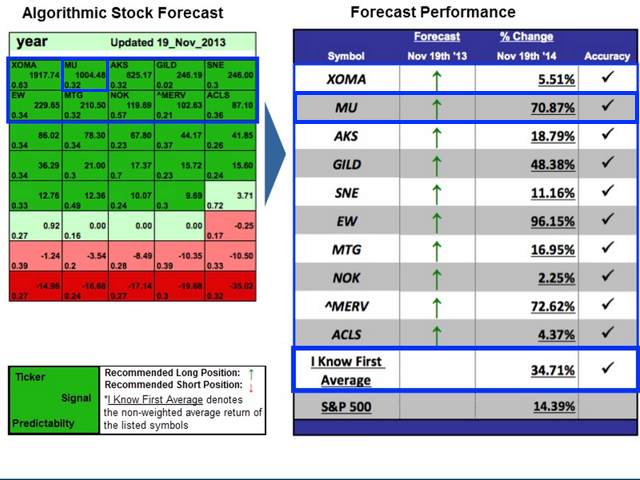

Micron released their last earnings report on September 25th, where they mostly beat expectations. The company had revenue of $4.23 billion for the quarter, up 48.7% over the prior year. They also posted $0.82 earnings per share, beating expectations by $0.02. During the same quarter the previous year, the company had posted $0.20 earnings per share, also showing immense growth over the previous year. The performance of Micron’s stock price has been similarly impressive. As seen in the figure below, the value of the stock increased 70.87% on November 19th from one year earlier.

Much of the company’s improved fortunes can be attributed to the purchase of the Japanese memory-chip producer Elpida Memory in 2013. The purchase of Elpida helped stabilize the memory chip market, which is usually extremely volatile. Micron is one of the three large players in the market, along with Hynix and Samsung, and holds roughly a 30% market share. Since the purchase, demand has grown slightly ahead of supply, facilitating growth for Micron.

The strong performance in the memory chip market has allowed Micron to start buying back shares to return excess capital to investors. On October 27th, the memory-chip maker announced a $1 billion share repurchase program, made possible by strong operating cash flows that will also allow the company to invest in strategic growth initiatives. The company also announced that they spent $389 million to eliminate a convertible debt offering earlier that year, also returning excess capital to investors.