Micron Stock Analysis: Micron Has A Tailwind From Growing Mobile DRAM Revenue

Micron Has A Tailwind From Growing Mobile DRAM Revenue

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- Ignore the noise/anxiety over China’s threat to file anti-trust charges against DRAM leaders like Micron. It is just China making retaliatory threats against Trump’s trade war words.

- Better focus on the fact that mobile DRAM sales continue to surge. Growing mobile DRAM demand can offset declining prices of PC DRAM products.

- Apple’s choice of Micron DRAM for its latest iPhones is a solid tailwind for Micron. Apple’s track record showed it can sell more than 50 million new iPhones per year.

- Micron’s mass production of 10-nm 12GB LPDDR4X mobile DRAM should keep Apple as a customer for a long time.

- MU has obvious notable upside potential because its valuation is way below than that of its peers in the semiconductor industry.

Micron’s (MU) stock price dropped almost 7% yesterday after China announced it has “massive evidence” of DRAM (Dynamic Random Access Memory) products price-fixing conspiracy between Micron, Samsung (SSNLF), and SK Hynix (HSXCF). China’s anti-trust officials have been investigating them since May. These firms are the oligopoly that produces more than 90% of DRAM chips. DRAM revenue surged more than 70% in 2017.

The big surge in DRAM prices last year is why Micron produced impressive quarter-to-quarter growth rate in its net income since 2017. For the past six quarters, Micron saw its quarterly net income grow from $1.647 billion to $4.326 billion. DRAM sales account for 70% of Micron’s revenue.

I opine China’s new allegation of ‘massive evidence’ is just a retaliatory statement against the U.S. Department of Justice’s recent decision to charge Fujian Jinhua Integrated Circuit Company and its Taiwanese partner, United Microelectronics Corporation with intellectual property theft. Fujian Jinhua is a Chinese state-owned semiconductor firm. These antagonistic announcements are all part of the persisting trade war between the U.S. and China.

Yes, Micron Is Vulnerable To China’s Whims

The high anxiety level of investors over China’s anti-trust investigation is understandable. China accounted for 51% of Micron’s semiconductor sales. If Trump and his minions keep provoking China, Xi Jinping’s minions will continue to make threats about possibly penalizing U.S. firms (like Micron) with anti-trust fines and/or outright sales ban of their products. The emerging fear now is China can seriously derail Micron’s surging quarterly revenue and net income.

On the other hand, I am not really scared of China’s regulators truly having enough evidence to prove in court that Micron conspired with Samsung and SK Hynix. DRAM prices soared over the last few quarters because of those three companies’ previous inability to supply demand. Further, China’s PC/smartphone/tablet manufacturers will still continue to depend on foreign brands of semiconductor chips. China’s rulers cannot risk an outright ban on Micron DRAM or NAND storage chips.

Unlike in the oil industry, nobody can really prove that DRAM firms intentionally conspired to limit their DRAM production in 2017 to boost prices. The reality was, Samsung, Micron, and SK Hynix did not have enough factories to meet the increased demand from the recovering PC industry and growing smartphone sales.

Now that Micron and others are producing enough units, PC DRAM contract prices are expected to drop 10% this last quarter of 2018. This declining trend will continue well into 2019. China’s anti-trust investigation will have little relevance once Chinese customers get to buy cheaper DRAM and NAND chips from Micron. The investigation was instigated by Chinese PC/smartphone/tablet manufacturers who wanted cheaper DRAM chips so they can increase their net margins. It was unfortunate that Micron, Samsung, and SK Hynix previously did not have sufficient production capacity to meet the demand last year.

What Matters More For Micron

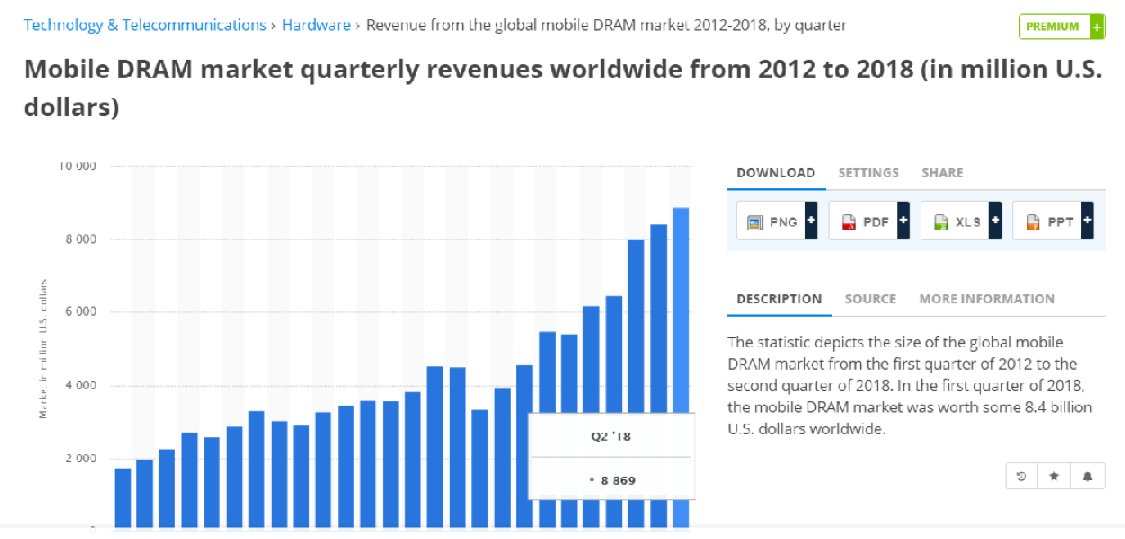

The emerging politically-motivated trouble in China is a valid potential headwind for Micron. However, it is more important for investors to appreciate Micron’s long-term tailwind from the growing sales of mobile DRAM. Global revenue from mobile DRAM in Q2 was $8.869 billion. In spite of the estimated -6% year-over-year Q3 dip in global smartphone sales, Q3 2018’s revenue from mobile DRAM was another record-setting $10 billion.

(Source: Statista)

The continuing growth in mobile DRAM global is likely due to the ever-increasing DRAM load of smartphones. Micron benefits from the trend of smartphones now using the more expensive 3GB, 4GB, and 6GB LPDDR4 RAM products. Most entry-level $150 smartphones now also use at least 2GB of mobile DRAM. There are now many $300 or cheaper Android phones with 4GB RAM. The $350 Pocophone F1 Android phone touts 6GB RAM.

Micron can offset the expected decline in average selling prices of its PC DRAM products by surging sales in mobile DRAM. Apple’s (AAPL) use of Micron-made mobile DRAM is strong tailwind for MU. There are rumors that the iPhone XS and iPhone XR models are not selling as well as expected. However, Apple has a good track record of eventually selling more than 50 million units of its latest smartphone products per year.

The succeeding versions of iPhone XS and XR will most probably use Micron’s 12GB LPDDR4X 10-nanometer memory chip. Micron has started mass production of its latest LPDDR4X mobile DRAM. This is just in time for the next-generation of 4G/5G-compliant smartphones and tablets that could be released in 2019. By 2020, Micron will join Samsung in producing the 20% more energy efficient LDDR5 version of mobile DRAM.

Micron has a much smaller market in mobile DRAM. However, Apple is unlikely to again use Samsung-made mobile DRAM because of the increasing rivalry between those two in smartphones/tablets. Apple’s long-term use of Micron-made DRAM could reduce Samsung’s dominance in mobile DRAM.

(Source: Statista)

Conclusion

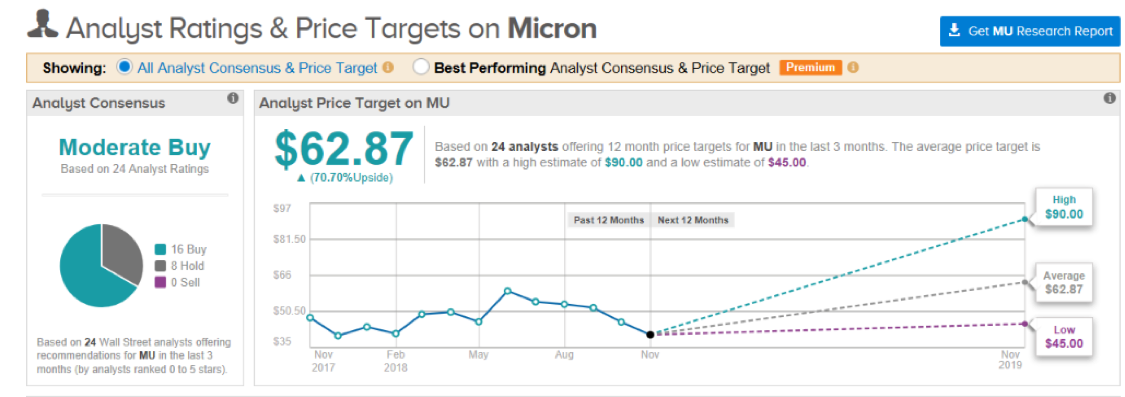

The stock could drop further but going long on MU is recommended for long-term investing purposes. Micron’s revenue/net income growth will slow but the company’s long-term prosperity is assured. Datacenters, PCs, smartphones, and tablets will continue to need DRAM chips. In spite of China’s anti-trust investigation, Wall Street analysts still have an average 12-month price target of $62.87 for MU.

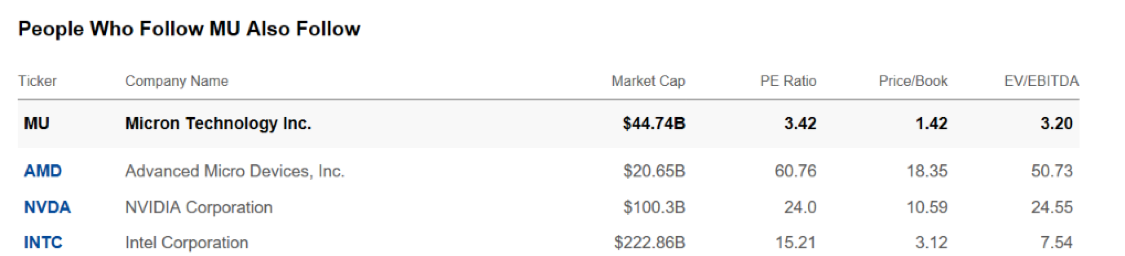

The continuing optimism over MU is easy to explain. MU is currently undervalued. Micron’s stock is notably undervalued when compared to its peers in the semiconductor industry. The comparative chart details Micron’s much lower P/E, P/B, and EV/EBITDA ratios than AMD, NVDA, and INTC. Micron’s healthy balance sheet and oligopoly status in DRAM and NAND chips convinced me that it deserves a higher valuation than 3.42x P/E.

(Source: Seeking Alpha)

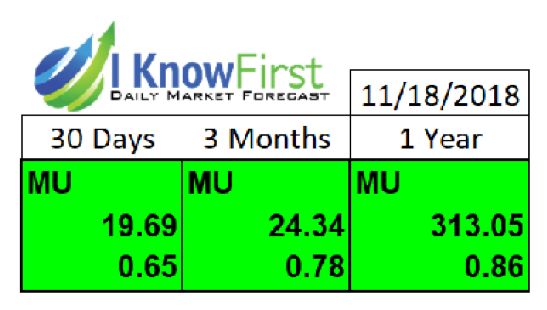

Current I Know First Forecast

My buy rating for MU is supported by its bullish 3-month and one-year market trend forecasts.

To subscribe today click here.

Past I Know First Forecast Success with MU

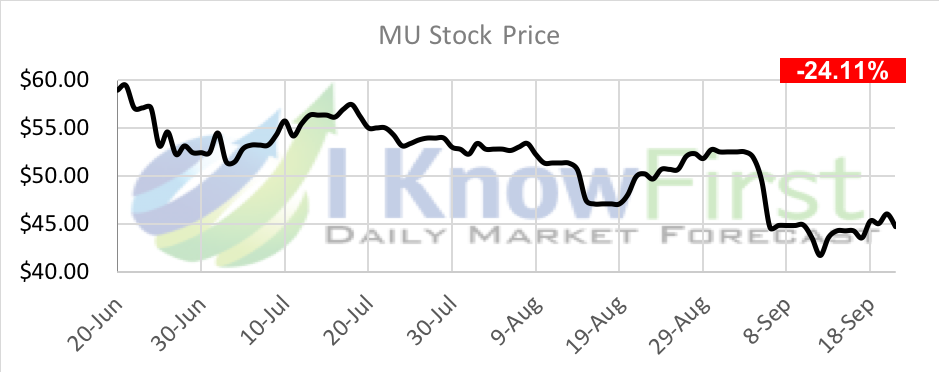

On June 21st the I Know First Algorithm provided a bearish forecast. The signal for 1 month was -11.59, and predictability was 0.61. During the one month forecast the stock dropped from $58.95 to $44.74 by -24.11%. This bearish movement was perfectly caught by I Know First.

Stock price movement since I Know First past forecast

Stock price movement since I Know First past forecast

Current I Know First subscribers received this bearish MU forecast on June 21st, 2018 To subscribe today, click here