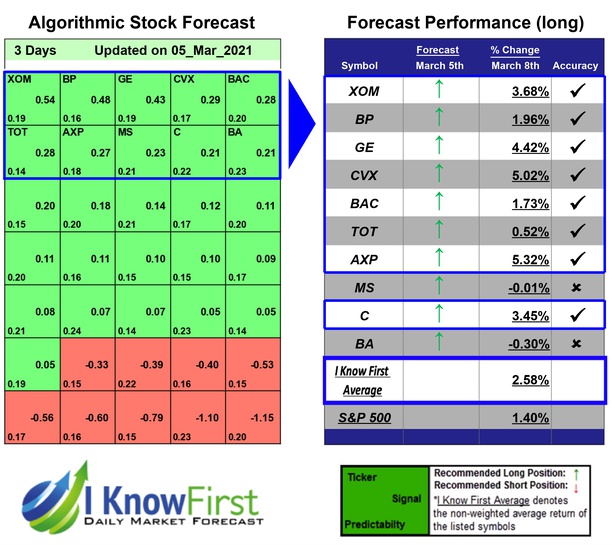

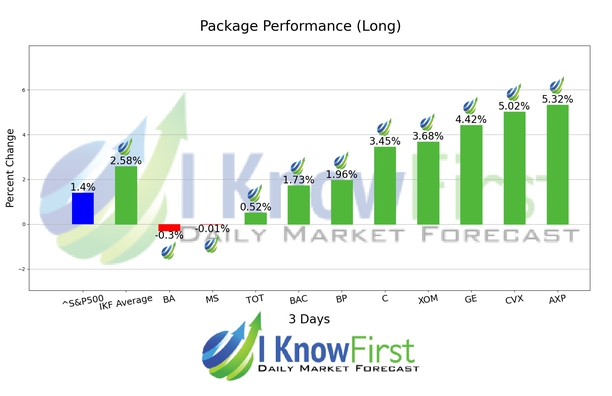

Mega Cap Stocks Based on Deep Learning: Returns up to 5.32% in 3 Days

Mega Cap Stocks

This stock market forecast includes the best Mega Cap Stocks determined by the algorithm with a market capitalization of more than $100 billion.

- Top 10 Mega Cap stocks for the long position

- Top 10 Mega Cap stocks for the short position

Package Name: Mega Cap Forecast

Recommended Positions: Long

Forecast Length: 3 Days (3/5/21 – 3/8/21)

I Know First Average: 2.58%

8 out of 10 stock prices in this forecast for the Mega Cap Forecast Package moved as predicted by the algorithm. AXP was the top performing prediction with a return of 5.32%. Other notable stocks were CVX and GE with a return of 5.02% and 4.42%. The package had an overall average return of 2.58%, providing investors with a premium of 1.18% over the S&P 500’s return of 1.4% during the same period.

American Express Company (AXP), together with its subsidiaries, provides charge and credit payment card products and travel-related services to consumers and businesses worldwide. It operates through four segments: U.S. Card Services, International Card Services, Global Commercial Services, and Global Network & Merchant Services. The company’s products and services include charge and credit card products; network services; expense management products and services; travel-related services; and stored value/prepaid products. Its products and services also comprise merchant acquisition and processing, servicing and settlement, merchant financing, point-of-sale, and marketing and information products and services for merchants; fraud prevention services; and the design of customized customer loyalty and rewards programs. The company sells its products and services to consumers, small businesses, mid-sized companies, and large corporations through direct mail, online applications, in-house and third-party sales forces, and direct response advertising. American Express Company (AXP) was founded in 1850 and is headquartered in New York, New York.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.