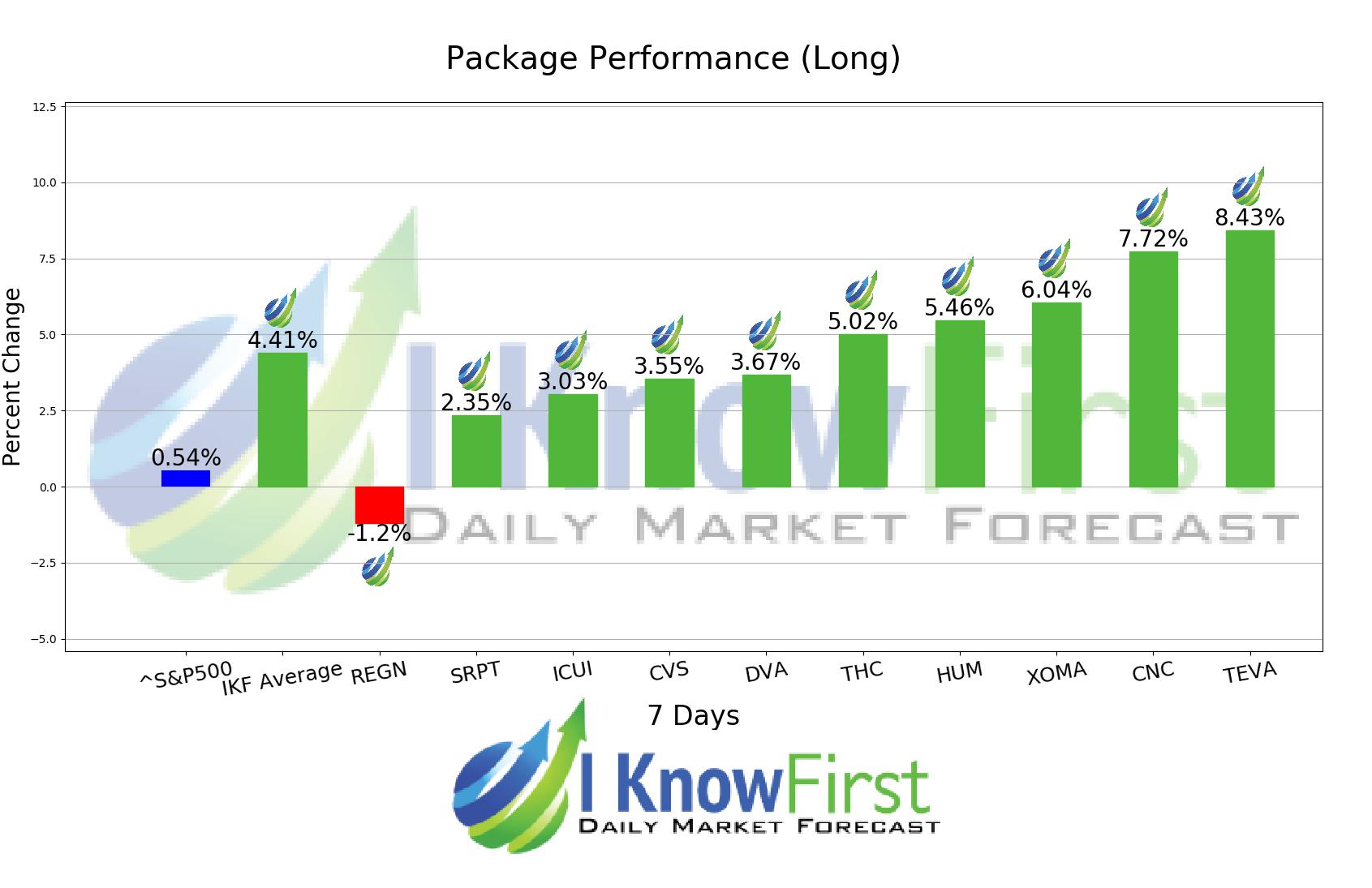

Medicine Stocks Based on a Self-learning Algorithm: Returns up to 8.43% in 7 Days

Medicine Stocks

The Medicine Stocks Package is designed for investors and analysts who need predictions for the best stocks to buy in the Medicine Industry. It includes 20 stocks with bullish and bearish signals and indicates the best medicine stocks to trade:

- Top 10 Medicine stocks for the long position

- Top 10 Medicine stocks for the short position

Package Name: Medicine Stocks

Recommended Positions: Long

Forecast Length: 7 Days (11/13/2019 – 11/20/2019)

I Know First Average: 4.41%

For this 7 Days forecast the algorithm had successfully predicted 9 out of 10 movements. TEVA was the highest-earning trade with a return of 8.43% in 7 Days. CNC and XOMA saw outstanding returns of 7.72% and 6.04%. The package itself saw an overall return of 4.41%, providing investors with a 3.87% premium above the S&P 500’s return of 0.54% for the same time period.

Teva Pharmaceutical Industries Limited (TEVA) develops, manufactures, markets, and distributes generic medicines and a portfolio of specialty medicines worldwide. The company’s Generic Medicines segment offers generic medicines, such as sterile products, hormones, narcotics, high-potency drugs, and cytotoxic substances in various dosage forms, including tablets, capsules, injectables, inhalants, liquids, ointments, and creams. This segment also develops, manufactures, and sells active pharmaceutical ingredients. The company’s Specialty Medicines segment provides branded specialty medicines for use in central nervous system and respiratory indications, as well as the women’s health, oncology, and other specialty businesses. Its products in the central nervous system area comprise Copaxone for multiple sclerosis; Azilect for the treatment of Parkinson’s disease; Nuvigil for the treatment of excessive sleepiness associated with narcolepsy and certain other disorders; Fentora/Effentora for the treatment of breakthrough pain in opioid-tolerant adult patients with cancer; and Zecuity, a prescription transdermal system for the acute treatment of migraine with or without aura in adults. This segment’s products in the respiratory market include ProAir, ProAir Respiclick, QVAR, and Duoresp Spiromax for the treatment of asthma and chronic obstructive pulmonary disease, as well as Treanda, Granix, Trisenox, Synribo, Lonquex, Myocet, Eporatio, Tevagrastim/Ratiograstim, and Trisenox products in the oncology market. This segment also offers a portfolio of products in the women’s health category, which includes ParaGard, Plan B One-Step, OTC/Rx, Zoely, Seasonique, and Ovaleap, as well as other products. Teva Pharmaceutical Industries Limited (TEVA) has collaboration arrangements with Takeda Pharmaceutical Company Limited, Procter & Gamble Company, Intel, and Regeneron Pharmaceuticals, Inc. The company was founded in 1901 and is headquartered in Petach Tikva, Israel.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.