Medical Stocks Based on Genetic Algorithms: Returns up to 72.29% in 14 Days

Medical Stocks

The Medical Stocks Package is designed for investors and analysts who need predictions for the best stocks to buy in the Medicine Industry. It includes 20 stocks with bullish and bearish signals and indicates the best medicine stocks to trade:

- Top 10 Medicine stocks for the long position

- Top 10 Medicine stocks for the short position

Package Name: Medicine Stocks

Recommended Positions: Long

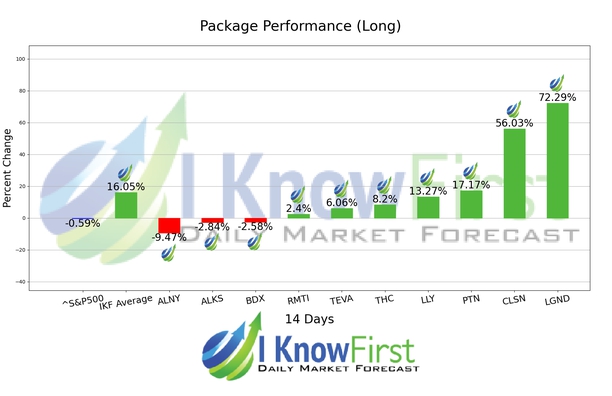

Forecast Length: 14 Days (1/14/21 – 1/28/21)

I Know First Average: 16.05%

The algorithm correctly predicted 7 out 10 of the suggested trades in the Medicine Stocks Package for this 14 Days forecast. The highest trade return came from LGND, at 72.29%. CLSN and PTN saw outstanding returns of 56.03% and 17.17%. This algorithmic forecast package presented an overall return of 16.05% versus S&P 500’s performance of -0.59% providing a market premium of 16.64%.

Ligand Pharmaceuticals Incorporated (Ligand), incorporated on September 28, 1987, is a biopharmaceutical company that focuses on developing and acquiring technologies that help pharmaceutical companies discover and develop medicines. The Company is involved in the development and licensing of biopharmaceutical assets. The Company employs research technologies, such as nuclear receptor assays, high throughput computer screening, formulation science, liver targeted pro-drug technologies and antibody discovery technologies to assist companies in their work towards obtaining prescription drug approvals. As of December 31, 2016, it had partnerships and license agreements with over 85 pharmaceutical and biotechnology companies, and over 140 various programs under license with it were in various stages of commercialization and development. It has contributed research and technologies for approved medicines that treat cancer, osteoporosis, fungal infections and low blood platelets, among others. Its partners have programs in clinical development targeting seizure, coma, cancer, diabetes, cardiovascular disease, muscle wasting, liver disease and kidney disease, among others. The Company is developing a small molecule glucagon receptor antagonist for the treatment of Type II diabetes mellitus.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.