Making over 200% In A Year Using Fundamental And Algorithmic Trading

BlackBerry’s Price Fluctuations

In a recent article we discussed the possibilities a fluctuating stock like BBRY presents. While recommending to short the stock in the short term, we did not feel the stock had no long term potential. At the end of 2009, BlackBerry was valued at $60 a share, with revenues of 11 billion. In 2013 the stock price declined to $7.2 a share, with revenues of 11 billion. Suggesting that a company restructure might quickly boost the stock price back up with a profit turn around.

After releasing a bullish signal for BBRY in our SA article we tested our performance in the 3 months “Best Tech Stock” forecast review.

Since then the stock went up by almost 14%. We also forecast the 11th of November 55% growth until the 22nd of January in an Upstart Business Journal Article “18 years in the making, stockmarket soothesayer forecasts the future“, which anticipated the short term growth, and decline after. However the stock offers much more potential, and has been for a long time. BlackBerry seems to be a poisonous fruit; however, those who know how to handle it may find it very tasty indeed.

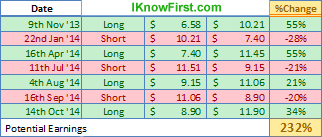

Figure 1: One Year BBRY Stock Analysis.

Figure 2: Optimal Trading Analysis (According To Figure 4)

While revenue streams begin to have a positive outlook, the market decides the price, and as previous trend has demonstrated people like to bite into the berry, and then throw it away – regardless of actual company performance. The I Know First 3 months outlook right now sees the stock price go down,; however, if the price drops, the 3 months forecast in 2 weeks could suggest otherwise. For optimal shorting strategy we recommend executing your trade only when two rules hold true. The first is that the last close is lower than the 5 days average. The second is if the average of the last 5 days forecasts is “down”. If both hold true then sell short. More about trading strategy and optimization can be found in the” I Know First Algorithm Performance Analysis”. To stay up to date with blackberry you can follow the I Know First Top 10 Tech Stock forecast.

This article is a section of out full article “BlackBerry Is A Risky Fruit: Making 232% In A Year Using Fundamental And Algorithmic Trading” we published on Seeking Alpha.

Want to see similar returns in your portfolio? Test our algorithm and let us identify the best market opportunities for you. The above mentioned small cap and dividend forecast are but a small portion of I Know First Financial Services List.

To learn more about our product please use the following links

For information about private investor products click here

For information about institutional investor products click here

For the most recent I Know First Research articles and news click here

Want to know just how accurate our predictions are ? click here

Contact us with any questions: [email protected]

Are you the professional able to position I Know First as the top choice for today’s investor. Explore career opportunities available now to join our team: latest jobs.