Low Volatility Stocks Based on Deep-Learning : Returns up to 76.0% in 1 Year

Low Volatility Stocks

This Conservative Stock forecast is part of the Risk-Conscious Package, as one of I Know First’s quantitative investment solutions. We determine our best defensive stocks by screening our database daily for lower volatility stocks that are less risky. The full Risk-Conscious Package includes a daily forecast for a total of 40 stocks divided into four main categories:

- Top 10 Conservative stocks for the long position

- Top 10 Conservative stocks for the short position

- Top 10 Aggressive stocks for the long position

- Top 10 Aggressive stocks for the short position

Package Name: Conservative Stock Forecast

Recommended Positions: Long

Forecast Length: 1 Year (8/3/2018 – 8/4/2019)

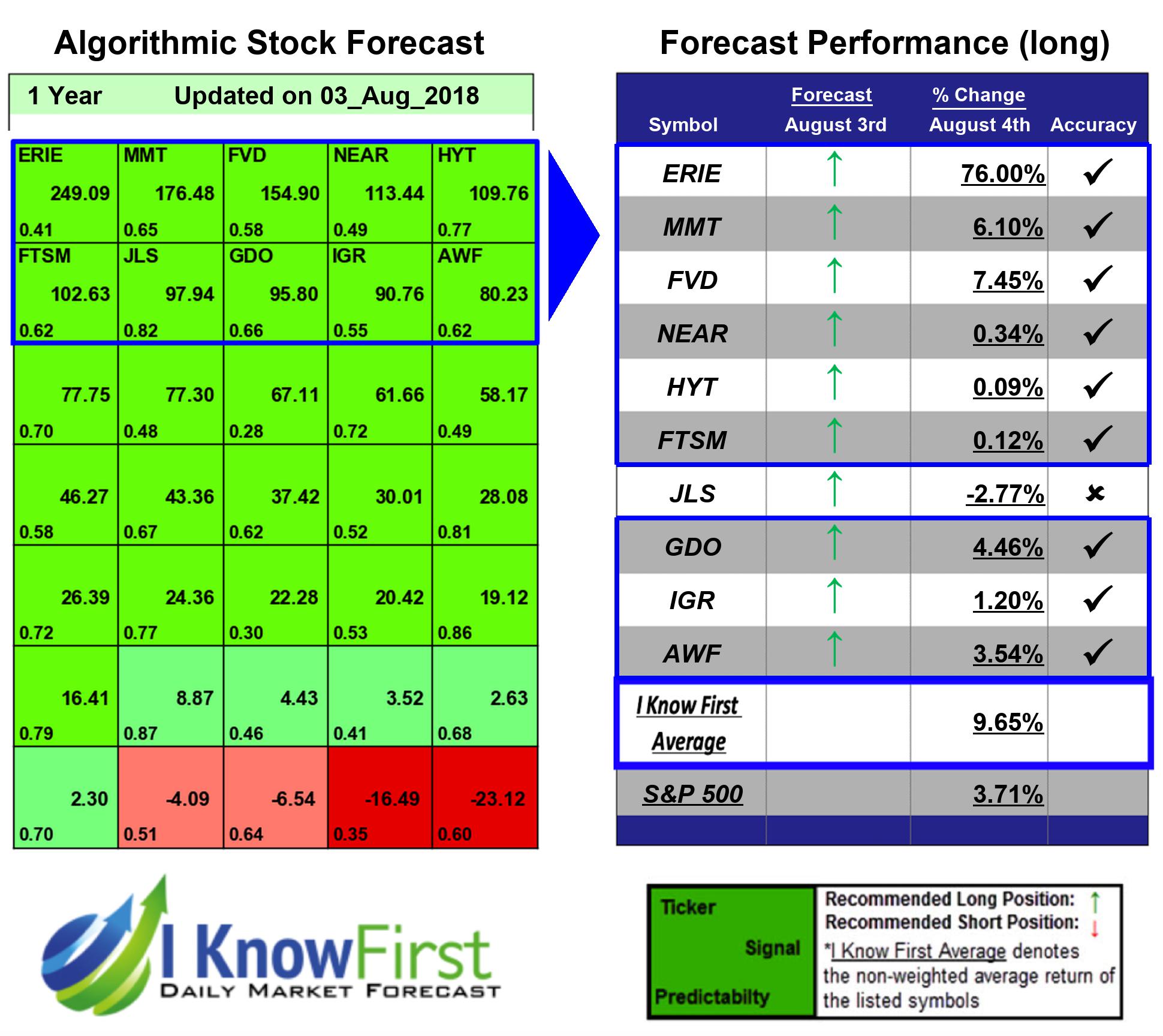

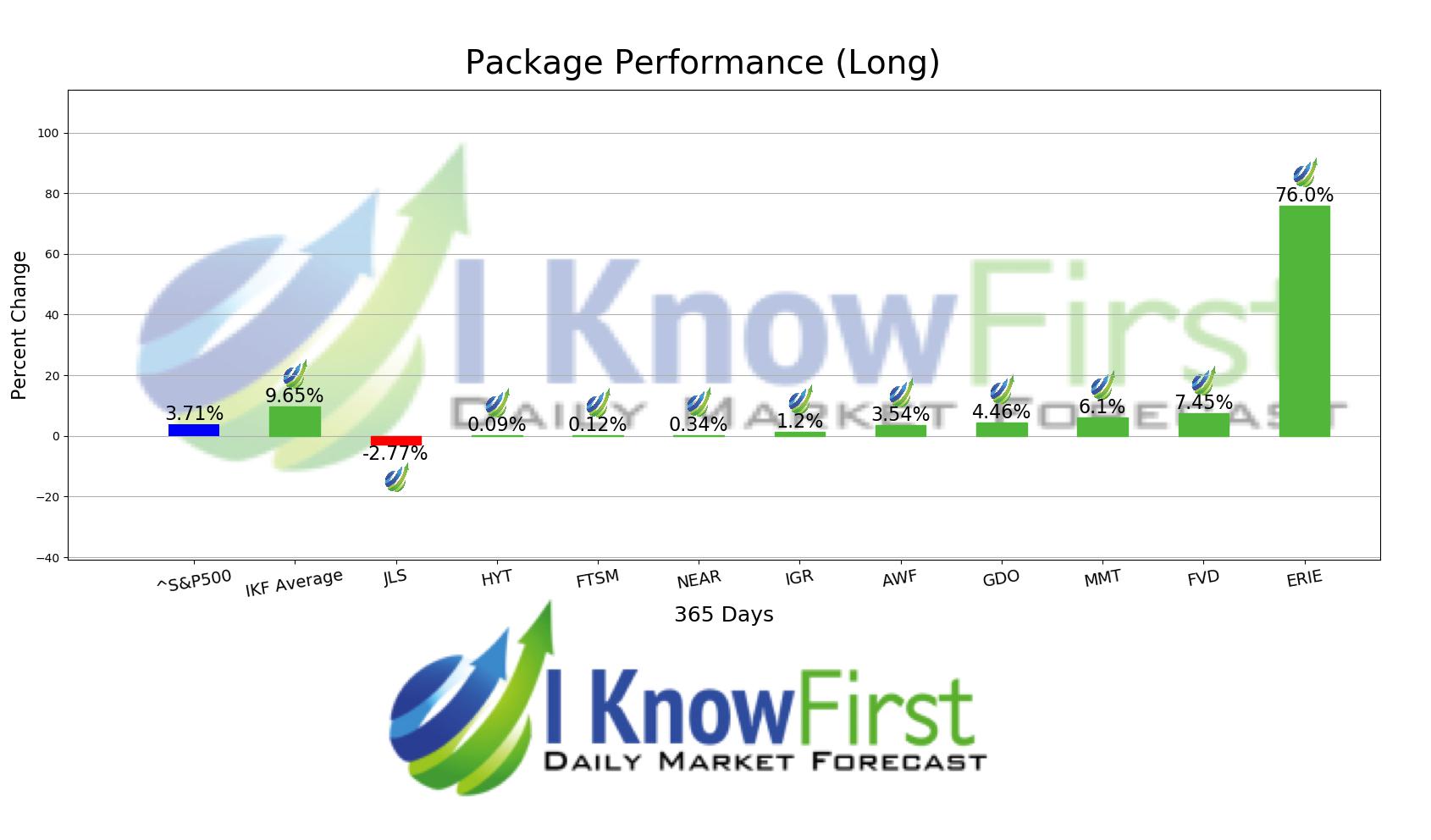

I Know First Average: 9.65%

For this 1 Year forecast the algorithm had successfully predicted 9 out of 10 movements. The prediction with the highest return was ERIE, at 76.0%. The suggested trades for FVD and MMT also had notable 1 Year yields of 7.45% and 6.1%, respectively. The package itself saw an overall return of 9.65%, providing investors with a 5.94% premium above the S&P 500’s return of 3.71% for the same time period.

Erie Indemnity Company, incorporated on April 17, 1925, is a management company. The Company serves as the attorney-in-fact for the subscribers (policyholders) at the Erie Insurance Exchange (Exchange). The Exchange is a reciprocal insurer that writes property and casualty insurance. The Company’s function is to perform certain services for the Exchange relating to the sales, underwriting and issuance of policies on behalf of the Exchange. The sales related services the Company provides include agent compensation, and certain sales and advertising support services. Agent compensation includes scheduled commissions to agents based upon premiums written, as well as additional commissions and bonuses to agents. The Exchange subsidiaries include Erie Insurance Company, Erie Insurance Company of New York, Erie Insurance Property and Casualty Company, Flagship City Insurance Company and Erie Family Life Insurance Company (EFL).

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.