KSS Stock Forecast: Activist Investors ‘Wakeup Call’ Signals Start of a Change

This KSS stock forecast article was written by Maria Grishaev, Analyst at I Know First.

This KSS stock forecast article was written by Maria Grishaev, Analyst at I Know First.

Executive Summary

- Kohl’s Corporation had a mixed year in 2020. The stock price went down by 17.28% from $48.50 to $40.69 due to the COVID-19 pandemic.

- Following a public dispute with an activist investors group and sequential agreement, fixing everything the activist group outlined in their analysis of Kohl’s is ahead.

- Quantitative analysis results indicate bullish signals after stock price topped out the moving average line.

- KSS deserves a one-year target price of $80, representing revenue growth and business model improvements.

Overview of the Recent Developments for KSS Stock

Kohl’s Corporation is an American department store retail chain. With more than 1,100 stores in 49 states and the online convenience of Kohls.com and the Kohl’s App, Kohl’s offers national and exclusive brands nationwide.

The company announced this month that it has commenced a cash tender offer for up to $1,000,000,000 combined aggregate principal amount of certain notes. Holders of $1.043 billion of debt due between 2023 and 2025 had agreed to the terms of the tender offer and Kohl’s accepted all of that debt for purchase. This helps the company to shrink its debt load that was taken in the initial wave of the pandemic last year. With $2.3B of cash in the company’s balance sheet, it could have covered the cost of the tender offer, but instead, Kohl’s issued $500M of new debt for 10 years with a low coupon, lowering its interest payments.

Kohl’s opened recently a new fulfillment center (sixth overall) in Ohio to continue strengthening its e-commerce capabilities. The facility will be engaged in processing, filling, and shipping orders from Kohls.com. This next-generation facility makes use of automation and advanced technologies for processing orders faster. Also, the company announced new brands are now available on sale: Cole Haan and its first private label – FLX.

In more news, Kohl’s had a public disagreement with a group of activist investors regarding the business momentum and some of the board members. The group collectively blasted Kohl’s for “poor retail execution, excessive executive compensation,” a “long-tenured Board with insufficient retail experience,” and a “systemic inability to achieve stated goals”. They recently reached an agreement that adds three independent directors to the board and expands existing share repurchase authorization to $2 billion. These changes in the board will affect the company’s growth strategy.

These events helped the stock price to surge in total by 46.01% YTD in comparison to an 11.03% rise of the S&P 500.

Multiples Valuation Analysis Results in Higher Target Price

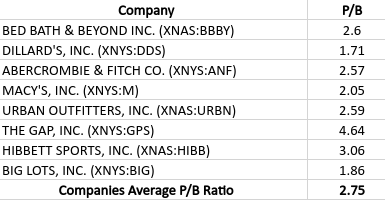

I estimated my own target stock price by using the Multiples Valuation model. I looked for KSS’s peer companies’ P/B ratios and calculated its average – 2.75, while Kohl’s current P/B ratio is 1.81. This shows us a potential for growth in the company’s performance.

Next, I made a few assumptions about the future of the company based on what I wrote above. I assumed that the total assets will reduce by a rate of 12%, while the liabilities will go down by 10% in the next year. These are reasonable numbers, given the company’s $1B cash tender offer that will reduce the total liabilities and the assets at the same time. I also assumed that the number of shares will go down by 5% in light of the company’s plan to resume share repurchases in 2021 to up to $2B. That in total brings us to a future book value per share of 29.15.

In total, I received a target price of $80, which is 31% higher than the company’s current stock price and is similar to the stock price at its peak.

Technical Indicators Show a strong BUY Signal

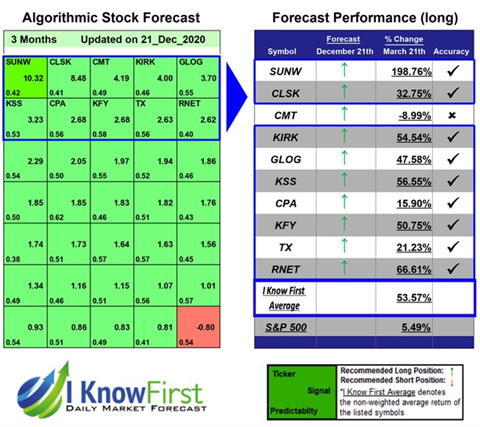

As we can see in the chart, the most recent time that the stock price crossed above the moving average for 200 days (the purple line) was in late November and it signaled a potential change in trend. That was indeed the case as the stock rose from there. We can also see that the moving average for 50 days (the red line) crosses above the moving average for 200 days in late December and it also indicates that the trend is shifting up. This is the known “golden cross” that gives us a buy signal.

The Bollinger Bands® squeeze also indicated a potential opportunity. A squeeze signals a period of low volatility and is considered by traders to be a potential sign of future increased volatility and possible trading opportunities. This can be seen happening here from August to October. The peak outside the bands in July and October corresponds with the announcements of the quarterly financial results.

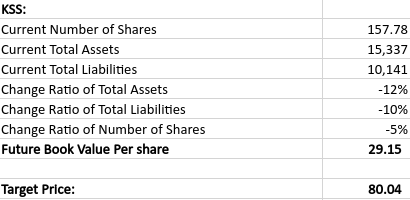

The Yahoo Finance coverage for the company is performed by 21 analysts, with the majority of whom took the hold position on the stock. The analysts’ community puts the average target price for the stock at 62$ while it is traded at 59.41$ which makes a 4.3% difference.

As the world continues to emerge from the COVID-19 crisis with the rollout of vaccinations worldwide, we can be optimistic about the outlook for the retail industry and the company. Considering the cash tender offer that will reduce the company’s debt, Kohl’s solid market position and scale, its significant level of private label and exclusive merchandise, and its excellent liquidity, and we can expect the stock’s growth in price.

Conclusion

I take the buy-side on KSS stock because it has a solid market position in recent years. It is reasonable to expect further growth of KSS stock price as the rollout of the vaccinations in the US and worldwide has a direct impact on the revenue.

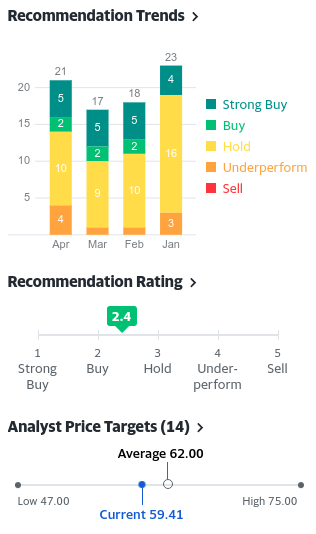

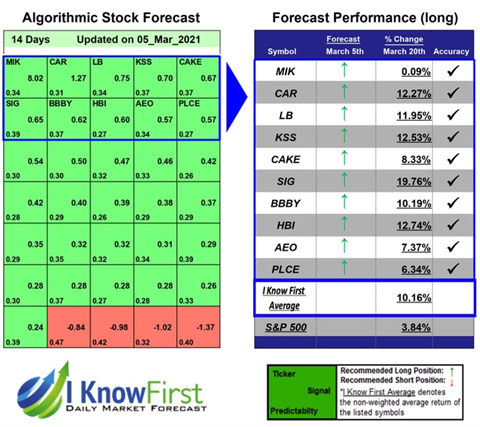

Please note that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts. Also, the light green in the short time horizons is a mildly bullish signal while the dark green in the one-year time horizon is a strong bullish signal.

Past Success with KSS Stock Forecast

I Know First noticed the upward trend of KSS and has been bullish with the price since December until now. On December 21st, 2020, the I Know First algorithm recommended KSS as one of the Retail stocks package. The AI-driven KSS stock forecast was successful on a 3-month horizon resulting in a 56.55% gain since the forecast date.

Moreover, on March 5th, 2021, the I Know First algorithm also recommended KSS as one of the Retail Stocks package. The AI-driven KSS stock forecast was successful on a 14-days horizon resulting in a 12.53% gain since the forecast date.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.