I Know First Reviews: Weekly Algorithmic Performance: November 6, 2016

I Know First Reviews

On November 6th, 2016, our weekly newsletter was sent out to all our I Know First subscribers, which can be found here. Below, find the I Know First Reviews, highlighting the algorithm’s performance for this past week.

I Know First sends a weekly newsletter every Sunday to all the I Know First subscribers, highlighting the past week’s performance in all the covered financial markets, i.e. equity positions, currencies, and commodities. Additionally, the weekly newsletter includes analysis and updated news reports regarding prominent firms such as well Apple, Yahoo, Baidu, and more. The I Know First algorithm maintains a bullish stance of the firms analyzed, and our subscribers are able to utilize these tools for their investment strategies. The in-depth analysis is provided by the I Know First financial analysts, who are often times as well top rated authors for prominent financial sites such as Seeking Alpha.

In general, the algorithm is made up of The system is a predictive stock forecast algorithm based on Artificial Intelligence and Machine Learning with elements of Artificial Neural Networks and Genetic Algorithms incorporated in it. This means the algorithm is able to create, modify, and delete relationships between different financial assets. Based on the relationships and the latest market data, the algorithm calculates its forecasts. Since the algorithm learns from its previous forecasts and is continuously adapting the relationships, it adapts quickly to changing market situations.

For a more detailed explanation, regarding the algorithm, click here.

As highlighted in the newsletter, our subscribers had seen superb returns, whether long-term or short-term. Our investors are able to tackle the market head on with all its recent uncertainties, and achieve premiums well over those offered by institutional and classic fund managers. For example, our state of the art algorithm tracks International stocks, in Brazil, on October 30, 2016, a one year long forecast was published. Within the span of one year, 3 Brazilian stocks gave returns well over 100%, with Gol Transportes Aéreos (GOL) bringing returns of 188.95%. The algorithm had predicted 9 out 10 stocks correctly in a bullish manner, for the one year time horizon.

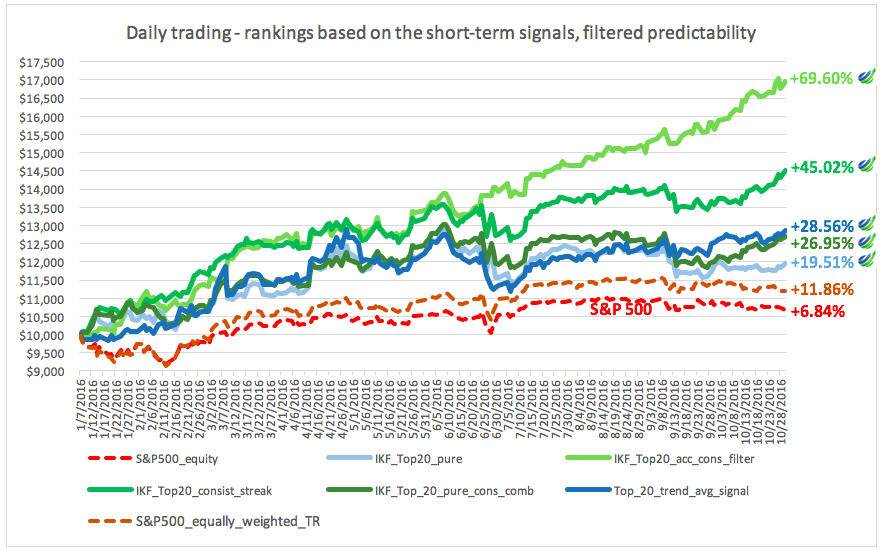

Over the past week, our R&D team had published a report regarding daily trading strategies utilizing I Know First’s state of the art algorithm. These trading strategies have yielded superb market premiums above the S&P 500 Index, and are meant to be utilized by hedge funds and other money management funds. From January, 2016 till the end of November, 2016, the highest return was at 58.75%. These strategies are based off of the securities found in the S&P 500, and are filtered by both signal strengths and a predictability indicator.

Every week the top performing financial instruments are highlighted, as shown below from this past week’s newsletter.

1. Past Week’s Highest Returns Show Algorithm Predicting Market Correction

Over the past week, the highest return came from this Brazil Stocks forecast, at 188.95% from GOL, and an overall average of 69.81% in 1 year. Additionally, this Aggressive Stocks forecast had superb returns reaching 131.53% In 3 months, with an overall performance average of 26.25%. As investors around the globe are coping with losses as the S&P 500 Index experienced its worst performance in over 8 years, I Know First’s algorithm had predicted this volatile week in advance. This 7 days Volatility Forecast had an overall average of 28.42%, reaching almost 49%. It as well had a market premium of 30.66% above the S&P 500 Index. Furthermore, this bearish Top 10 Stocks forecast that tracks stocks within the S&P 500 had returns reaching as high as 27.90% in 7 days. The same forecast was as well able to detect a bearish outlook on the S&P 500 Index as well.

2. 3 Day Forecast Show Short Term Decade High Volatility

The highest 3 day forecast came from this short trading Stocks Under 10 Dollars forecast, with an overall average of 9.78% and returns reaching up to 29.76%. Furthermore, in this Top 10 Stocks forecast that tracks stocks in the S&P 500 Index, returns reached as high as 23.98%, while the S&P 500 Index had a poor performance -1.78% during the same period. Additionally, this Volatility forecasthad an overall average of 19.46%, as the financial markets had experienced historic volatility levels. Our long positions had as well performed well during this week, as this Biotech Stocks forecast reached a 12.37% return in 3 days.

3. Weekly Forecasts Reach Almost 35% Return

The top performing 7 day forecast was this Stocks Under 10 Dollars forecast, with an overall average of 15.09%, and returns reaching 34.55% from WINT. The algorithm as well predicted high returns for this simultaneous long & Short Position reaching 29.32% return with MTL, coming from the Stocks Under 10 Dollars package. Additionally, this 52 Week Low forecast had excellent short-term returns reaching 29.32% and an overall average of 4.95%.

4. 68.37% Return Reached In 14 Days

The highest 14 day returns came from this European Stock forecast, with an overall average return of 10.07% that reached as high as 68.37% from MTL. Furthermore, this two week Volatility forecast had seen returns climb as high as 35.23% from ^VXO, with an overall package average of 15.57%. As market were turbulent this past week, our top two week short position came from this Fundamental Stocks package with returns reaching 60.77% from SGY. Brazil stocks had a great 14 day period, as this Brazil Stocks forecast had reached 16.19% coming from ERJ.

5. Almost 80% Return In 30 Days

The top performing forecast for 1 month came from this Volatility forecastreaching 79.58% return, with an overall average performance of 32.63%. Additionally, this short position Biotech Stocks forecast and Small Cap Stocks forecasts saw high returns at 46.67% and 42%, respectively. This long position Brazil Stocks forecast as well saw a high return reaching 16.30% from GOL in 30 days.

6. Tripling Returns In 3 Months

Our 3 month forecast had returns with this Aggressive Stocks forecast being the top performer, with an overall average of 28.03% reaching a 147.71% return. This long and short energy stocks forecast as well had high returns at 156.70%, and an overall average of 21.75 (long) and 7.92% (short).

7. Excellent Yearly Returns Reaching 177.45%

The highest yearly return came from this Energy Stocks forecast, with an overall average of 51.77% and returns as high as 177.45%. The market premium for the year was 50.21%. Furthermore, this Brazil Stock forecast had a superb yearly average of 63.61%, achieving an alpha above the S&P 500 Index at 62.05%. The forecast had reached returns as high as 159.21%, which came from GOL.

8. Short-Term Trading Reaches 58.75%

This short-term trading report details I Know First’s results from January 7th, 2016, to September 30th, 2016. I Know First yielded results up to 58.75% while the S&P returned only 8.94% in the same time horizon. Read the full report for a more detailed analysis with charts and graphs, depicting a high reward to risk payoff with low Betas and high Sharpe Ratios.

Article Summaries

- On October 9th, 2016, one of I Know First’s top analyst had published a bearish article regarding Glu Mobile Inc (GLUU). As a result of GLUU’s declining growth and unattractive mobile games, the analyst explained that this would negatively impact revenues. Due to its poor business strategy performance, the analyst recommended a sell position on the firm. In accordance with I Know First’s state of the art algorithm’s bearish, GLUU shares are down over 16% to date.

- Towards the end of October, an I Know First analyst had written a forward looking on Advanced Micro Devices (AMD). Though in the short-term both I Know First’s algorithm and the analyst predict a bearish outlook on AMD, in long-term (1 Year), AMD will shares will rise. The reason is a mixture of technical indicators as well as an explanation of AMD’s current debt situation. The release their new x86 servers should boost their revenues over time. AMD is down 10% to date, in accordance with the short-term bearish prediction of the algorithm.

- Earlier this year on April 18th, 2016, an I Know First analyst had written a value analysis on Amazon Inc. (AMZN), explaining its continual market share growth in online video subscription services. Additionally, AMZN’s premium services, or Amazon Prime, will become more attractive as benefits begin to increase to hardware discounts. In accordance with I Know First’s AI-based algorithm, AMZN shares have risen almost 21%, or $129.16 per share, to date.