I Know First Reviews Weekly Algorithmic Performance: January 23, 2017

I Know First Reviews

On January 22, 2017, our weekly newsletter was sent out to all our I Know First subscribers, which can be found here. Below, find the I Know First Reviews, highlighting the algorithm’s performance for this past week.

I Know First sends a weekly newsletter every Sunday to all the I Know First subscribers, highlighting the past week’s performance in all the covered financial markets, i.e. equity positions, currencies, and commodities. Additionally, the weekly newsletter includes analysis and updated news reports regarding prominent firms such as Apple, Yahoo, Baidu, and more which our subscribers are able to utilize for their investment strategies. The in-depth analysis is provided by the I Know First financial analysts, who are often times also top rated authors for prominent financial sites such as Seeking Alpha.

In general, the algorithm is based on Artificial Intelligence and Machine Learning with elements of Artificial Neural Networks and Genetic Algorithms incorporated in it. This means the algorithm creates, deletes, and modifies relationships between different financial assets to optimize its predictive accuracy. Based on the relationships and the latest market data, the algorithm calculates its forecasts. Since the algorithm learns from its previous forecasts and is continuously readjusting the relationships, it adapts quickly to changing market situations.

For a more detailed explanation, regarding the algorithm, click here.

As highlighted in the newsletter, our subscribers had seen superb returns, whether long-term or short-term. Our investors are able to tackle the market head on with all its recent uncertainties and achieve premiums well over those offered by institutional and classic fund managers. For example on January 22, 2017, we published a 1 year long forecast of our Dividends Stock Package with a bullish signal for Vale S.A.. Within 1 year 10 of the 10 predictions revealed themselves to be correct and VALE registered a return of 321.93%.

Package Name: Dividends

Recommended Positions: Long

Forecast Length: 1 Year (01/18/2016 – 01/18/2017)

I Know First Average: 92.33%

Every week the top performing financial instruments are highlighted, as shown below from this past week’s newsletter.

1. Top Algorithmic Predictions Yield 325% In 1 Year

This past week’s top forecast came from this Dividend Stocks forecast with a one-hundred percent accuracy and three stocks returning over 100%. The highest return came from VALE at almost 322%, and the forecast had an overall average of 92.33%. Additional high returns came from this Risk Conscious Stocks forecast with returns reaching 325% in 1 year. Investors looking for exposure to a basket of stocks, had returns reaching 100.98% from this ETFs Forecast.

2. Short Term Forecasts Return Almost 31%

I Know First’s top 3 day forecast came from this Medicine Stocks forecast, with an overall average of 5.65% and returns reaching 30.77% in Just 3 days from CLSN. Additionally, this Low Short Ratio Fundamental Stocks forecast, had a high return of over 30% and a market premium of 5.26%. Those seeking to stocks with the algorithm’s top signal strength had returns of 26.45% in 3 days from this Top Stocks forecast. The AI-based algorithm had successfully forecasted over a 14% return with this Transportation Stocks forecast.

Package Name: Medicine Stocks

Recommended Positions: Long

Forecast Length: 3 Days (01/13/2017 – 01/17/2017)

I Know First Average: 5.65%

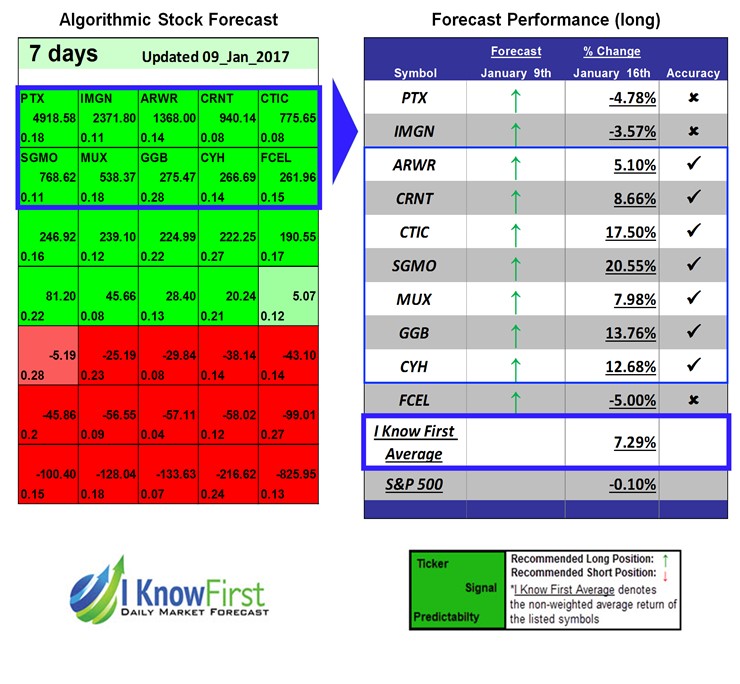

3. 7 Day Forecasts Reach Over 30% Return

This Low Price High Volume Stocks forecast was I Know First’s top 7 day prediction this week, with four predictions bover a 12% return in just 7 days. The highest return came from SGMO at 20.55%. Additionally, value investors were able to earn up to 30.23% from this High Short Ratio Fundamental Stocks forecast. I Know First’s self-learning algorithm had predicted returns which yielded up to 14.25% from this Transportation Stocks forecast. Those seeking to hedge forex risk and/or to practice carry trade strategies, had an 80% hit ratio from this Currency Forecast.

Package Name: Low Price High Volume Stocks

Recommended Positions: Long

Forecast Length: 7 Days (01/09/2017 – 01/16/2017)

I Know First Average: 7.29%

4. Almost 68% ROI In 14 Days

In 14 Days, I Know First’s AI-based algorithm had forecasted a 67.77% return from KBLB with this Small Cap Stocks forecast. The forecast had an overall return of 12.49%, achieving a market premium of 11.19%. Furthermore, this Low Short Ratio Fundamentals Stock forecast gave investors returns up to 50% in 14 days, and an overall average of 10.25%. Those seeking to track how the management of a firm buy or sell their own stock, were able to achieve almost a 10% overall average from this Insider Trading forecast.

Package Name: Fundamental – Low Short Ratio Stocks

Recommended Positions: Long

Forecast Length: 14 Days (01/05/2017 – 01/19/2017)

I Know First Average: 10.25%

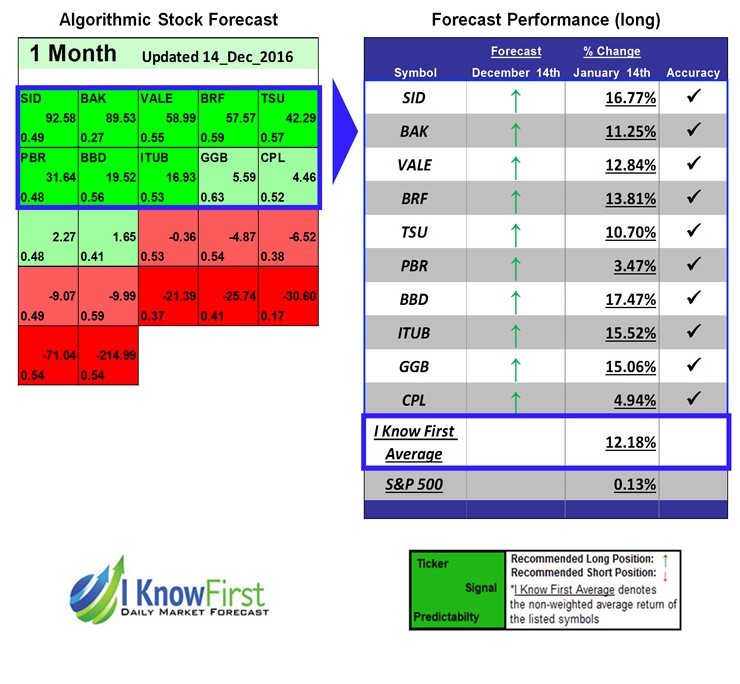

5. 1 Month Predictions Yield Almost 66%

Investors were able to reach, in 1 month, a 65.97% return in from TGB with this Low Short Ratio Fundamental Stocks forecast. The forecast had an overall average of 10.96%, reaching an alpha above the S&P 500 Index by 10.57%. Additional high 1 month returns came from this Brazil Stocks forecast, which had an overall average of 12.18% and returns up to 17.47%.

Package Name: By Country – Brazilian Stocks

Recommended Positions: Long

Forecast Length: 1 Month (12/14/2016 – 01/14/2017)

I Know First Average: 12.18%

6. Investors Achieve Over 125% Return In 3 Months

With a 100% accuracy, five out ten forecasts had achieved returns over 22% in this Energy Stocks forecast. The highest return was at 82% and the forecast had an overall average 33.41%. Additionally, this Low Price To Book Ratio Fundamentals Stock forecast had returns reach 125.34% from MTL. I Know First’s AI-based algorithm had forecasted returns over 119% and an overall average of 27.04% from this Stocks Under 10 Dollars forecast.

Package Name: Energy Stocks

Recommended Positions: Long

Forecast Length: 3 Months (10/21/2016 – 01/21/2017)

I Know First Average: 33.41%

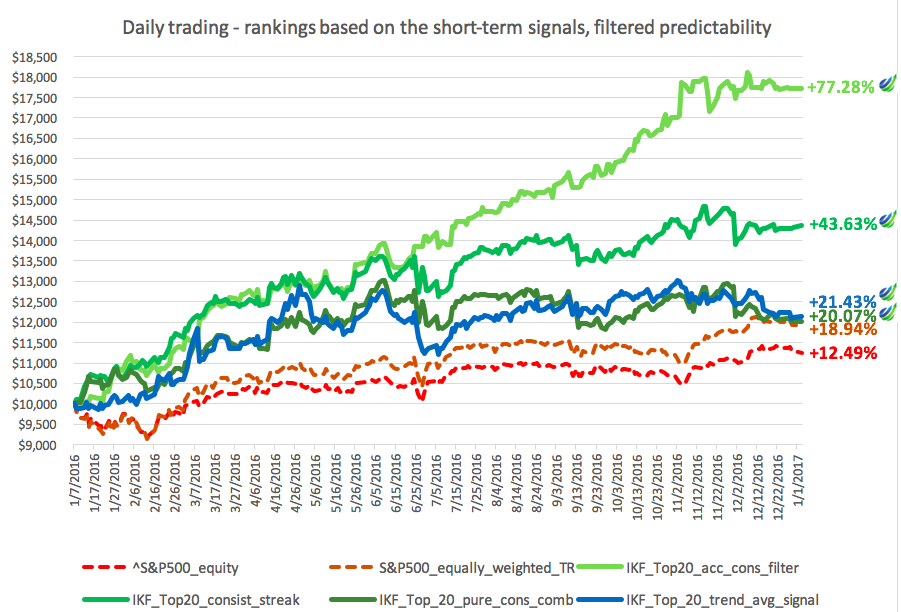

7. Swing Trading Strategies Reach Over 77% In 1 Year

I Know First’s algorithmic indicators can be used to backtest various short term trading strategies. The top strategy had yielded up to a 64.79% alpha above the S&P500 Index, from January, 2016 till January 1st, 2017. Read the full trade report for a more detailed analysis with charts and graphs, depicting a high reward to risk payoff with low Betas and high Sharpe Ratios.

Article Summaries

|