I Know First Review: July 26th 2015

I Know First Reviews

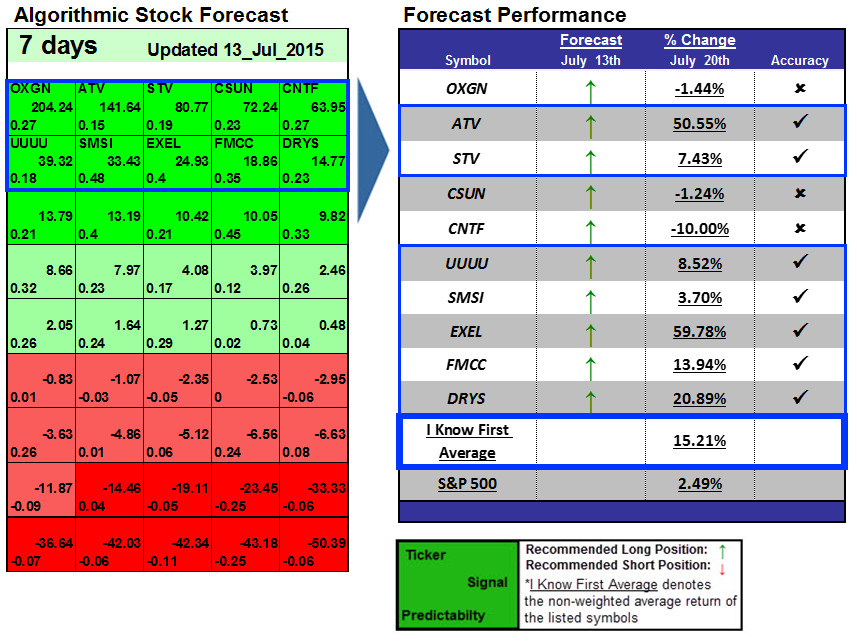

The stocks selected here are the top performing stocks from I Know First: Daily Market Forecast’s July 5th, 2015 stock forecast titled “5 Dollar Stocks: up to 59.78 Return in Seven Days”.

This forecast is part of the “Stocks Under 5 Dollars” package, as one of I Know First’s quantitative investment solutions. The “I Know First Average” return for the long position was 15.21% over 7 days versus the S&P 500’s return of 2.49% over the same time period.

Learn how to read the predictions: Instructions

Learn how to strategise with the forecast: Algorithmic Trading Strategies

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.

Signal: 204.24

Predictability: 0.27

Return: -1.44%

Oxigene (OXGN) is a biopharmaceutical company in California that focuses on developing cancer therapies that disrupt blood vessels associated with tumors.

Signal: 141.64

Predictability: 0.15

Return: 50.55%

Acorn International, Inc. (ATV), is a marketing and branding company in China. They participate in both direct-sales business and distribution. The company had a signal strength of 141.64 and a predictability indicator of 0.15. In accordance with the algorithm’s prediction, the stock price increased by 50.55%.

ATV’s stock is on the upswing after sweeping changes made to their executive team and board of directors. From the former co-founder, former chairman, and CEO, the company repurchased and canceled 6,518,656 Acorn ordinary shares. After risking possible loss of listing on the NYSE due to low trading price, the company managed to boost their price, regaining their listing. The combination of these major changes contributed to this healthy return predicted by the algorithm.

Signal: 80.77

Predictability: 0.19

Return: 7.43%

China Digital TV Holding Co. (STV) is the leading provider of conditional access (CA) systems to the digital television market in the People’s Republic of China. Conditional access systems prevent access to unauthorized content through the use of smart cards and software for set-top boxes that connect televisions to an external signal to transmit encrypted information into what people see on television. The company had a signal strength of 80.77 and a predictability indicator of 0.19. In accordance with the algorithm’s prediction, the stock price increased by 7.43%.

Share prices spiked on July 16th upon release of a news article reporting an update on their restructuring. The venture capital company handling their asset restructuring received approval in principle for the restructure from the Ministry of Commerce. The restructuring agreement requires completion by December 31, 2015. In addition, they changed Auditors, both the CEO and CTO resigned, and founder Jianhua Zhu took over as CEO.

Signal: 72.24

Predictability: 0.27

Return: -1.24%

China Sunergy (CSUN) is a leading manufacturer of solar cells and modules that convert sunlight into electricity.

Signal: 63.95

Predictability: 0.23

Return: -10.00%

China TechFaith Wireless Communication Tech. Ltd. (CNTF) is a global company based in China that develops and produces middle to high end mobile phone handsets. They also develop content, software, and devices for motion gaming markets.

Signal: 39.32

Predictability: 0.18

Return: 8.52%

Energy Fuels Resources (UUUU), an integrated uranium miner, produces and sells uranium to major global nuclear utilities. With 5 locations in the U.S., their Utah facility makes them the owner and controller of the only operational conventional uranium processing facility in the U.S. The company had a signal strength of 39.32 and a predictability indicator of 0.18. In accordance with the algorithm’s prediction, the stock price increased by 8.52%.

UUUU share prices roses steadily throughout the week, before jumping on Thursday, the 16th upon the release of the news that Wyoming approved a revision to a an existing mining permit to grant expansion of mining area. Currently one of the largest uranium development projects in the U.S., this single mining permit gives Energy Fuels to over 30 million pounds of uranium.

Signal: 33.43

Predictability: 0.48

Return: 3.70%

Smith Micro Software Inc (SMSI) is a California based company that provides software to enhance quality of use for mobile device consumers. Their products are either: applications for connecting consumers, platforms for controlling device behavior, or communication services. The company had a signal strength of 33.43 and a predictability indicator of 0.48. In accordance with the algorithm’s prediction, the stock price increased by 3.70%.

Following numerous positive ratings from analysts and healthy financial statements, SMSI’s share price rose in anticipation of the release of second quarter earnings. Second quarter earnings reports are scheduled to post on July 27th.

Signal: 24.93

Predictability: 0.4

Return: 59.78%

Exelixis, Inc (EXEL) is a biopharmaceutical company with a focus on molecular therapies to improve cancer treatment. The company had a signal strength of 24.93 and a predictability indicator of 0.4. In accordance with the algorithm’s prediction, the stock price increased by 59.78%.

EXEL’s stock price saw a dramatic increase upon the release of positive results from Phase 3 of a clinical trial for a therapy that drastically reduces disease progression and death in patients with certain types of kidney cancer. Also helping to raise the price was the filing of a Form 4 for insider trading. and the announcement that Exelixis plans to offer 20 million stock shares in an underwritten public offering.

Signal: 18.86

Predictability: 0.35

Return: 13.94%

Chartered by Congress in 1970, the Federal Home Loan Mortgage Corporation (FMCC) is a major source of financing for multifamily housing by focusing their business on mortgage loans and mortgage related securities. The company had a signal strength of 18.86 and a predictability indicator of 0.35. In accordance with the algorithm’s prediction, the stock price increased by 13.94%.

FMCC experienced a price increase following upgrades from numerous analysts. It was also released that the FHFA approved a conditional pay raise for current executives at FMCC, specifying that it must stay under the 25th percentile of what executives at some of the major banking corporations earn.

Signal: 14.77

Predictability: 0.23

Return: 20.89%

DryShips Inc. (DRYS) is a Greek shipping company that owns 39 drybulk containers, 10 tankers, and owns and operates 13 offshore drilling units. The company had a signal strength of 14.77 and a predictability indicator of 0.23. In accordance with the algorithm’s prediction, the stock price increased by 20.89%.

Optimism over bailout talks gave DryShips an impressive bump in stock price. Amid continued talks and deals, DRYS was among the many stocks that reflected the hopefulness investors feel as Greece makes headway in concluding their bailout deal.

Business Disclosure: I Know First Research is the analytic branch of I Know First, a financial startup company that specialises in quantitatively predicting the stock market. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article.