The Future of Risk Management Part 1: Forecasting Liquidity

This article was written by Julia Masch, a Financial Analyst at I Know First.

Highlights:

- What is a liquidity forecast?

- Why does it matter?

- I Know First’s Plans To Predict Liquidity

What is a liquidity forecast?

A liquidity forecast is a prediction of a company or market’s cash flows at some future point in time. On a company or market basis, liquidity forecasting allows companies to pinpoint potential times that available sources of credit would not be able to cover cash shortages. Alternatively, liquidity forecasting also allows companies to identify if there is an excess of liquid assets which can then be utilized for other initiatives. Using a combination of liquidity tools allows companies to measure their liquidity and manage potential excess or insufficient cash in advance. Liquidity can be committed or uncommitted; in times of volatility, uncommitted liquidity may be decreased significantly whereas committed liquidity will stay stable.

While there is a variety of ways to calculate liquidity, a thorough liquidity forecast will have accounted for potential shocks by performing simulations and analyzing various scenarios on both cash flow and availability of liquidity. The most liquid asset a company can have is cash.

A company’s liquidity has many factors. One of the most common determinants of liquidity is cash flow. Cash flow is the difference between inflows and outflows for a company. Since forecasting these is not always accurate, unpredictability can affect actual liquidity. A drag on liquidity occurs when cash inflow is either reduced or delayed and can be caused by, obsolete inventory, bad debt, tight credit, and more. Contrarily, a pull on liquidity occurs when cash outflow increases and can be a result of making payments, reduced credit, and more. A drag or pull decreases a company’s liquidity.

Additionally, a company’s management policies and control of cash flow can affect the total liquidity. If a company is more risk averse, it may be more likely to maintain liquid cash balance. Alternatively, if management prefers higher returns instead, a company may opt to invest in high risk high-return assets instead of keeping liquid assets readily available. Another factor that affects liquidity is a company’s ability to raise cash. If a company knows it has eager investors or is able to increase its cash without taking a loan, it is more likely to invest more of its cash flow. This is often the case for subsidiaries and companies that can depend on parent companies in case of emergency. Many factors can affect a company’s liquidity and it is important for companies to be aware of these and know possible results if any of these are to change. Liquidity can be measured by the quick ratio, which is the sum of cash, cash equivalents, short term investments, and current receivables, divided by their current liabilities. Quick ratio is a short term measurement.

On the other hand, if a company wants to measure liquidity in the longer run (up to a year), it can use the current ratio. This ratio is simply current assets divided by current liabilities.

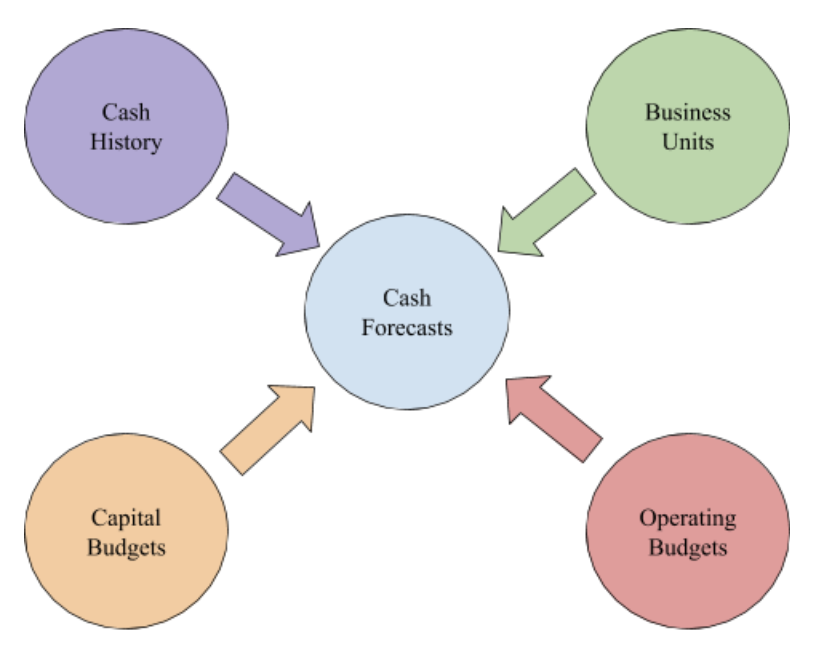

Using historical data on cash and liquidity, a company can also predict future liquidity. Cash forecasts are created using capital budgets, cash history, business units, and operating budgets.

So, why does it matter?

These liquidity forecasts can provide information about the company to potential investors. When making investment choices, people often look at the balance sheet to determine financial strength of a company and liquidity is an important aspect of this. Prior to the financial crisis of 2008, many would not have focused on a company’s liquidity when deciding whether to buy its stock. However, many have learned the importance of liquidity since then.

Creating liquidity forecasts allows companies to optimize plans as they are more aware of where cash flow will be at future points in time. Investors will opt to put their money towards companies who have strong liquidity forecasts and are more prepared for future situations. Companies are given Moody’s rating which allows investors to gauge the relative credit worthiness of a security. Companies with greater liquidity are more likely to receive higher ratings and thus be rated as a more dependable investment.

A Macro Picture – Market Liquidity

Market Liquidity is the ease at which market participants can buy or sell assets with minimal cost, risk, or inconvenience. Market liquidity risk is the loss that occurs when a trade is made at a non-equilibrium price. In general, market liquidity refers to a market’s depth, breadth, and resilience in combination with time. Market depth refers to the change in volume of transactions based on a change in price. Meanwhile, market breadth gauges the number of stocks that are rising in comparison to those that are falling.

In a liquid market, bid-ask spread (the difference between the highest price a buyer is willing to pay and the lowest price the seller is willing to accept) should be minimal and prices will be relatively constant. Market resilience indicates the market’s ability to adjust back to equilibrium following significant price changes. Finally, time is the last major factor that affects market liquidity; in a liquid market, trades are absorbed by the market quickly so transactions can occur almost instantaneously.

There are 4 main inputs upon which the market liquidity can be measured: transaction cost, volume, equilibrium price, and market impact. However, the presence of dark pools where large volumes of stock change hands obscures the real values. The more accessible substitutes are market’s depth, breadth, and resilience.

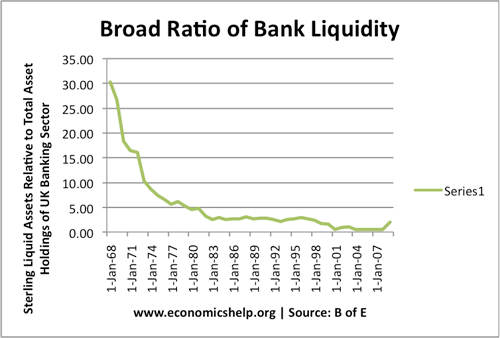

Liquidity can also depend on macroeconomic fundamentals such as fiscal policy and exchange rate. For example, bank liquidity ratio, or the ratio of a bank’s assets to liabilities, is monitored by the reserve requirement the Federal Reserve puts on US banks. If the Fed were to decrease the reserve requirement, the liquidity of the US market would increase dramatically.

Additionally, many companies are dependent on their relationships with others and one company’s changes can affect another and cause a ripple effect. Alternatively, problems for a large player in a sector can influence the entire industry. In the case of the 2008 financial crisis, as the housing crisis deepened, it began affect the upper echelons of Wall Street and companies that had invested in subprime mortgages tried to liquidate their backing as soon as possible. When Lehman Brothers declared bankruptcy, they set off turmoil in financial markets all over the world and particularly in the US. A big part of why many of these large companies backed such risky securities is because they believed they were “too big to fail,” which ended up being partly true as the government provided bailouts for some of the largest companies who struggled during the recession.

Liquidity is also dependent on a country’s money supply and the Quantity Theory of Money:

If the Federal Reserve increases money supply in a country by printing more money, there will be a consequent increase in price level (which is a measure of inflation). Each individual dollar will have less spending power and the value of the dollar will decrease. Therefore, while this is a seemingly simple way for a country to increase its liquidity, the rising costs of goods and service will cancel the benefit of increased liquidity.

Because there is so little agreement on the terms “money supply” and “country liquidity,” it becomes a struggle to measure these important values. Different definitions of money supply like M0 and M1 have been defined, but economists still argue about which is best, but they are simply different collections of liquid assets. Because of these varying opinions, it becomes nearly impossible to identify an exact numerical formula for a country’s liquidity. A rough measure some economists like to use is the ratio of a company’s debt to its GDP, which mimics the current ratio on a macroeconomic level.

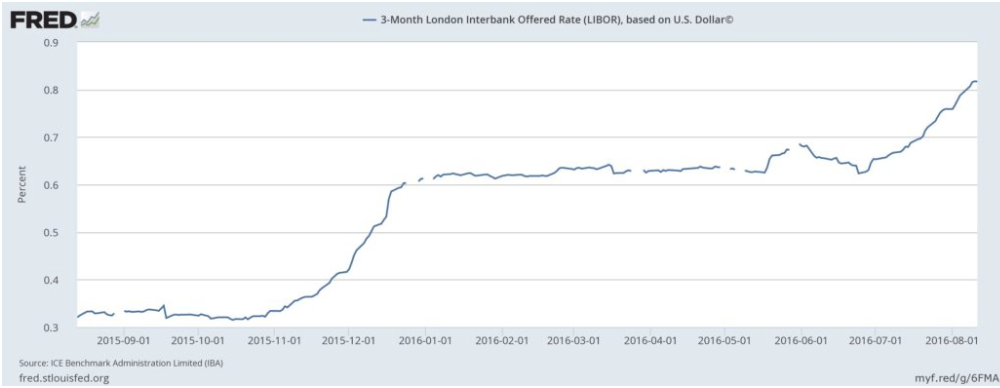

Currently, people expect that if they need they will easily be able to get a loan or the liquid assets they need. However, LIBOR (a benchmark for interest rates banks charge each other for short term loans) has been increasing, thus making it more expensive for banks to borrow from each other which trickles down to companies and individuals when they wish to take loans.

Recently, Italy faced political turmoil as the country struggled to create a government from the parties that had been elected in the last elections which could have led to new elections and uncertainty about what lies ahead for the country. During this time, the Italian government’s bond market, worth more than $2.2 trillion outstanding, was highly illiquid with many brokers unwilling to offer a quote for an Italian bond. This cause yields to spike immensely as price decreased. The volatility in the Italian market has showcased the importance of keeping track of liquidity, as you do not want to be the one stuck with worthless Italian bonds when the country is in crisis.

Many economists are becoming more and more concerned about the potential for a liquidity crunch, in which demand for cash sources while supply is low, which will lead to higher interest rates. Recently, Bridgewater Associates, the world’s biggest hedge fund has become concerned about an impending economic crisis in 2019 as economic drivers stop playing into financial results and they maintain bearish predictions on more and more stocks. Once the economy starts going down, the economy will enter a feedback loop and liquidity will decrease immensely.

I Know First’s Plans To Predict Liquidity

I Know First is currently in the processing of implementing its algorithm to forecast liquidity of both companies and entire markets. Using historical data, I Know First will be able to predict the cash shortages, and which companies and industries will be more vulnerable. Once the I Know First algorithm begins forecasting liquidity, it will be able to see the potential for situations like this to arise. The I Know First algorithm will be able to predict the deterioration of liquidity and inform subscribers before it is too late.

Part 2: Quantifying Uncertainty

More About I Know First

I Know First is a fintech company that provides state of the art self-learning AI based algorithmic forecasting solutions for the capital markets to uncover the best investment opportunities. The algorithm generates daily market predictions for stocks, commodities, ETF’s, interest rates, currencies, and world indices for the short, medium and long term time horizons.