I Know First Algorithm Review: August 18th

I Know First Algorithm Review

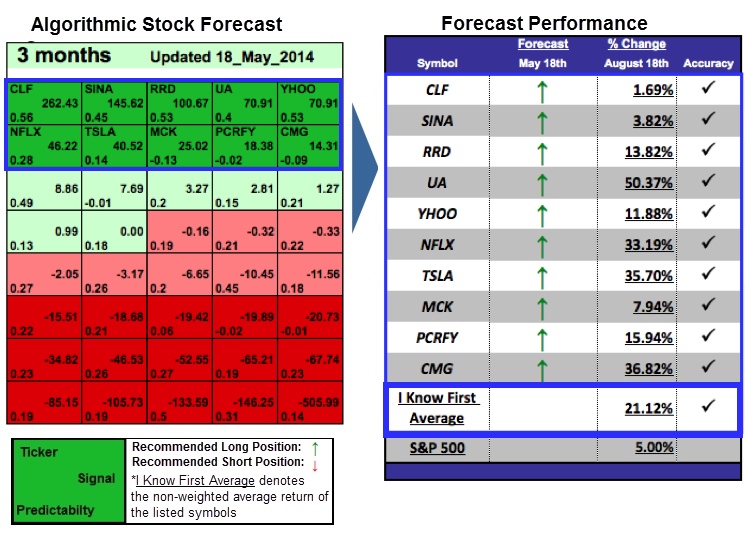

The I Know First Algorithm Review shows the top performing stocks from I Know First: Daily Market Forecast’s May 18th 2014 Stock Forecast titled, Algorithmic Trading: 50.37% Return in 3 Months. The “I Know First Average” return was 21.12% versus the S&P 500’s return of 5.0% over the same time period.

Click Here For Full Story Learn how to read the predictions: Instructions Learn how to strategize with the forecast: Algorithmic Trading Strategies Please note-for trading decisions use the most recent forecast.

Signal (3 months): 262.43

Predictability (3 months): 0.56

Return: 1.69%

Cliffs Natural Resources Inc. is an international mining and natural resources company. The Company is an iron ore producer and a producer of metallurgical coal. The Company’s operations are organized according to product category and geographic location: U.S. Iron Ore, Eastern Canadian Iron Ore, North American Coal, Asia Pacific Iron Ore, Asia Pacific Coal, Latin American Iron Ore, Ferroalloys, and its Global Exploration Group. On May 12, 2011, the Company completed the acquisition of Consolidated Thompson Iron Mining Limited.

Signal (3 months): 145.62 Predictability (3 months): 0.45 Return: 3.82% SINA Corporation is an online media company serving China and the global Chinese communities. Its main products include SINA.com, SINA.cn, and Weibo.com. These digital networks enable users to access and share user generated media and professional media with their friends and acquaintances. In a recent conversation with Christine Tan of CNBC, CEO of SINA Corp, Charles Cao, stated SINA plans to spend more money and energy on growing their user base.

Signal (3 months): 145.62 Predictability (3 months): 0.45 Return: 3.82% SINA Corporation is an online media company serving China and the global Chinese communities. Its main products include SINA.com, SINA.cn, and Weibo.com. These digital networks enable users to access and share user generated media and professional media with their friends and acquaintances. In a recent conversation with Christine Tan of CNBC, CEO of SINA Corp, Charles Cao, stated SINA plans to spend more money and energy on growing their user base.  Signal (3 months): 100.67 Predictability (3 months): 0.53 Return: 13.82% R.R. Donnelley & Sons Company (RRD) is a global provider of integrated communications. The Company works collaboratively with more than 60,000 customers worldwide to develop custom communications solutions that reduce costs, drive top line growth, enhance return on investment and ensure compliance. RRD last posted its quarterly earnings results on May 1st: the company reported $0.31 earnings per share for the quarter, beating the analysts’ consensus estimate of $0.27.

Signal (3 months): 100.67 Predictability (3 months): 0.53 Return: 13.82% R.R. Donnelley & Sons Company (RRD) is a global provider of integrated communications. The Company works collaboratively with more than 60,000 customers worldwide to develop custom communications solutions that reduce costs, drive top line growth, enhance return on investment and ensure compliance. RRD last posted its quarterly earnings results on May 1st: the company reported $0.31 earnings per share for the quarter, beating the analysts’ consensus estimate of $0.27.  Signal (3 months): 70.91 Predictability (3 months): 0.4 Return: 50.37% Under Armour develops, markets, and distributes apparel, footwear, and accessories. The Company specializes in athletic gear and sells its products worldwide and to athletes at all levels. Under Armour has posted 16 consecutive quarters of other 20% growth in its top line. During this time, the company has managed to triple its revenues. Furthermore, the company announced a goal to increase its revenue to $4 billion by 2016, which is almost twice its current revenue of $2.33 billion. To meet this goal, Under Armour will need to continue to expand internationally and strengthen its product lines beyond its primary business: synthetic performance apparel.

Signal (3 months): 70.91 Predictability (3 months): 0.4 Return: 50.37% Under Armour develops, markets, and distributes apparel, footwear, and accessories. The Company specializes in athletic gear and sells its products worldwide and to athletes at all levels. Under Armour has posted 16 consecutive quarters of other 20% growth in its top line. During this time, the company has managed to triple its revenues. Furthermore, the company announced a goal to increase its revenue to $4 billion by 2016, which is almost twice its current revenue of $2.33 billion. To meet this goal, Under Armour will need to continue to expand internationally and strengthen its product lines beyond its primary business: synthetic performance apparel.  Signal (3 months): 70.91 Predictability (3 months): 0.53 Return: 11.88% Yahoo is a global technology company involved in many different aspects of Internet and digital content and experiences across many devices. Yahoo has many plans for the near future : Yahoo recently acquired Blink, a Snapchat-like messaging app. Yahoo is also poised to release a Youtube-like video platform this summer in an effort to compete with Google and other online video providers. Finally, Yahoo is debuting Yahoo Movies, a digital magazine that is focused on all things film from blockbusters to indie movies.

Signal (3 months): 70.91 Predictability (3 months): 0.53 Return: 11.88% Yahoo is a global technology company involved in many different aspects of Internet and digital content and experiences across many devices. Yahoo has many plans for the near future : Yahoo recently acquired Blink, a Snapchat-like messaging app. Yahoo is also poised to release a Youtube-like video platform this summer in an effort to compete with Google and other online video providers. Finally, Yahoo is debuting Yahoo Movies, a digital magazine that is focused on all things film from blockbusters to indie movies.  Signal (3 months): 46.22 Predictability (3 months): 0.28 Return: 33.19% Netflix, Inc. is an Internet television network with more than 44 million members in over 40 countries. Netflix members can watch as much online content as they want, no matter the time or the place. Netflix is currently trading at a historical high: the stock is up 43.7% since last January. Netflix plans to enter 6 European markets by the end of 2014, and it should reach over 60 million customers by 2017 (compared to 10.9 in 2013).

Signal (3 months): 46.22 Predictability (3 months): 0.28 Return: 33.19% Netflix, Inc. is an Internet television network with more than 44 million members in over 40 countries. Netflix members can watch as much online content as they want, no matter the time or the place. Netflix is currently trading at a historical high: the stock is up 43.7% since last January. Netflix plans to enter 6 European markets by the end of 2014, and it should reach over 60 million customers by 2017 (compared to 10.9 in 2013).  Signal (3 months): 40.52 Predictability (3 months): 0.14 Return: 35.70% Tesla Motors, Inc. designs, develops, manufactures and sells electric vehicles and electric vehicle components. Tesla owns its own sales and service network. The company is considering building a multibillion dollar factory to produce its own batteries which could be finished in the next few years. Tesla provides services for the development of electric powertrain components and sells electric powertrain components to other automotive manufacturers.

Signal (3 months): 40.52 Predictability (3 months): 0.14 Return: 35.70% Tesla Motors, Inc. designs, develops, manufactures and sells electric vehicles and electric vehicle components. Tesla owns its own sales and service network. The company is considering building a multibillion dollar factory to produce its own batteries which could be finished in the next few years. Tesla provides services for the development of electric powertrain components and sells electric powertrain components to other automotive manufacturers.

Signal (3 months): 25.02

Predictability (3 months): -0.13

Return: 7.94%

McKesson Corporation delivers pharmaceuticals, medical supplies, and health care information technologies to the healthcare industry in the United States and internationally. The company operates in two segments, McKesson Distribution Solutions and McKesson Technology Solutions. The McKesson Distribution Solutions segment distributes ethical and proprietary drugs and equipment, and health and beauty care products. McKesson crushed its first quarter earnings and revenues and is forecasted to continue its strong growth throughout the rest of the fiscal year.

Signal (3 months): 18.38 Predictability (3 months): -0.02 Return: 15.94% Panasonic Corporation is a Japan-based company with many divisions: it offers audio and video equipment, household air-conditioning machines, system network and mobile communications-related products and services, automotive multimedia-related equipment, electrical components, semiconductors and optical devices. Nokia announced on July 20th that it had struck a deal to buy Panasonic Corporation wireless networks business.

Signal (3 months): 18.38 Predictability (3 months): -0.02 Return: 15.94% Panasonic Corporation is a Japan-based company with many divisions: it offers audio and video equipment, household air-conditioning machines, system network and mobile communications-related products and services, automotive multimedia-related equipment, electrical components, semiconductors and optical devices. Nokia announced on July 20th that it had struck a deal to buy Panasonic Corporation wireless networks business.  Signal (3 months): 14.31 Predictability (3 months): -0.09 Return: 36.82% Chipotle Mexican Grill, Inc. (Chipotle) operates Chipotle Mexican Grill restaurants. Chipotle Mexican Grill restaurants serve a menu of burritos, tacos, burrito bowls (a burrito without the tortilla) and salads. As of December 31, 2012, the Company operated 1,410 restaurants, including Chipotle restaurants throughout the United States. Chipotle reported great second-quarter earnings: CMG saw overall sales increase by 28.6% on a year-over-year basis for the quarter, while net income saw an increase of 25.5% to $110.3 million. Business Disclosure: I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article. Read More From I Know First Research:

Signal (3 months): 14.31 Predictability (3 months): -0.09 Return: 36.82% Chipotle Mexican Grill, Inc. (Chipotle) operates Chipotle Mexican Grill restaurants. Chipotle Mexican Grill restaurants serve a menu of burritos, tacos, burrito bowls (a burrito without the tortilla) and salads. As of December 31, 2012, the Company operated 1,410 restaurants, including Chipotle restaurants throughout the United States. Chipotle reported great second-quarter earnings: CMG saw overall sales increase by 28.6% on a year-over-year basis for the quarter, while net income saw an increase of 25.5% to $110.3 million. Business Disclosure: I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article. Read More From I Know First Research: