JNPR Stock Forecast: PTX, 400 Gig, and Contrail will Drive Juniper Networks’ Revenue

This article was written by Kwon Sok Oh, a Financial Analyst at I Know First.

JNPR Stock Forecast

(Source: Wikimedia Commons)

Juniper Networks, Inc. (NYSE: JNPR), incorporated on September 10, 1997, designs, develops and sells products and services for high-performance networks to enable customers to build networks for their businesses. The Company sells its high-performance network products and service offerings across routing, switching and security. Juniper Networks’ client verticals are composed of cloud, enterprise, and service provider.

Summary

Juniper Networks Delivers Better-Than-Expected Results for Q1 2018

Cloud Routing is Suffering Short Term due to the Transition from MX to PTX

Cloud Switching has Positive Outlooks Attributable to 400 Gig Development

Service Provider is Looking Strong Thanks to Contrail and SD WAN

Valuations Methods Suggest JNPR is Currently Underpriced

I Know First’s Algorithm Forecast is Bullish for JNPR in the Long Run

Juniper Networks Delivers Better-Than-Expected Results for Q1 2018

Juniper Networks delivered a better-than-expected total revenue of $1,083 million for Q1 2018, which was driven by the better-than-expected results of its cloud vertical and the year-over-year growth of its enterprise vertical, partially offset by its weaker-than-expected service provider vertical. For the cloud vertical, Juniper Network’s largest clients are transitioning from Juniper Network’s MX platforms to its PTX platforms. However, this transition is creating downward pressure on average selling price for cloud routing, and this pressure is speculated to persist for the next couple of quarters, mildly easing as time passes. Nevertheless, cloud routing revenue increased quarter-over-quarter due to increasing client network requirement. PTX platforms accounted for 80% of the cloud routing ports shipped, which was an increase from less than 40% a year ago.

Enterprise vertical revenues increased 4% year-over-year, which is attributable to favorable trends across all areas of technology. Contrail Enterprise Multicloud is expected to create simple engineering environments for enterprise datacenters, pushing Juniper Network towards a dominant position in networking systems.

Service provider vertical revenues declined 16% year-over-year, but Juniper Network’s management expects to turn the tides through improving client confidence in Juniper Network’s nodes slicing feature, software disaggregation, and integrated optical capabilities. Clients’ shifting tendency towards metro initiative and 5G build are also interpreted as favorable future factors for service provider revenues.

(Source: Wikimedia Commons)

Juniper Network’s product areas are divided up onto routing, switching, and security. Routing revenue for Q1 2018 declined both quarter-over-quarter and year-over-year, but PTX platform potentials for the cloud vertical and MX demand in the cable and telecom sectors provide a positive outlook for routing revenues in the future.

Switching revenue also declined quarter-over-quarter and year-over-year, caused by low cloud switching revenue. However, QFX and EX products received positive feedback from clients, retaining competitiveness across all verticals, especially with Tier 2 cloud providers, Saas providers, and enterprise.

Security revenue decreased by 17% quarter-over-quarter but increased by 11% year-over-year, due to the general trend among clients investing more for cyber threat protection. Juniper Networks’ Software-Defined Secure Network is gaining momentum, and many new clients have been added in Q1 2018.

(Source: Flickr)

A final point that deserves attention is that Juniper Networks has been committed to increasing software revenue, and it has more than doubled in the past three years. Contrail is gaining momentum through new clients in Q1 2018, including a U.S. SaaS provider and an international strategic enterprise. Contrail has gone through major improvements, including augmented multicloud capabilities that provide more control for workload in physical, virtual, and multi-vendor settings. Moreover, AppFormix is gaining momentum too by winning new clients in the enterprise and service provider verticals. Juniper Networks is attempting to further strengthen software capabilities to collect more recurring software revenues in the future, especially for the security vertical.

Cloud Routing is Suffering Short Term due to the Transition from MX to PTX

Cloud routing has been going under downward pressure on price due to the transition from PTX to MX. Currently, the PTX price per port is lower than that of MX, but Juniper Network’s management expects that as the transition process progresses further, the average selling price will start to normalize, alleviating the downward pressure. Furthermore, even though PTX has a lower margin compared to MX, PTX’s margin is still higher than that of the average Juniper Networks product, which provides the company with a constant stream of healthy revenue flow. Finally, based on cloud providers’ reports on their business, they are not experiencing any decrease in demand for their service, which will in turn maintain demand for Juniper Networks’ products in the long run.

Furthermore, AT&T’s usage of 60,000 white box routers seemed problematic for Juniper Networks, but Juniper System’s management is confident that Juniper Networks’ well-established stance as an established network vendor that managed to disaggregate its operating system will prove to be an attractive feature for potential clients. Juniper Networks’ disaggregation of its operating system will be able to meet client demand for high levels of flexibility, programmability, and telemetry, and Juniper Networks has been communicating constantly with clients who seek customized solutions in this area.

(Source: Wikimedia Commons)

Cloud Switching has Positive Outlooks Attributable to 400 Gig Development

Cloud switching performed better than expected in Q1 2018, and it is expected to perform even better in the coming quarters. Currently, switching for the cloud provider market has a high degree of concentration, and Juniper Networks views this as an opportunity to expand market share. In order to capture more market share, Juniper Networks is working on the transition from the 100 gig to the 400 gig, which is expected to take place next year. For this transition, Juniper Networks is developing appropriate software, silicon technology, and optics components. For 2018, switching is expected to experience year-over-year growth.

Service Provider is Looking Strong Thanks to Contrail and SD WAN

The service provider vertical experienced difficulties in Q1 2018. For the past couple of quarters, the factors affecting service providers mainly resided in how they were going to expand on cloud-oriented architecture. This pressure on service providers caused them to become more conservative, causing clients, especially in North America, to not spend capital expenditure on Juniper Network products as much as they did in the past. Although this difficulty in the service provider vertical is expected to endure for the next couple of years, there are some driving factors that could potentially turn the tides around for Juniper Networks.

(Source: Wikimedia Commons)

First, as seen during the Mobile World Congress this year, the demand for 5G is increasing rapidly, and this will create more demand for high performance metro infrastructure to meet increased capacity requirements of 5G. Juniper Networks has already captured some of this demand in EMEA through Contrail.

(Source: Wikimedia Commons)

Furthermore, Juniper Networks views SD-WAN as an opportunity to turn around service provider vertical revenues. Juniper Networks’ management regards SD-WAN as part of a broader solution for cloud CPE, through which Juniper Networks offers connectivity solutions and leverage for third-party virtual networks. Juniper Networks is aiming to enable service provider clients to increase SD-WAN market share, increasing Juniper Networks’ revenue in turn.

Valuations Methods Suggest JNPR is Currently Underpriced

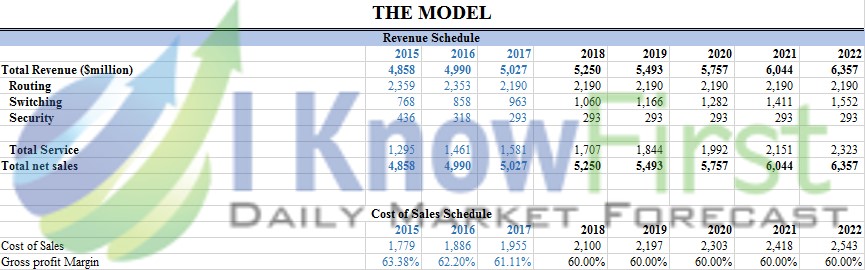

Inferring from the 5-year DCF analysis, the target price of JNPR for January 1st, 2019, is $33.65, which is a 19.03% upside from the current price of $28.27 (Jul. 18th, 2018). The main assumptions were made conservatively as the following: constant growth of the Switching segment (10%) and no growth for the Routing (0%) and Security (0%) segments. Such assumptions take in the historical performance of Juniper Networks and the projections made by management during the conference call, with more weight given towards negative outlooks. Even under such conservative assumptions, JNPR is still undervalued.

According to the 5-year dividend discount model, JNPR’s target price for January 1st, 2019 is $30.24, which is a 6.96% upside from the current price of $28.27 (Jul. 18th, 2018). JNPR has been repurchasing high amounts of equity in the past couple of years through its high operating cash flows, and the sum of dividends paid and equity repurchased were 162%, 60%, and 165% of net income and depreciation for the years 2015, 2016, and 2017, respectively. Hence, to be conservative, the dividend payout ratio (including equity repurchase) has been assumed to be 75% from 2018 to 2022 and 100% after that into perpetuity. Even under such conservative payout ratio assumptions, JNPR is still undervalued.

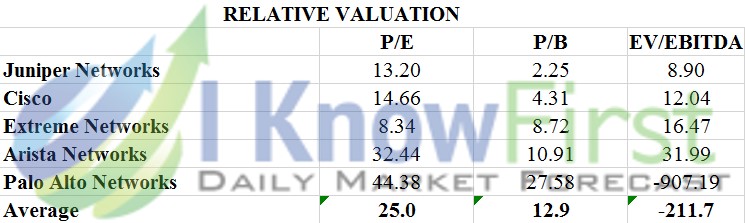

Juniper Network’s main competitor is Cisco, and its stance against Cisco is normally regarded as David versus Goliath. Cisco’s market cap is $198.51 billion, which is more than 20 times the market cap of Juniper Networks ($9.78 billion). Hence, there is no ideal candidate to use for relative valuation. Compared to Cisco, Juniper Networks is more fairly priced according to all ratios.

MACD Indicator is Giving a Buy Signal

(Source: CSIMarket.com)

The MACD indicator is giving a buy signal JNPR. The Signal line (red line) is currently above the MACD line (black line), but it is moving towards a crossing trend, which means that the time to go long on JNPR is imminent. Hence, MACD analysis also indicates a good buying opportunity.

I Know First’s Algorithm Forecast is Bullish for JNPR in the Long Run

I Know First’s algorithm has very bullish forecasts for the 1-month, 3-month, and 1-year time frames. The forecasts for longer time horizons have stronger signals and predictabilities, further supporting the long-term bullish stance of I Know First’s algorithm.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.

To subscribe today click here.