Invest Properly During the Reopening With AI

This article about investments during the reopening season was written by Gabriel Plat, a Financial Analyst at I Know First.

This article about investments during the reopening season was written by Gabriel Plat, a Financial Analyst at I Know First.

Summary

- High vaccination rates are speeding up the reopening phases across the globe;

- Stocks and indexes fell due to uncertainty, but are ready to bounce back;

- Tourism and entertainment sectors could be good investment opportunities;

- I Know First AI-powered algorithm can improve your portfolio.

We Have Already Been Through The Worst

On February 7th, Australia Prime Minister Scott Morrison announced that will open the borders to international travelers. Days before, New Zealand announced a plan to slowly return to normal. The same trend could be seen in Asian countries such as Vietnam and Thailand, as well as European countries such as Sweden, the Netherlands, and the United Kingdom. In the United States, mask mandates are already being eased in several states such as California and Connecticut.

In other words, the world is already understanding that the worst part of the pandemic has been overcome.

Yes, the 7-days moving average of daily new cases of Covid-19 hit an all-time high by the end of January. In spite of that, the daily deaths 7-days moving average didn’t increase proportionally given the number of vaccinated across the globe. According to Our World in Data, about 63% of the global population (or 4,84 billion people) received at least one dose of the vaccine. Countries such as Canada, China, Spain, and Chile already surpassed 80% of their population fully vaccinated.

At this moment, it seems a matter of time before we can return to live our lives without any restraining order.

The Time To Invest Is Now

By the time the Omicron wave started to spread, stock markets were filled with uncertainty. The three main U.S. indexes, S&P 500 (SPX), Dow Jones (DJIA), and Nasdaq (COMP) fell over the last three months. Even though the S&P 500 hit its all-time high in January, external factors such as diplomatic conflicts between Russia and Ukraine as well as a possible rise in interest rates from the FED had a strong impact over the last month. Even so, all three indexes started February in an uptrend.

The cryptocurrency market suffered a huge blow in the same period. Bitcoin (BTC) fell from $65,000 in November to almost $33,000 in January. Ethereum (ETH), Cardano (ADA), and XRP (XRP) also saw similar losses in the same period. The “crypto winter” did not last long as the assets started to recover by the end of January.

Other markets also saw similar tendencies. Gold dropped over 5% between November and December. Crude Oil fell over 18% in the same period. Both overcame the deficit over the next months.

Given this tendency, where should I put my money?

Pay Attention To These Stocks

According to Goldman & Sachs, the moment past market corrections are historically good buying opportunities. Since 1950, the S&P 500 had 33 corrections of at least 10%. On average, an investor who bought the index 10% below its high had a median return of 15% over the next 12 months.

More specifically, we can look to different sectors the reopening can favor. By the end of 2020, I mentioned stocks that could take advantage of the reopening. Three months later, Disney (DIS) jumped 30.18% and Universal Studios (UVV) 13.4%. As 2022 is scaring away the Delta and Omicron, we can believe the uptrend to continue during this year.

Also mentioned, airlines stocks also had potential. Delta Airlines (DAL), American Airlines (AAL), and United Airlines (UAL) enjoyed increases over the period even though the new covid waves.

For 2022, we can look to other sectors with potentially good returns. Stocks such as Domino’s Pizza (DPZ) and McDonald’s (MCD) are in a good spot as this moment favors restaurants. More than that, the urge to travel from Americans can boost stocks from the energy sector such as Chevron (CVX) as well as the entertainment sector such as Las Vegas Sands (LVS).

And how about thinking outside the box? Net private savings had a huge increase during the pandemic, as the population feared the future. At this point, this money can be used to spend in several areas besides those already mentioned. Concerts and music festivals are ready to come back at full capacity, so why not them? Live Nation Entertainment (LYV) owns Ticketmaster and is poised to a comeback after a long and suffering period during the pandemic. Warner Music Group (WMG), which owns several record labels, is also worth watching.

Artificial Intelligence Can Boost Your Portfolio

Regardless of the asset you are looking to invest in, the I Know First predictive algorithm can help you optimize your investments. By using decades of stock market data around the world, the algorithm can understand market trends and generate predictions of stock movements.

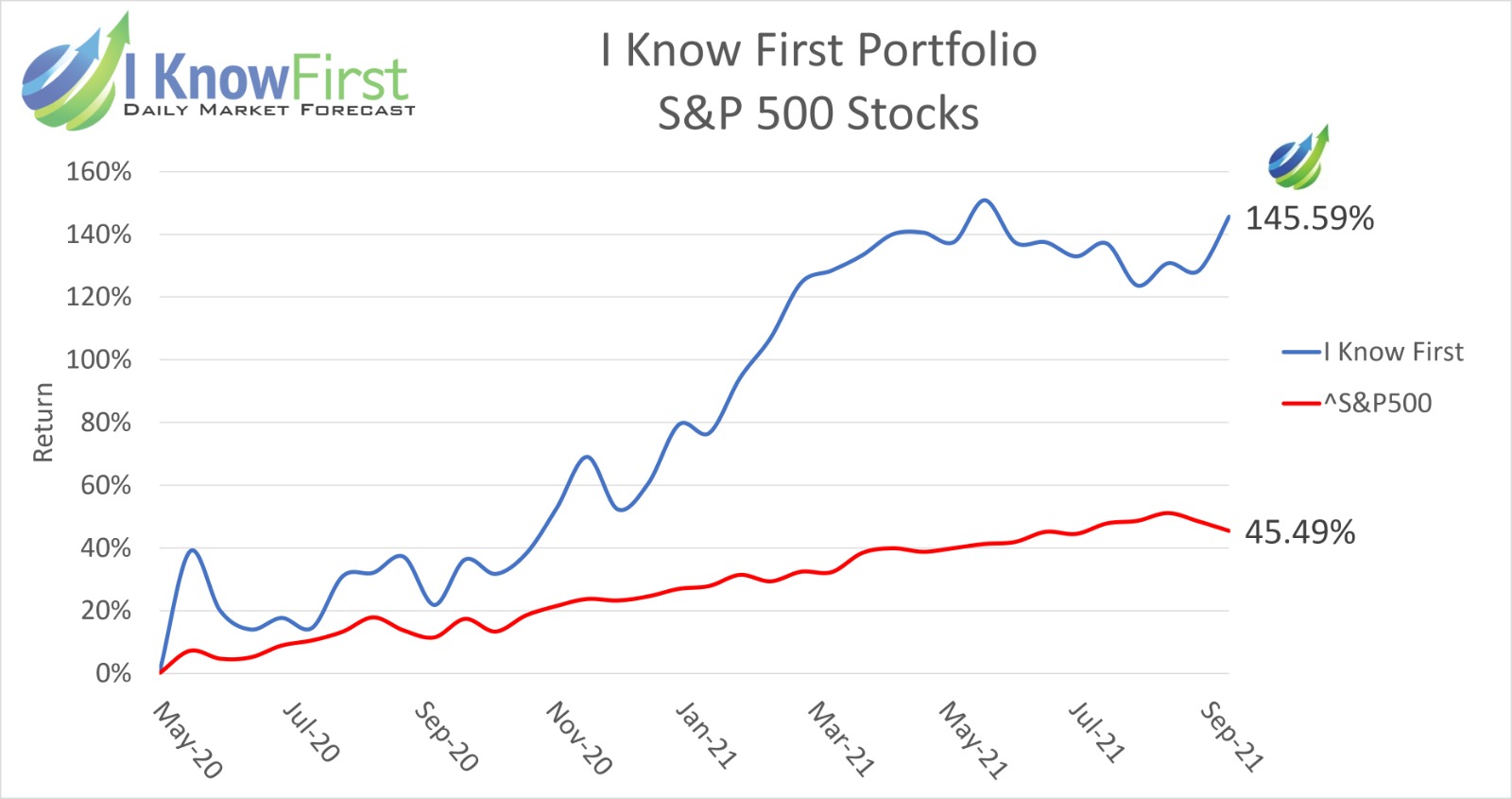

Over the course of 2020 and 2021, at the pandemic peak, the algorithm was still able to indicate the future movement of indexes such as S&P 500, Nasdaq, and Dow Jones correctly across all time horizons. The recommended investment strategy exceeded the S&P 500 return by 100.1%, providing our clients with a huge improvement over the benchmark.

More specifically, we designed a package covering the assets that may be affected by the coronavirus with the biggest financial exposures. It includes assets such as gold and relevant commodities, biotech companies’ stocks, pharmaceutical companies’ stocks, semiconductors, technological sectors stocks, and more. You can have access to it here.

Conclusion

The rise of Delta and Omicron variants interrupted the dream of a pandemic end in 2021. Even though the setback, the world looks ready to enjoy a gradual reopening for this year. Due to high vaccination rates across the globe, countries already started to ease restrainment orders aiming for a return to the old normal.

Following the countries reopening decisions, the stock market shows us several investment opportunities. This decision can heavily favor the entertainment industry, as well as the restaurant and airlines sectors.

As we are still dealing with a period with high volatility, investing can be challenging and risky. By using the AI stock market predictions of the I Know First algorithm, it is possible to mitigate risks and enjoy the best market opportunities at the same time.

To subscribe today, click here.