Intel Stock Price Forecast: What To Expect from Intel’s Biggest Deal Ever – An Algorithmic Perspective (INTC)

Intel Stock Price Forecast

Intel Corp. (NASDAQ: INTC) just announced the acquisition of Altera Corporation (NASDAQ: ALTR), a semiconductor company, for an outstanding price of $16.7 billion, or $54 per share. But is it really worth it?

Altera Corporation

Altera Corporation is an American supplier of programmable semiconductors. They are known to design and sell high-performance programmable logic devices (PLDs) and HardCopy application-specific integrated circuit (ASIC) devices. These are semiconductor integrated circuits that are manufactured as standard chips that its customers program to perform desired logic functions within their electronic systems.

Besides the networking and computers market, Altera has a range of customers within the telecom and wireless, industrial military, and automotive, networking, computer, and storage industries.

Since March 28th, Intel made several offers to Altera, even reaching $54 per share on April 9th (the same price at Altera was bought for on Monday), while other bidders were only interested to buy it at a maximum price of $45. Altera refused offers from Intel, even if many analysts thought it was a win-win situation.

Why Altera is so important to Intel

The “Internet of Things”

Intel wants to develop their “version” of the Internet of Things (IoT). The “Internet of Things” is a scenario where objects, animals, or people are provided with unique identifiers and the ability to transfer data over a network without requiring human-to-human or human-to-computer interaction. (Whatis.com). For Intel, about 60% of this buyout will be dedicated to create “synergies between products”, a whole new class of products.

The Xeon is a brand of x86 microprocessors designed and manufactured by Intel Corporation, targeted at the non-consumer workstation, server, and embedded system markets.

Intel is offering customers, such as server makers and companies building data centers, the option to package server chips with third-party FPGAs, which are being used for dedicated functions like search, sorting, and character matching.

With the buyout of Altera, its clear that Intel will implement this technology into their servers: they want to integrate FPGAs into Xeon processors. And it will cost less for Intel than its competitors to use it, because now Altera is theirs. Intel will be able to build fast chips at an affordable cost.

Finally, this acquisition will hurt the competitors that uses Altera products: Agah Shah, from PC World, said that “IBM and ARM will be left scrambling to seek other FPGA options for their server products”.

Impact on Stock Prices

The stock price of Intel decreased by 2.2% since June 1st, while Altera increased by 10.07%. Shareholders of Intel are not sure what to think about this transaction: It takes time to put together a Xeon CPU with an FPGA, and in the short term, investors are not sure what to do with their assets. But one thing is clear: In the long term, Intel should be able to offer a very great line of new/innovative products in the market.

Meanwhile, shareholders of Altera weren’t compensated adequately according to Robbins Arroyo, an expert in shareholders rights law: Shareholders have had a premium of only 10.5% (based on the stock price of May 29th), while the average 1-day premium was at nearly 38%.

Analysts’ opinion

Most of the analysts are bullish on the stock: Jefferies, Crédit Suisse, and Canacord Genuity all raised or kept a good rating, going from $38 to $48 stock price target. Even if the price tag looks steep, Intel is believed to have made a good move by acquiring Altera. Also, Intel will launch its new range of CPUs, Skylake, at the end of the year, and Microsoft will launch the new Windows 10. Those 2 products will drive the PC market in the future, giving investors confidence in Intel.

Ambrish Srivastava does not agree with this assumption. The analyst of BMO Capital downgraded Intel’s rating from outperform to market perform, as he believes the price paid for Altera is too high. Also, in the transaction no indicator showed the percentage of debt and cash used by Intel; for a transaction as important as this one, we can be sure that Intel didn’t use only cash flow, and it’s possible that Intel has a large debt load after this purchase.

Algorithmic analysis

I Know First supplies financial services, mainly through stock forecasts via their predictive algorithm. The algorithm incorporates a 15-year database, and utilizes it to predict the flow of money across 2000 markets. The algorithm has more data to forecast within the long term and, naturally, outputs a more accurate predication in that time frame. Having said that, intraday traders, along with short-term players, will also benefit by taking the algorithmic perspective into consideration.

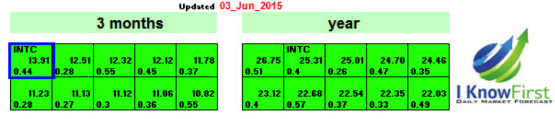

The self-learning algorithm uses artificial inelegance, predictive models based on artificial neural networks and genetic algorithms to predict money movements within various markets. The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

I Know First was correctly able to predict the rise of Intel’s stock price in the past. An article written on March 27th, 2015 had a bullish three-month forecast for the company, indicating that the stock price was undervalued and would increase during that time. As one of the top suggested stock picks by the algorithm, the company had a signal strength of 36.41 on March 27th, 2015. Today, almost 3 months after writing this article, the stock price raised by 10.61%.

Figure 1. Previous Long-Term Algorithmic Forecast For Intel, March 27th, 2015.

Having explained how I Know First’s algorithm works and demonstrated its success in predicting the stock’s behavior in the past, it is worthwhile to see if the algorithm agrees with the bullish fundamental analysis of the company.

Figure 2. Long-Term Algorithmic Forecast For Intel.

The above forecast is for the long-term time horizons of three months and one year. These forecasts are bullish, especially the one-year forecast with a strong signal strength of 25.31 and predictability of 0.4.

We believe that Intel made a very good investment here: Not only will it help Intel to innovate even more in the market, it will also offer the opportunity to make Intel the backbone of Internet of Things field, the competence to create new and innovative products, the ability to focus more on its server offering and the power to hurt its competitors.

As a result, I Know First believes that this transaction strengthens the stock, giving it a huge advantage on the market.