Intel Stock Forecast: Intel Is Now More Affordable

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- We should exploit the big dip in Intel’s stock price last April 26.

- INTC dropped by more than 8.99% due to the lowered guidance given during its Q1 2019 earnings report.

- This stock now trades at $52 price range. This is a great buy-in window. Intel is still king of data center and server processors.

- Intel’s abandonment of 5G smartphone modems can help it save a lot of money. The modem supply business was reportedly costing Intel $1 billion in annual losses.

- In spite of the big dip in INTC’s price, I Know First’s stock-picking algorithm still gives it a slightly bullish one-year market trend forecast score of + 88.28.

I strongly disagree with the overblown negative reaction to Intel’s (INTC) Q1 2019 earnings. INTC’s price dropped by 8.99% after the company’s April 25 Q1 2019 earnings report. We should be grateful to those who dumped their INTC holdings on April 26. They gave us a cheaper buy-in window to own more INTC shares. Intel is now even more relatively undervalued compared to Advanced Micro Devices (AMD) and Nvidia (NVDA).

INTC’s P/E is now only 12.62 and its Price/Book 3.56x. Intel’s stock is a super-bargain investment compared to AMD’s P/E ratio of 80.60x, and Price/Book valuation of 22.59x.

(Source: Seeking Alpha)

The notable undervaluation of INTC against AMD is an aberration that won’t last long. More investors will eventually realize that INTC deserves a much higher valuation. The current mainstream pessimism over Intel is temporary. Going forward, INTC can return to its 52-week high of $59.59 within the next 12 months. The revised FY 2019 guidance from Intel’s management is not that bad. Intel’s new CEO is a finance person. Finance-centric managers always tend to issue conservative (or understated) future projections.

I will still hold on to my INTC position even though Intel’s management said it expects FY 2019 GAAP revenue of $69 billion, and EPS of $4.14.

(Source: Intel)

Why Intel Can Beat Its Estimates

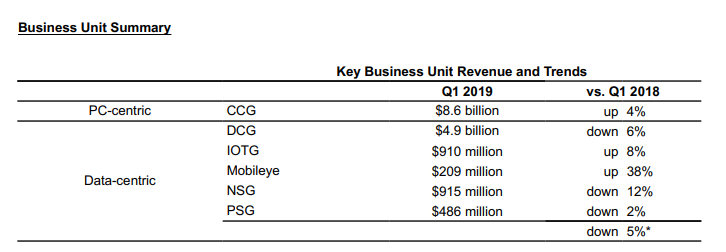

My fearless forecast is that Intel has a great chance of finishing 2019 with a higher revenue and EPS. The largest business segment, Client Computing Group of CCG posted a 4% year-over-year growth to $8.6 billion in Q1. This pattern can continue because Microsoft (MSFT) is end support for Windows 7 computers. Companies and individuals will likely buy new computers that can actually run Windows 10 comfortably. Most Windows 7 computers right now are older than 5-years old.

The other EPS growth driver for INTC this year is its decision to kill its 5G smartphone chip business. There’s talk that Intel is trying to sell its money-losing wireless chip/modem business too. Making modems was reportedly costing Intel $1 billion in annual loses. Getting rid of a money-losing subsidiary can help INTC finish 2019 with an EPS higher than $4.14.

My takeaway is that Chinese companies will gladly purchase Intel’s modem/wireless communications chip subsidiary at any price.

Why Investors Will Eventually Fall In Love Again With Intel

Intel is a much bigger company than AMD. Intel generates more annual revenue and net income. Intel has a much stronger balance sheet than AMD and Nvidia. Those two rivals are not the reasons why Intel’s Data Center Group or DCG saw -6% year-over-year drop in Q1 2019. I believe the weakness was due to companies are still maximizing deployment/use of the the server/data center processors they bought last year. Demand for server processors will rebound in the second half of 2019.

(Source: Intel)

AMD and Nvidia are also not vendors of NAND or flash storage drives. We cannot say the -12% drop in the NSG subsidiary’s quarterly revenue was due to AMD and Nvidia stealing market share. This was due to the oversupply issue that’s causing flash storage prices to keep on declining.

What We Should Focus On

We raise our bets on INTC because its now cheaper to own. We also do so because we like the growing revenue streams of IOTG and Mobileye. IOTG or the Internet of Things Group posted 8% year-over-year growth in Q1, with $910 million. This is good because supplying the processors to IoT devices is a long-term tailwind. Statista estimated that there were 23.14 billion IoT devices being used last year. This number can grow to 75.44 billion by 2025.

The next thing we should focus more on is self-driving cars. Intel’s purchase of Mobileye will eventually make it the go-to company when it comes to processors, sensors, and connectivity of autonomous vehicles. Going forward, I expect Mobileye to contribute $2 billion/year to Intel’s topline by 2022.

Conclusion

The resilience of Intel is best illustrated by the fact that its PC-centric revenue grew 4% Year-over-Year in Q1. IDC and Gartner both reported a dip in Q1 2019 global PC shipments. It goes to show that Intel can grow its PC revenue even in a down market. This should convince you all why we should raise our bets on INTC. We should buy more INTC because DCG’s quarterly revenue will eventually recover by 2H 2019.

Based on IDC’s server tracker platform, server sales is growing at double-digit per quarter. This can continue well into 2021. Intel remains the priority processor supplier of 99% of server vendors like Dell.

(Source: IDC)

I Know First also agrees with my bullish outlook for Intel. It gave INTC a +88.28 one-year market trend forecast score. The score is near the +100 certified bullish algorithmic endorsement.

How to interpret this diagram.

Past I Know First Forecast Success With INTC

I Know First has been bullish on Intel shares in past forecasts. On August 28, 2018, the I Know First algorithm issued a bullish 1 year forecast for INTC with a signal of 36.58 and a predictability of 0.52, the algorithm successfully forecasted the movement of the INTC share. Until today, INTC shares have risen by 7.95% in line with the I Know First algorithm’s forecast. See chart below.

This bullish Intel stock forecast was sent to the current I Know First subscribers on August 28, 2018.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.