Intel Stock Forecast For 2021: Exploit The Deep Value Offered By Intel

The Intel stock forecast for 2021 was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The Intel stock forecast for 2021 was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- I reiterate my strong buy recommendation for Intel. This semiconductor industry leader’s stock remains in deep value opportunity.

- Intel still enjoys more than 93% market share of the data center/server processor market. This invidious status will improve as Intel launches more deep learning/AI accelerators.

- Amazon is launching Intel’s Habana AI/Deep Learning processor instances on AWS. Intel is emerging as a serious rival to Nvidia’s dominant position in deep learning accelerators.

- INTC deserves a fair value of $68. This stock currently has a very low TTM P/E valuation of 9.37x that value investors should exploit.

The -15.67% YTD performance of Intel’s (INTC) stock is a golden opportunity. Going long on INTC is justified. The 93.4% market share of Intel on data center processor sales will remain for many years to come. Intel’s recent launch of its data center GPUs and the oneAPI unified cloud software platform fortifies Intel’s monopoly over the $15.2 billion/year server processor industry. The return to normalcy early next year can also help Intel’s DCG again do quarterly revenue of $4 to 6 billion.

Despite the COVID-19 headwind, Intel remains very profitable and dominant. Intel will again wrap up 2020 as the world’s no. 1 vendor of semiconductor products.

Yes, the 4% revenue growth of Intel is disappointing. However, Intel’s slow sales growth plus excellent profitability, is still better than Advanced Micro Devices’ (AMD)high growth + low profitability. The deep value of INTC is clearly illustrated by the chart below. It is always safer to invest in undervalued companies rather than speculating on market-darling firms with low-profit performance.

AMD’s net margin of 5.07% is grossly lower than Intel’s 29.25%. The recent revenue surge of AMD is coming from its bottom-pricing business model. Intel’s very healthy balance sheet can help it quickly extinguish AMD’s bottom-pricing strategy.

Intel’s forward P/E valuation of 11.74 is an aberration considering its consistently-high profitability. AMD’s net margin of 5.07% is grossly lower than Intel’s 29.25%. The recent revenue surge of AMD is coming from its bottom-pricing business model. Intel’s very healthy balance sheet can help it quickly extinguish AMD’s bottom-pricing strategy.

Aside from Intel’s supply constraints, lower-priced Ryzen processors is partly why AMD now has 20% market share in x86 laptop processors.

Intel Is A Solid Bet On Deep Learning/Machine Learning

I am highly confident that Intel deserves a 1-year price target of $68. Going forward, INTC should attract more bulls because of Amazon’s (AMZN) upcoming launch of Habana Gaudi Deep Learning accelerator EC2 instances on AWS. The promised 40% price performance advantage of Gaudi over GPU-based deep learning accelerators will attract many AWS customers.

Azure and Google (GOOGL) Cloud will promptly imitate Amazon. They will also eventually offer cost-efficient Habana Gaudi alternatives to their Nvidia (NVDA) GPU-based deep learning/machine learning instances. The end result is that Intel will disrupt Nvidia’s $1.9 billion/quarter data center business.

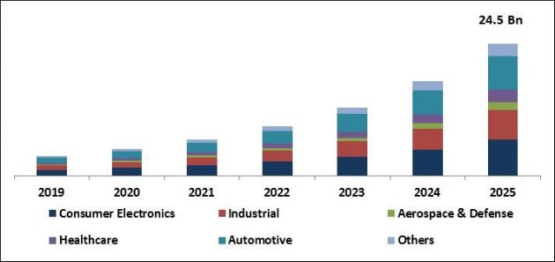

You should go long on INTC because the $2 billion acquisition of Habana Labs is a boost to Intel’s already-assured future in the fast-growing deep learning chipset industry. The global deep learning/machine learning processors/accelerators market is growing at 37% CAGR. It will be worth $24.5 billion by 2025.

Habana is just one of Intel’s tailwinds on deep learning/machine learning semiconductor products. Intel has been supplying Altera FPGA accelerators to cloud computing giants like Microsoft. Intel also owns Movidius – a leader in AI-powered Vision Processing Units or VPUs. Intel is also working hard on its Loihi neuromorphic AI processor. Neuromorphic processors will be able to self-learn like a human brain. Current CPU, GPU, ASIC, and FPGA accelerators still rely on rigid inferencing. The Pohoiki Beach (with 64 Loihi processors) neuromorphic system is now being used by 60 of Intel’s selected partners.

Tests showed Loihi neuromorphic design is more energy-efficient than current deep neural network processors available.

Lastly, the recent launch of the unified oneAPI for faster cross-architecture software development that are all optimized via Intel x86 CPUs, Loihi systems, FPGA, ASICS, and GPU products.

Going forward, five years from now, Intel’s diversified approach to AI hardware could help it surpass Nvidia’s lead in deep learning/AI processors.

DCG Numbers Will Bounce Back

My fearless forecast is that Habana AI accelerators could add $250 million to $600 million in new annual revenue to Intel by FY 2021. Habana AI accelerators could help offset Intel’s lowered average selling prices of Xeon server processors. As of Q3 2020, Intel is obviously fending off EPYC processors by lowering the average price tags for its Xeon products. Investors dumped INTC because of the chart below. The -15% drop average selling prices of DCG products intimidated a lot retail and institutional investors. This misplaced fear is not worrisome. Intel is simply flexing its pricing advantage over its midget rivals, AMD and a handful of ARM server processor vendors. DCG’s recent drop in revenue is also due to the COVID-19 pandemic. Countries around the world are gradually vaccinating their citizens against COVID-19 virus. Xeon sales will again pick up after this COVID-19 headwind evaporates.

The other thing that could boost DCG is Intel’s new data center GPU products. Tencent (TCEHY) is the biggest video games company in the world. Tencent’s decision to use Intel’s Xeon scalable processors and H3C XG310 GPU for its XianYou cloud gaming platform is a big endorsement. Intel no longer makes smartphone processors but thanks to Tencent, INTC will indirectly monetize from Android and iOS gamers.

The H3C XG310 server GPU was created for Android games streaming but it is also suited for media streaming. It can also be used to improve Tencent Music and iFlix movie streaming. Intel is going to be a top beneficiary of Tencent’s $70 billion 5-year investment budget for its cloud/streaming strategy.

Conclusion

It might be wise to take your big profits on market darlings AMD and NVDA. You can use some of the cash to buy more INTC. Thanks to its many acquisitions, Intel will persist as a monopoly on server/data center hardware. I do not believe that AMD and ARM server processor vendors will be able to bring down Intel’s server share to below 85% anytime soon. The upcoming boost from Habana, Altera, Movidius, and Mobileye will ultimately improve Intel’s annual sales growth.

Apple’s (AAPL) use of its own ARM-based processors for some macOS computers is not a serious headwind. Intel is now a data center/AI company. Intel is not reliant on the slow-growth PC industry. The big profits come from DCG. It is therefore immaterial if Intel is in no hurry to build and sell 7-nanometer processors for laptops and desktop computers. Gauge INTC’s investment quality on how fast Intel is growing its suite of data center products and services. Intel still has more than $18 billion in cash & equivalents. It can acquire more AI/cloud computing companies to grow its presence in the

The predictive AI of I Know First is also slightly bullish on INTC’s 1-year market trend. It gave Intel’s stock a trend score of 40.82.

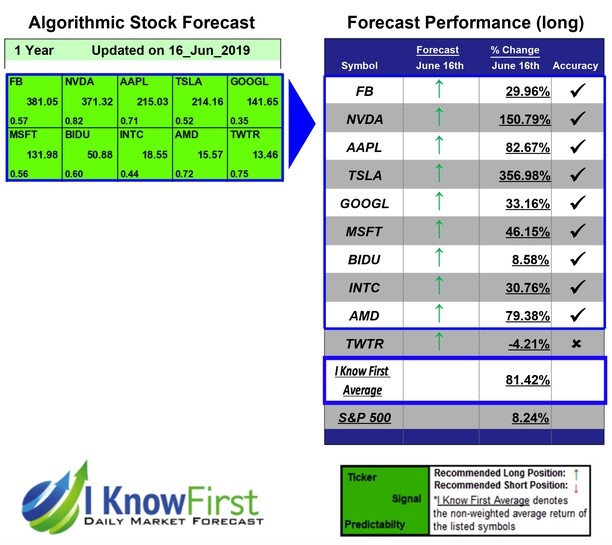

Past Success With Intel Stock Price Forecast

I Know First has been bullish on INTC’s shares in past forecasts. On June 16, 2019, the I Know First algorithm issued a bullish forecast for Intel. The algorithm successfully forecasted the movement of Intel’s shares on the 1 year time horizon. INTC’s shares rose by 30.76% in line with the I Know First algorithm’s forecast.

On November 27th 2020, the I Know First algorithm also issued a bullish forecast. The algorithm successfully forecasted the movement of Intel’s shares on the 3 days time horizon. INTC’s shares rose by 5.33% in line with the I Know First algorithm’s forecast.

Here at I Know First, our AI-based stock forecast algorithm has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. The database used is 100% historical data free from human-derived assumptions and is constantly evolving with newly added data and adapting to changing market situations. Today, we are producing daily forecasts for over 10,500 assets such as S&P 500 forecast, as well as gold predictions and forex forecast, while also providing the latest Apple stock predictions. These forecasts generated by our quant trading tool are used by institutional clients, as well as private investors and traders to identify the best investment opportunities in the market.

To subscribe today click here.

Please note – for trading decisions use the most recent forecast.