Intel Stock Forecast: COVID-19 Pandemic Proved How Strong Intel Is

The Intel Stock Forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The Intel Stock Forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- The better-than-expected Q1 2020 earnings report proved my March 31 argument that in spite of COVID-19, INTC is still prospering.

- I reiterate my $75 one-year price target for INTC. Take your profits on AMD and use the money to buy more INTC.

- Don’t be fooled, better benchmark scores from AMD’s new processors doesn’t automatically translate to better sales.

- Sad but true, Intel will still dominate x86 processors for the next decade. The high valuation ratios of AMD is a dangerous mirage.

- You should buy more INTC because Intel is still enriching itself while the rest of the world is losing billions of dollars trying to combat a pandemic.

My pancreas and heart are bad… but my brain is still doing great! I argued last March 31 that the COVID-19 pandemic is not a hindrance to Intel’s (INTC) ongoing prosperity. The better-than-predicted figures for Q1 2020 proved my conjecture as correct. Buy more INTC because this company is so dominant, no pandemic can derail its persistent profitability.

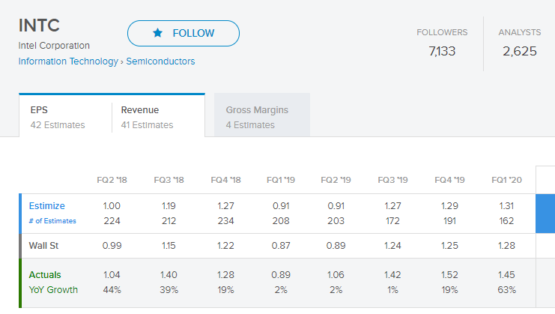

Please study the chart below. You will agree with me when I say Wall Street analysts are really dumb when it comes to predicting the EPS of INTC. For the past eight quarters, Intel consistently beat Street estimates.

INTC’s current price is now over 9% higher than what it was last March 31. A 9% return in less than 30 days is justifiable reason to sell. However, my brain is dictating that I must insist INTC remains a strong buy.

Sell AMD, Buy More INTC

You should really take your profits on Advanced Micro Devices (AMD) immediately. You can then use some of the cash to buy more INTC. The Q1 numbers are easy to comprehend. Intel is enriching itself while China (and other countries) are getting poorer trying to control or solve the COVID-19 pandemic. This undeniable fact is why I still have a $75 one-year price target for INTC.

Kindly browse the chart below. You should buy more INTC because it actually delivered year-over-year increase in revenue and net income (while there is a global pandemic). Q1 2020’s net income was $5.7 billion. This is significantly higher than Q1 2019’s $4.0 billion. The Q1 2020 revenue of $19.8 billion is 23% higher than Q1 2019’s revenue of $16.1 billion.

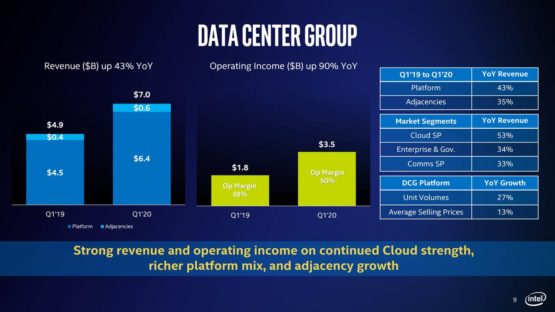

The most impressive figure on the above chart is obviously the +43% year-over-year growth in Data Center Group’s revenue. We all know that the most profitable segment of Intel is DCG. DCG touts operating margin of 50%. The client computing group only has operating margin of 43%.

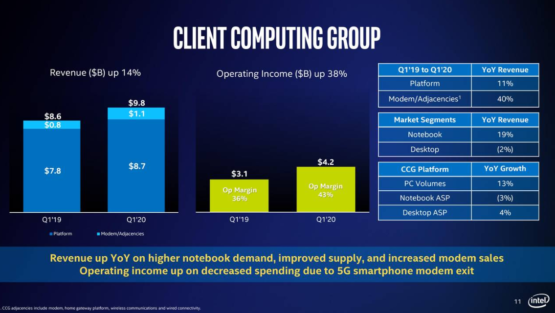

If the above chart did not impress you enough, the one below should do it.

You should sell (or short) AMD and bet more on Intel. The chart above revealed that despite of the hype around AMD’s server processors and ARM-based server chips, Intel’s pricey and electricity-hungry Xeon processors remains the top choice of big and small data center operators.

There is an ongoing pandemic and yet DCG Platform still managed to post a 27% year-over-year growth in unit volumes. This volume increase also came with +13% year-over-year boost in average selling prices. You should buy INTC because this company can increase the price tags of its products and still attract more and more buyers for them.

Going forward, the new 2nd-Gen EPYC processorswill again fail to disrupt Intel’s 98% in x86 server processors. Intel is a high conviction buy because AMD will never ever get 15% of the lucrative data center market.

Don’t Be Misled By The Persistent Hype Over AMD

There’s a cabal of savvy traders who are overbuying AMD. They believe in their own mirage that AMD is now a worthy competitor of Intel. The short-sellers are afraid to pierce the AMD bubble. There’s obvious cooperation among the biggest investors in AMD. These institutional investors will protect their overvaluation of AMD.

Many analysts have little appreciation of Intel. Their illusion is the new processors of AMD are hurting Intel. This is patently misguided thinking. The reality is AMD can keep releasing new processors and Intel will remain the better and safer long-term investment. Keep ignoring the noise that 7-nanometer AMD Ryzen processors deliver better benchmark tests scores. Intel’s very old 14-nanometer processors are still selling like hotcakes.

All the media praises over Ryzen processors never translated to notable change in AMD’s financial health. AMD is still struggling to make a profit. On the other hand, Intel’s PC processors are killing it. Despite COVID-1, Intel’s CCG or Client Computing Group (which covers pc processor sales) still posted 14% year-over-year improvement. Despite the proliferation of cheaper 7-nanometer processors, Intel still increased CCG’s operating profit from $3.1 billion to $4.2 billion.

Conclusion

The big year-over-year gains in Q1 revenue and net income are enough evidence to render a verdict… Intel is guilty of being too dominant and profitable. Heed my advice, go buy more INTC shares. This boring stock is grossly undervalued and underappreciated.

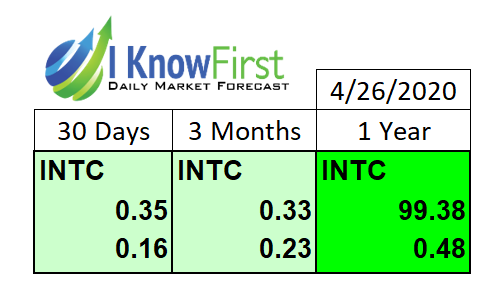

Go against the flow, invest more on Intel. The stock-picking AI of I Know First shares my optimism over Intel. Intel stock forecast for one-year scores signal of 99.38 from I Know First. A stock only needs to score 100 to get a clear buy signal.

Past Success With Intel Stock Forecast

I Know First has been bullish on INTC’s shares in past forecasts. On January 6, 2019, the I Know First algorithm issued a bullish forecast for Intel. The algorithm successfully forecasted the movement of the INTC’s shares. Until today, INTC’s shares have risen by 26.92% in line with the I Know First algorithm’s forecast. See chart below.

This bullish Intel stock forecast was sent to the current I Know First subscribers on January 6, 2019.

Here at I Know First, our AI-based algorithm has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. Since 2011, we have been providing daily stock market predictions, as well as a gold price predictions, forex predictions, and, in particular, Apple stock forecast and Apple Stock News. Today, we are producing daily forecasts for over 10,500 assets. These forecasts generated by our quant trading tool are used by institutional clients, as well as private investors and traders to identify the best investment opportunities in the market.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast