Intel stock forecast: Intel Could Become A Leader In Cryptocurrency Mining Hardware

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- I proposed last August 2017 that Intel should get involved in cryptocurrency mining.

- Intel already filed a patent application for its own Bitcoin/cryptocurrency mining hardware in September 23, 2016.

- The patent proposed a more energy-efficient System-on-Chip using processors, ASIC, and FPGA for its energy-efficient Bitcoin miner.

- 21, Inc. hired Intel years ago to manufacture two generations of its ASIC Bitcoin miners.

- CEO Brian Krzanich’s email in 2015 promised to consider the potential of mining chips for Intel’s future product map.

My August 2017 article called for Intel (INTC) to join the growing hardware market for cryptocurrency mining. Six months later, I’m surprised to learn that Intel filed a patent in September 23, 2016 proposing a Bitcoin mining accelerator design which promises 35% better energy efficiency. Intel could possibly rival the world’s top mining hardware vendor Bitmain. Bitmain sold $2.3 billion worth of ASIC (Application-Specific Integrated Circuit) mining hardware last year.

(Source: U.S. Patent & Trademark Office)

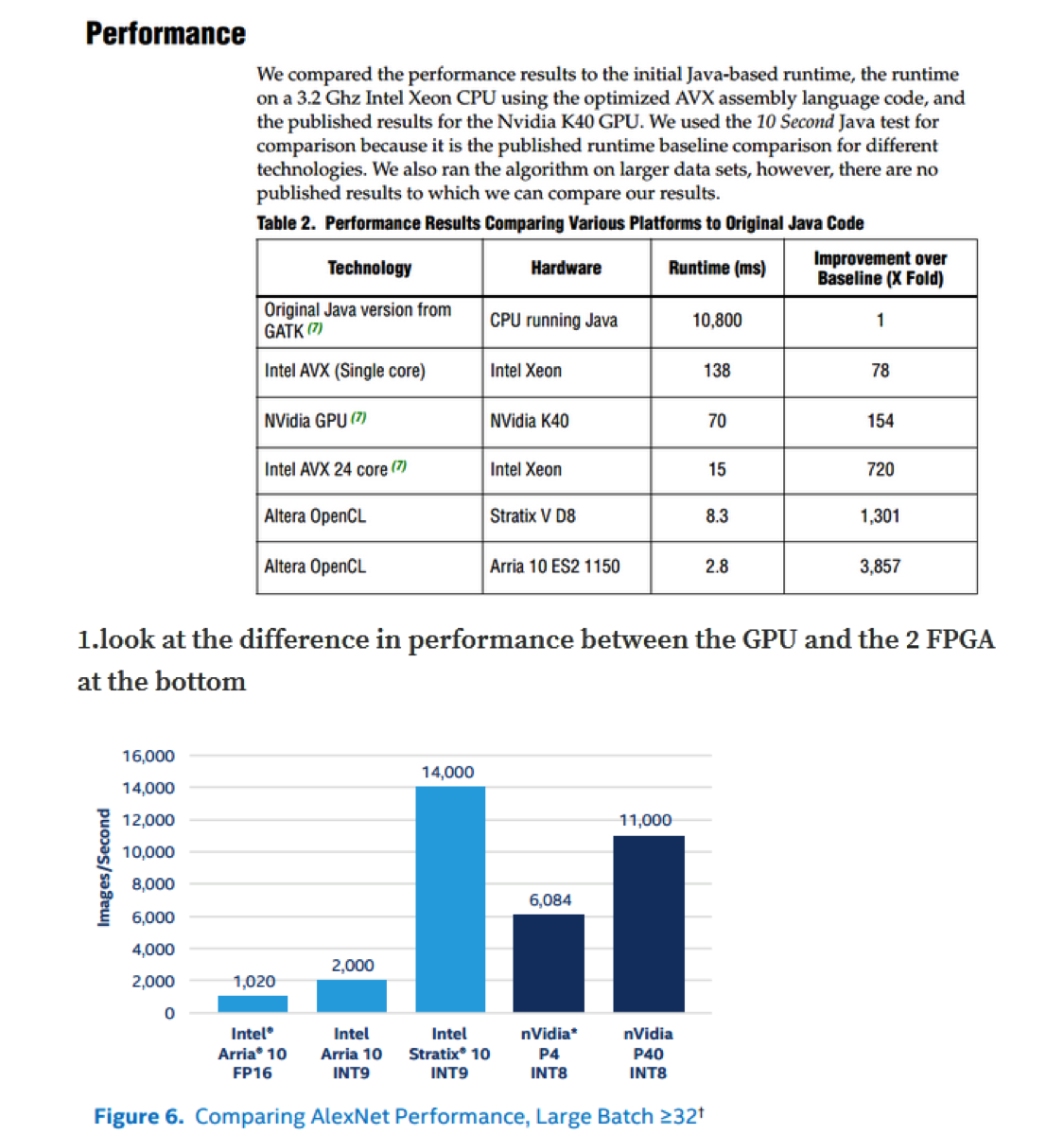

Selling cryptocurrency mining hardware can help Intel recover faster its $16.7 billion purchase of Altera. Altera is a leader in Field-Programmable Gate Array (FPGA) compute hardware. Before ASIC hardware became the go-to choice, FPGA hardware were popular for Bitcoin mining.

The proposed design is based on using a System on Chip (SoC) design with a processor core and a hardware accelerator to mine digital currency. The drawing below was 2016-era. My speculation is Intel will use Altera’s Stratix 10 FPGA as an accelerator for this design.

(Source: U.S. Patent & Trademark Office)

(Source: U.S. Patent & Trademark Office)

Intel might also use its license from Advanced Micro Devices (AMD) to integrate Radeon RX Vega M GPU for its future cryptocurrency mining product. GPUs are so scarce and expensive right now because Ethereum miners are buying them hand-over-fist. Intel’s low-power cryptocurrency mining hardware design could

Yanbellavance’s article last year hinted that Altera’s Stratix 10 FPGAs could eventually outperform GPUs (Graphics Processing Units) in Ethereum mining. Ethereum’s blockchain network uses the Keccak 256 algorithm. The $250 Stratix 10 FPGA can outperform a $1,000 Nvidia (NVDA) GPU on Keccak 256 algorithm workload.

(Source: Yanvellabance)

The faster compute efficiency of Altera Stratix 10 is also confirmed when Microsoft (MSFT) chose it to power its real-time Artificial Intelligence platform, Project Brainwave last year. Nvidia is perceived as the leader in AI computing hardware but Microsoft still opted to use Stratix 10 FPGAs.

Cryptocurrency Mining For The Masses

The other design option could also use some IP/technology used in Intel Movidius Myriad X VPU/Neural Compute Stick. Brian Krzanich’s 2015 email proposed distributing Bitcoin mining chips in consumer electronic devices. It is is clear that Krzanich dreamed of small Bitcoin mining hardware sticks products which could be plugged into computers, tablets, and smartphones.’

Four Movidius Neural Compute Stick products can be powered by a single USB port. They are made for deep learning/artificial intelligence workload but they could be easily reprogrammed for consumer-level Bitcoin/cryptocurrency mining.

(Source: Nervana Systems)

Cloud Cryptocurrency Mining For Intel

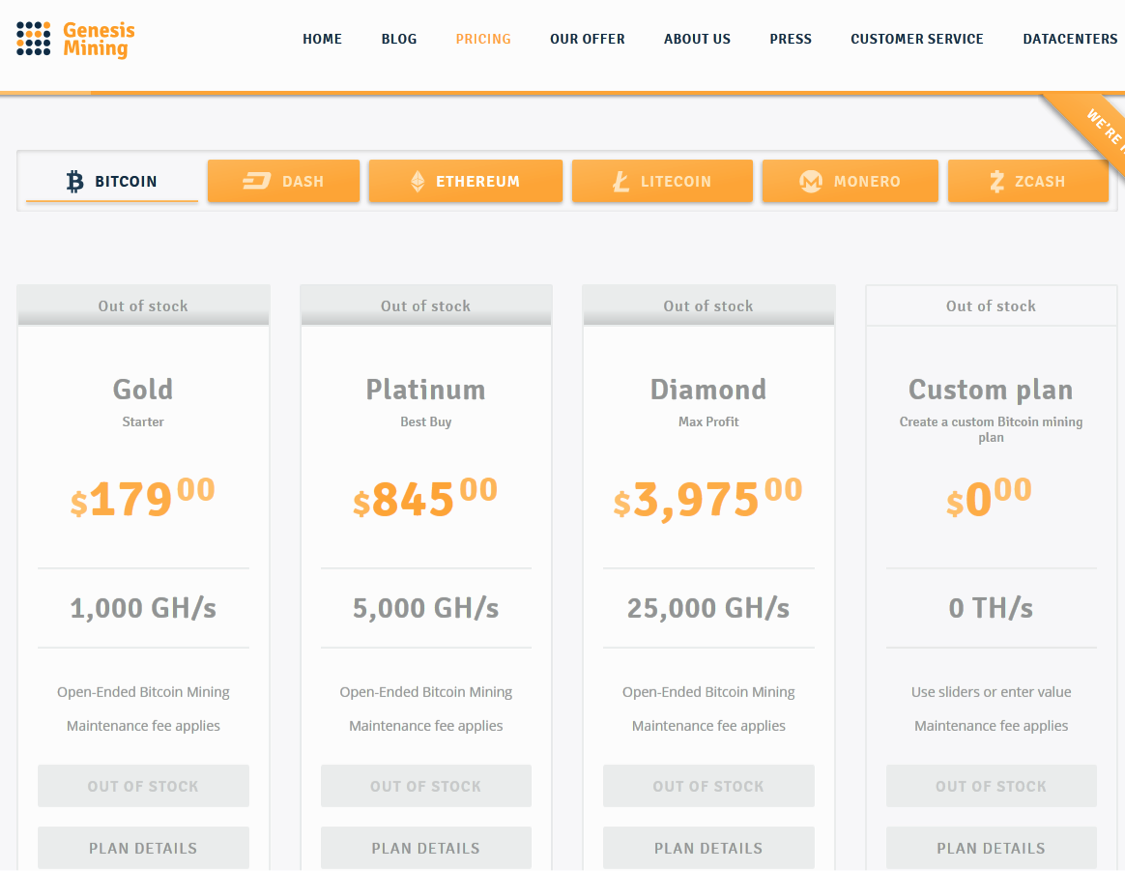

The other future market for Intel-made cryptocurrency mining hardware could be intended for cloud operators like Genesis Mining and HashNest. People who do not want to buy and operate their mining rigs could just buy hashing rate power from Genesis Mining. These cloud operators have datacenters located in countries with cheap electricity rates like China, Russia, and Iceland.

Instead of people spending thousands of dollars to build their own home/office Bitcoin mining set-up, they could just rent a Genesis Platinum package for $845/month to have a 5,000 GH/s Bitcoin mining operation.

(Source: Genesis Mining)

Intel could manufacture and supply the server processors/FPGAs/ASIC/NAND flash storage to help Genesis Mining increase its global datacenter capability.

Conclusion

Intel’s apparent long-running interest in cryptocurrency mining is a good reason to hold on to INTC shares. The patent application convinced me that Intel could really come up with more energy-efficient cryptocurrency mining products. It could prevent government officials from banning electricity-hungry mining operations. The electricity-intensive compute workload has compelled Plattsburg, New York to ban Bitcoin/cryptocurrency mining last year.

Bitcoin mining’s global electricity usage is greater than the electric consumption of 159 countries. Its annual electricity consumption is now 58.56 Terrawatt Hours (TWh). Global mining of bitcoin’s electricity cost is $2.93 billion.

(Source: Digiconomist)

Intel’s proposed energy-efficient Bitcoin mining hardware could prevent other cities/municipalities from imitating Plattsburg’s ban.

My buy rating for INTC is supported by this stock’s positive one-year algorithmic forecast. Intel’s stock could hit $60 before 2018 ends.

Monthly technical indicators and moving averages analysis also produced a Strong Buy recommendation for INTC.

Past Intel stock forecast: Past I Know First Success with Intel

On July 20, 2016 I Know First has been bullish on INTC’s stock on 1, 3 months and 1 year time horizon. We suggested to buy it at that time. Since then, the algorithm successfully predicted the movement of the INTC stock price which rose by 39.39%.

This bullish forecast for INTC was sent to I Know First subscribers on July 20, 2016.

To subscribe today click here.