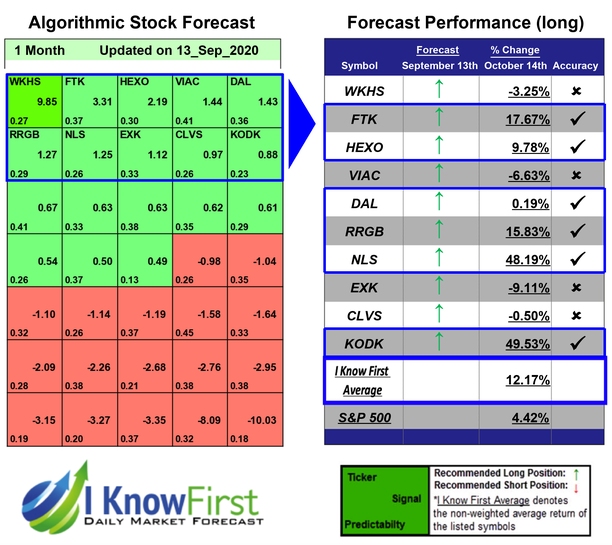

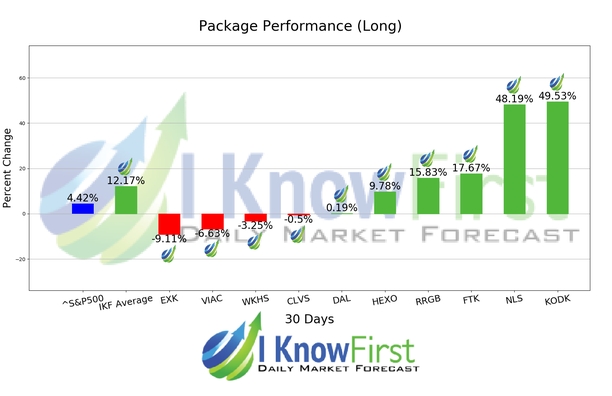

Implied Volatility Based on Predictive Analytics: Returns up to 49.53% in 1 Month

Implied Volatility

The Implied Volatility Options Package is designed for investors and analysts who need implied volatility predictions for options trading. It includes 20 stock options with bullish and bearish signals for implied volatility and indicates the best options to buy and sell:

- Implied volatility Top 10 call options

- Implied volatility Top 10 put options

Package Name: Implied Volatility Options

Recommended Positions: Long

Forecast Length: 1 Month (9/13/2020 – 10/14/2020)

I Know First Average: 12.17%

I Know First’s State of the Art Algorithm accurately forecasted 6 out of 10 trades in this Implied Volatility Options Package for the 1 Month time period. The top performing prediction from this package was KODK with a return of 49.53%. NLS and FTK followed with returns of 48.19% and 17.67% for the 1 Month period. This algorithmic forecast package presented an overall return of 12.17% versus S&P 500’s performance of 4.42% providing a market premium of 7.75%.

Eastman Kodak Company (KODK) provides hardware, software, consumables, and services to customers in various markets worldwide. The company operates in seven segments: Print Systems; Enterprise Inkjet Systems; Micro 3D Printing and Packaging; Software and Solutions; Consumer and Film; Intellectual Property Solutions; and Eastman Business Park. It offers offset plate and computer-to-plate imaging solutions; electrophotographic printing solutions; production press systems, and inkjet components and services, as well as consumables, such as ink; and flexographic printing equipment and plates, and related consumables and services, as well as printed functional materials and components. The company also offers enterprise services and solutions in the areas print and managed media services, and document management services; motion picture, industrial chemicals and films; and consumer inkjet systems, as well as engages in intellectual property and brand licensing activities. In addition, it provides digital and traditional products and services to various commercial industries, including commercial print, direct mail, book publishing, newspapers and magazines, and packaging markets; and commercial inkjet printing solutions and digital front-end controllers for use in inkjet printing process. The company sells its products and services through third party resellers and distributors, as well as directly and indirectly to enterprise accounts and customers. Eastman Kodak Company (KODK) was founded in 1880 and is headquartered in Rochester, New York.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.