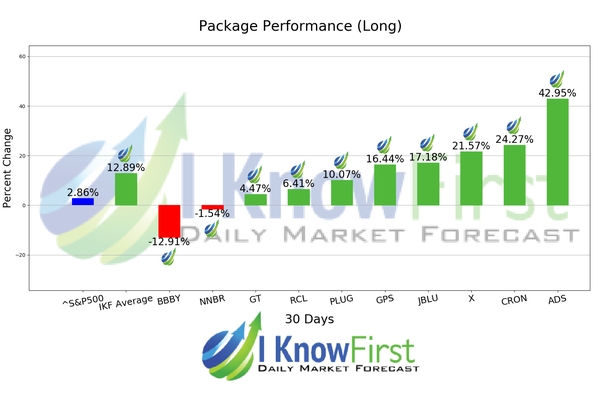

Implied Volatility Based on Deep Learning: Returns up to 42.95% in 1 Month

Implied Volatility

The Implied Volatility Options Package is designed for investors and analysts who need implied volatility predictions for options trading. It includes 20 stock options with bullish and bearish signals for implied volatility and indicates the best options to buy and sell:

- Implied volatility Top 10 call options

- Implied volatility Top 10 put options

Package Name: Implied Volatility Options

Recommended Positions: Long

Forecast Length: 1 Month (10/9/2020 – 11/10/2020)

I Know First Average: 12.89%

Several predictions in this 1 Month forecast saw significant returns. The algorithm had correctly predicted 8 out 10 stock movements. ADS was the top performing prediction with a return of 42.95%. Other notable stocks were CRON and X with a return of 24.27% and 21.57%. The package had an overall average return of 12.89%, providing investors with a 10.03% premium over the S&P 500’s return of 2.86% during the period.

Alliance Data Systems Corporation (ADS) provides marketing and loyalty solutions in the United States and internationally. It facilitates and manages interactions between its clients and their customers through consumer marketing channels, including in-store, online, email, social media, mobile, direct mail, and telephone. The company operates in three segments: LoyaltyOne, Epsilon, and Card Services. The LoyaltyOne segment owns and operates the AIR MILES Reward Program and BrandLoyalty program that are coalition and short-term loyalty programs. This segment also offers loyalty consulting, customer analytics, creative services, and mobile solutions. The Epsilon segment provides direct marketing solutions that leverage transactional data to help clients acquire and build relationships with their customers. Its services include strategic consulting, customer database technologies, omnichannel marketing, loyalty management, proprietary data, predictive modeling, permission-based email marketing, personalized digital marketing, and direct and digital agency services. This segment’s marketing services comprise agency, marketing technology, data, strategy and analytical, and traditional and digital marketing. The Card Services segment offers credit card processing, billing and payment processing, customer care, and collections services for private label retailers, as well as private label retail credit card and loan receivables financing, including securitization of the credit card receivables that it underwrites from its private label and co-brand retail credit card programs. This segment also designs and implements strategies that help its clients in acquiring, retaining, and managing repeat customers. It serves financial services, specialty retail, grocery and drugstore chains, petroleum retail, automotive, hospitality and travel, telecommunications, insurance, and healthcare markets. The company was founded in 1996 and is headquartered in Plano, Texas.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.