IBM Stock Forecast: Why IBM Is Still A Buy

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- International Business Machines’ stock already touts a year-to-date return of +23.90%. I am still endorsing it as a buy.

- I am highly confident that the $34 billion Red Hat acquisition will boost IBM’s revenue performance going forward.

- Red Hat can further fortify IBM’s huge presence in the $310.2 billion annual enterprise application software market.

- IBM has a decades-long partnership with multinational banks. I see this niche market of financial/banking services software as a long-term tailwind.

- Compared to its software industry peers, IBM is notably undervalued.

I am highly confident that International Business Machines (IBM) still has intrinsic upside potential. In spite of IBM’s YTD return of +23.90%, I still rate is as a buy going forward. The $34 billion acquisition of Red Hat, Inc. (RHT) increased the long-term revenue growth performance of IBM. My fearless forecast is that Red Hat Linux can add $3 billion in new annual revenue for IBM.

(Source: YTDreturn.com)

Red Hat will help IBM get out of it stagnating revenue performance for the last five years. IBM posting consistent annual growth in its revenue can likely boost its stock for the next five years. Red Hat’s excellent 5-year revenue growth averaged at 17.06%. IBM’s 5-year revenue performance is pathetic, judging by the chart below.

(Source: MacroTrends.net)

IBM’s Valuation Can Go Higher If It Can Grow Its Revenue

IBM is notably undervalued by investors when compared to its software industry peers. The reason for this is because IBM was a contracting business. Its annual revenue in 2014 was notably greater than that of 2018’s, $92.79 billion versus $79.51 billion.

IBM’s PE ratio is only 14.64, its Price/Book ratio is 7.40, and EV/EBITDA 9.27. The valuation ratios are way lower than Microsoft’s (MSFT) valuation numbers. It goes to show that IBM is perceived as a declining tech giant while Microsoft is accepted as the growing giant of cloud computing and enterprise software services.

(Source: Seeking Alpha)

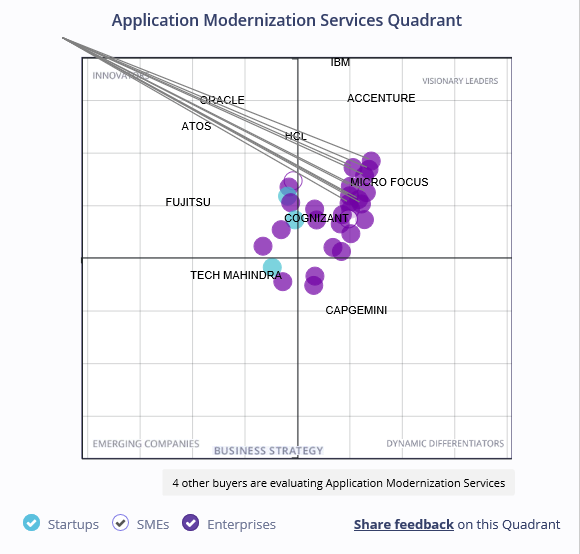

IBM is clearly underappreciated by investors. This dark cloud will eventually fade away. I therefore posit that now is the time to go long on IBM. Acting before hedge fund and mutual fund managers starts going bullish on IBM is judicious. IBM does not have an equalizer to Azure right now. On the other hand, IBM is rated by Gartner as the no.1 firm for application modernization services.

The Gartner Magic Quadrant chart below listed IBM as the leading visionary leader of the Global Application Modernization Services industry. IBM’s decades-long reign on financial & banking software (most of them still reliant on IBM mainframe OS/2 and COBOL) is likely why Gartner chose it as the leading innovator.

(Source: Gartner)

IBM’s mainframe-related software ruled the banking/finance industry from 1970s to until now. It therefore makes sense that IBM will be most trusted source for banks, insurance firms, and governments should they want to upgrade their network hardware and software.

Upgrading corporate software programs is under the $208.8/billion year enterprise software application industry. IBM is a buy right now because it has a long-term tailwind from it being the no.1 service provider for company who needs to upgrade their computer systems’ software.

(Source: Statista)

Why Red Hat?

IBM needed a modern enterprise-level operating system. Enterprise Red Hat Linux happens to be the second-most popular operating system in servers. As of 2017, Red Hat Linux OS had 32.7% marketer share in server OS. Microsoft had 49.6% market share. IBM apparently was not willing to be a sub-seller of Windows server operating systems.

IBM had no choice but to buy Red Hat so it can own the second-most popular operating system for servers and cloud computing computers. IBM has a giant presence in the enterprise. IBM’s persistent support for Linux is likely why this open-source operating system (Linux) is now huge paid subscription software. Linux is now bigger than Windows in servers.

(Source: IDC)

Below is a screenshot of IBM’s PDF file declaring its everlasting love for Linux. Microsoft hates it but IBM is adept at using Linux as a weapon against Windows on server operating systems.

(Source: IBM)

Conclusion

I rate IBM as a buy. This company has long-term benefits from its leading position in banking and other enterprise application software services. IBM is not just mainframe ecosystem provider anymore. It has cloud computing, AI, and Big Data commercial services to offer.

As of last year Big Data services and platforms already tout a market size of $42 billion.

(Source: Statista)

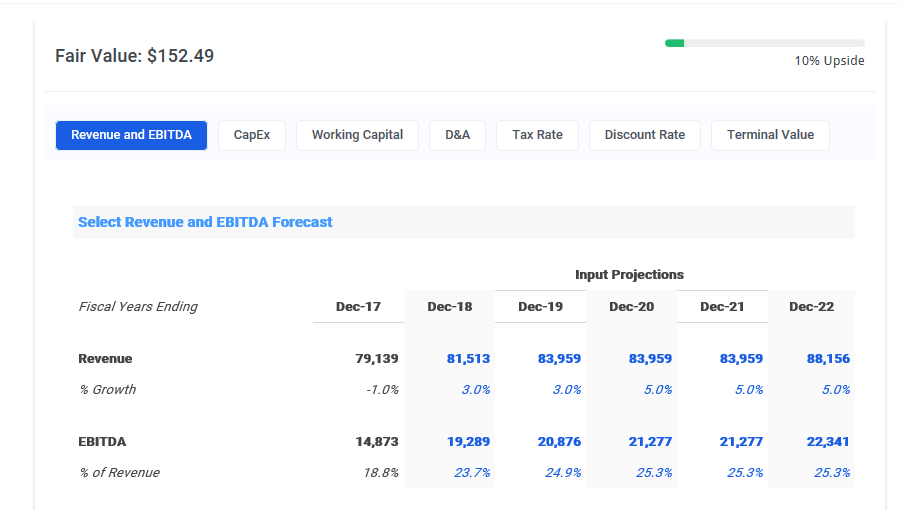

Even without Red Hat’s contribution my very conservative 5-year revenue exit DCF valuation for IBM is $152.49. Now that Enterprise Linux leader Red Hat is owned by IBM, my old DCF valuation might be undervaluing IBM too much going forward. However, I’m still putting the chart below as another compelling reason to exploit the low valuation ratios of IBM right now.

(Source: finbox.io)

My Buy rating for IBM is backed by its positive one-year predictive market trend score from I Know First.

How to interpret this diagram.

The weekly technical indicators and moving averages trend patterns are also in favor of going long on IBM right now.

(Source: Investing.com)

Past I Know First Success with IBM

On July 16, 2017, an I Know First Analyst wrote an article about IBM price analysis. In this article, it is stated that the company’s stock would probably trade sideways along the $140-$155 price levels for the next 12 months. In addition, the author rate IBM as a buy for a long-term investing, alluding as long-term as five to ten years. For that date the I Know First algorithm issued a bearish 1 year forecast. Since then, IBM’s shares fell -5.69% in 1 year in line with the I Know First algorithm’s forecast. See chart below.

This bearish forecast for IBM was sent to the current I Know First subscribers on July 16, 2017.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.