IBM Stock Forecast: Why IBM Can Become A Major Player In The $209 Billion/Year Advertising Business

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

IBM stock forecast Summary:

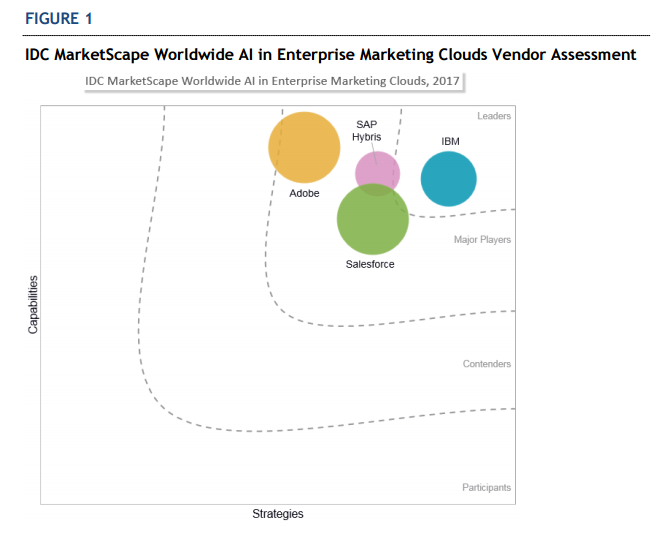

· IDC has identified as Adobe’s fiercest rival in artificial intelligence-enhanced digital marketing services.

· IBM’s Watson is widely acknowledged as the best cognitive computing platform. Watson is emerging as a potent tool for digital marketers.

· Nvidia is now helping Adobe improve its Sensei AI platform so it can compete better against IBM’s Watson Marketing.

· Aside from Watson, IBM’s blockchain technology is its other advantage over Adobe. Blockchain technology could minimize fraud in ad buying.

· IBM excellent free cash flow is undervalued compared to most of its peers in the software industry. TipRanks has an average 12-month PT of $178 for IBM stock forecast.

International Business Machines (IBM) Stock Forecast only launched its Watson Marketing service a year ago. Watson Marketing must have been successful enough that industry leader Adobe (ADBE) was compelled last week to partner up with Nvidia (NVDA). Nvidia’s GPUs (graphics processing units) and expertise in artificial intelligence [AI] could help Adobe’s Sensei AI platform compete better against IBM Watson.

Watson Marketing could be IBM’s most important growth driver within the next two years. The global market for digital marketing software is growing at CAGR of 13%. It is predicted to be worth $77.4 billion by 2023.

My bet is Watson Marketing could outpace the growth of Adobe Experience Cloud because in addition to its advantage in AI compute power, IBM is also a pioneer developer of blockchain technology for ad buying. It will likely take several quarters before Adobe and Nvidia will consider matching IBM’s blockchain technology for ad media trading processing. As per Juniper Research’s survey, 2/3 of large corporations will adopt blockchain technology for enterprise applications.

One of these applications will definitely go toward improving their ad buying process and marketing campaigns.

Unilever and IBM iX are testing blockchain technology to eliminate fraud in ad buying. Fake/bot traffic cost ad buyers $12.5 billion in 2016 (and an estimated $16.4 billion in 2017). Watson Marketing could be more attractive to marketers than Adobe Experience Cloud because it offers a more transparent process in ad placements.

Not many investors are aware of IBM iX. This subsidiary is why IBM is a leader in Gartner’s Magic Quadrant for Digital Experience Platforms [DXP]. For a fee, IBM iX helps corporations and marketers constantly develop strategies to improve their position in this digitally-driven business climate.

By offering both Watson’s AI and blockchain technology to marketers, IBM stock forecast stands to get a larger share of the $209 billion/year billion digital ad spending. A large part of that $209 billion is spent on service providers like IBM and Adobe who help the best ad campaigns for marketers.

Watson Is Far More Advanced Than Adobe Sensei

There’s tough competition but Watson is still widely regarded as the best commercial cognitive computing platform. Google (GOOG) and Microsoft have excellent cognitive computing platforms but they are still not being used for marketing services.

IDC identified IBM and Adobe are among the global leaders in AI cloud enterprise marketing solutions. Adobe Experience Cloud’s (its marketing software segment) revenue last year $2.03 billion. Digital marketing software is therefore a lucrative opportunity for the stock IBM.

(Source: IDC)

Adobe is merely copying IBM’s strategy. Since 2015, Nvidia has been supplying its deep learning GPU products to boost IBM’s Watson AI and IBM Cloud platforms. IBM was actually one of the first companies to offer Nvidia’s most advanced GPU for AI and cloud computing services.

Yes, Adobe Sensei will get better as it uses more Nvidia GPUs. However, the prior multi-year collaboration with Nvidia means IBM Cloud and Watson Marketing have reached advanced optimization for Tesla GPUs. IBM’s partnership with Nvidia runs deeper. Adobe and Nvidia are merely collaborating on providing AI cloud services for marketers, content creators, and artists. IBM and Nvidia are actually helping each other create new AI processors and deep learning hardware.

Conclusion

You should consider adding IBM to your long-term portfolio. The $209 billion/year advertising business is a huge expansion opportunity for IBM. Watson Marketing could feasibly contribute $2 – $5 billion in new annual revenue for IBM. IBM has a more advanced AI platform than what Adobe has right now. No other company is also offering blockchain technology for ad buying. The other compelling reason to go long on IBM is its outstanding record of strong free cash flow. Furthermore, IBM is a cheap investment right now. Its forward P/E is only 10.81x. IBM’s Price/Sales ratio is also attractively low, 1.82. IBM is trading below $155 right now but TipRanks-tracked Wall Street analysts have an average 12-month PT of $178.27 for it.

(Source: TipRanks)

My buy rating for IBM stock forecast is backed by its optimistic one-year algorithmic forecast from I Know First.

I Know First Algorithm Heatmap Explanation

The sign of the IBM stock forecast signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.