I Know First Reviews: June 7th, 2015

I Know First Reviews

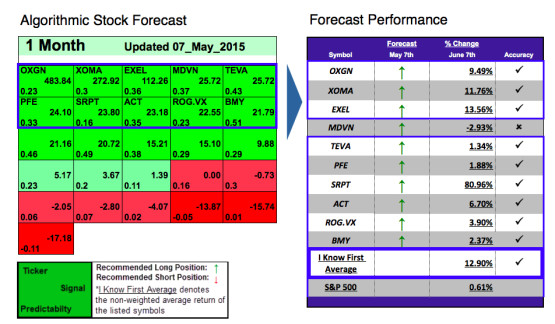

The stocks selected here are the top performing stocks from I Know First: Daily Market Forecast’s May 7th, 2015 stock forecast titled “Top 10 Biotech Stocks Based On Algorithms: Up To 80.96% In 1 Month“.

This forecast is part of the “Biotech Stocks” package, as one of I Know First’s quantitative investment solutions. The “I Know First Average” return was 12.90% over 1 month versus the S&P 500’s return of 0.61% over the same time period.

Learn how to read the predictions: Instructions

Learn how to strategize with the forecast: Algorithmic Trading Strategies

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.

Signal: 483.84

Predictability: 0.23

Return: 9.49%

Oxigene is a cancer research and treatment company in the business of killing tumor cells with their groundbreaking anti-vascular drug, Vascular Disrupting Agents (VDA’s). The company had a signal strength of 483.84 and a predictability indicator of .23. In accordance with the algorithm’s prediction, the stock price increased 9.49%. Oxigene stock rose abruptly over the month based off of two separate pieces of news; firstly, the U.S Patent and Trademark Office granted the company a patent for its OXi4503 myeloid neo-plamsms treatment. Secondly but more importantly, the FDA gave Oxigene approval to go ahead with stage three of the development of their new fosbretabulin drug in combination with bevacizumab, bringing the company closer to another new key drug issue.

Signal: 272.92

Signal: 272.92

Predictability: .3

Return: 1.06%

XOMA is the company that has made a name for itself by developing a monoclonal antibody called gevokizumab. Most of the company’s efforts are now pointed towards wrapping up the stage 3 trial period so they can get their product to market. The company had a signal strength of 272.92 and a predictability indicator of 0.3. In accordance with the algorithm’s prediction, the stock price increased 1.06%. After tumbling for months, the stock looks like it may finally end higher than it did the previous two month period due to positive reviews during their stage 3 testing.

Signal: 112.26

Predictability: 0.33

Return: 13.56%

Located in San Francisco, Exelixis is a drug discovery company that brings small molecule therapies to market as cancer treatments. Exelixis already markets its Cometriq drug which battles medullary thyroid cancer, and additionally has many drugs in the development pipeline. The company had a signal strength of 112.26 and a predictability indicator of 0.36. In accordance with the algorithm’s prediction, the stock price increased 13.56%. At the American Society of Clinical Oncologists summit, or ASCOon, Exelisis was one the biopharmaceutical companies that made the news by presenting its positive results of a phase II trial of Cabozantinib patients.

Signal : 25.72

Predictability : 0.37

Return: –2.93%

Medivation is a biopharmaceutical firm that does not focus on a specific type of diseases per se, but aims its operational efforts to treat and/or eliminate any disease for which there is no cure. Currently, Medivation focuses on prostate and breast cancer.

Signal: 25.72

Predictability: .43

Return: 1.34%

Teva Pharmaceutical Industries is an Israeli pharmaceutical giant which operates all over the world. Although the company is 114 years old, their constant facility raising and innovative feats gives it a much more youthful facade. The company had a signal strength of 25.72 and a predictability indicator of 0.43. In accordance with the algorithm’s prediction, the stock price increased 1.34%. After a legal row with rival Mylan on a potential buy out, Teva continued its acquisition strategy and nearly doubled its exposure to a 2.2% stake in the company. Exciting shareholders, this puts Teva in a position of strength for any potential shareholder vote in Mylan to determine whether or not to sell out.

Signal: 24.10

Signal: 24.10

Predictability: 0.47

Return: 1.88%

Pfizer is an American household brand name pharmaceutical company with a massive line of products ranging from Accupril to Zyvox. The company had a signal strength of 24.10 and a predictability indicator of 0.47. In accordance with the algorithm’s prediction, the stock price increased 1.88%. With its new Ibrance cancer treatment drug almost ready to market, CEO Ian Read happily revealed to the public that Pfizer has doubled its market share in breast cancer treatment products. Naturally, Pfizer is also slowly announcing details of its new lung cancer medicine which was revealed at the ANCOon. Although Pfizer has not historically been an Oncology company, its presence at the ANCOon symbolizes its steady investments in Oncology science since the 2000’s.

Signal: 23.8

Predictability: .16

Return: 80.96%

Sarepta Therapeutics is a biopharmaceutical specializing in medical solutions to genetic mutations and diseases. The company had a signal strength of 23.8 and a predictability indicator of .16. In accordance with the algorithm’s prediction, the stock price increased 80.96%. Sarepta enjoyed massive stock price growth on May 20th when the FDA approved the company’s refilling plan for its Duchenne muscular dystrophy drug eteplirsen. The month was also highlighted by a 5.07% bump on June 5th after a lacklustre week of trading.

Signal: 23.18

Predictability: 0.35

Return: 6.70%

Actavis is a vertically-integrated Irish biopharmaceutical corporation which provides generic over-the-counter medicines to most countries in the globe. The company had a signal strength of 23.18 and a predictability indicator of .35. In accordance with the algorithm’s prediction, the stock price increased 6.70%. Actavis was granted punctual approval from the FDA to market its new line of gel-filled textured breast implants with the name NATRELLE INSPIRA™. Just three months ago, Actavis marketed the prequel to this product, a soft version of the NATRELLE INSPIRA™. Punctuality and consistency are highly valuable traits in biopharmaceutical companies to investors.

Signal: 22.55

Predictability: 0.23

Return: 3.90%

Roche Holdings is a multinational health care firm traded on the Swiss Stock Exchange. The dual division company, divided into diagnostics and pharmaceuticals, remains united in its mission to treat “malfunctions in the body”, maintain “excellence in science”, and identify genetic differences in patients to increase the effectiveness of their treatments. The company had a signal strength of 22.55 and a predictability indicator of 0.23. In accordance with the algorithm’s prediction, the stock price increased 3.90%. Roche Holdings got swept up in the trading week starting June 1st due to the positive outlook for oncological research and services framed by the widely positive ASCO conference.

Signal: 21.79

Predictability: 0.51

Return: 2.37%

Bristol-Myers Squibb is an American pharmaceutical giant with over a century in the business of prescription drug development. The company had a signal strength of 21.79 and a predictability indicator of 0.51. In accordance with the algorithm’s prediction, the stock price increased 2.37%. Bristol Myers received a large contract with Danish company Genmab (GEN.KO) in which they will receive a $4,000,000 licensing fee in return for the right to utilize confidential intellectual property and market a new antibody that targets certain cancer cells.

Business Disclosure: I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article. Read More From I Know First Research:

- Electric Buses Vs. Fuel Cell Buses: Plug Power Has A Stake In The Winner (View)

- Why BlackBerry Holds Long-Term Value For Investors (View)

- Tata Motors Is An Attractive Opportunity: An Algorithmic Analysis (View)

- Applied Material’s Venture Group Invests Into UV LED, An Interesting Portfolio Expansion With Growth Potential (View)

- Can Apollo Fight Online Education Any Longer? (View)