I Know First Algorithm Review: March 21st, 2016

I Know First Algorithm Review

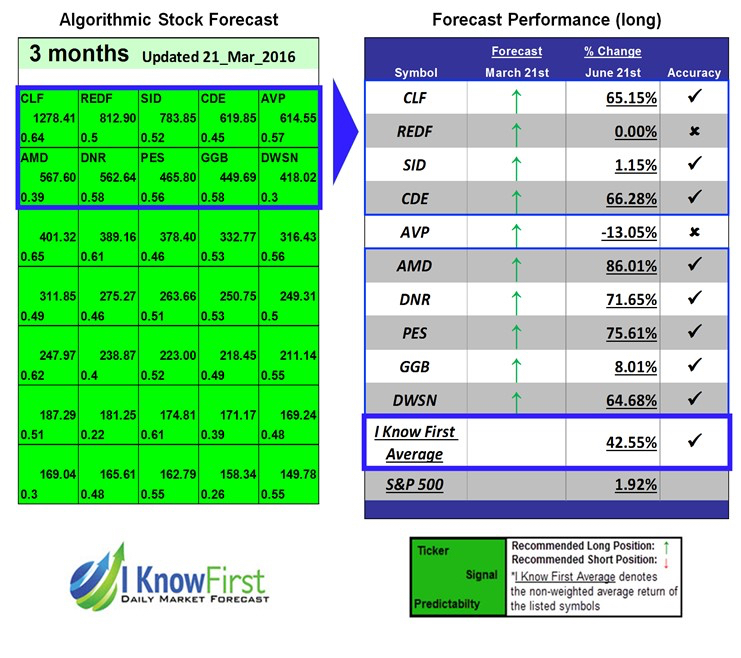

The stocks selected here are the top performing stocks from I Know First: Daily Market Forecast’s March 21st, 2016 stock forecast titled “Stock Market Analysis Based on Self-Learning Algorithm: Returns up to 86.01% in 3 Months“.

This forecast is part of the “Stocks Under 5 Dollars” package, as one of I Know First’s quantitative investment solutions. The “I Know First Average” return was 42.55% over 3 months versus the S&P 500’s return of 1.92% over the same time period.

Learn how to read the predictions: Instructions

Learn how to strategize with the forecast: Algorithmic Trading Strategies

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.

Signal: 1278.41

Predictability: 0.64

Return: 65.15%

Cliffs Natural Resources Inc. is a major supplier in the production of iron and steel that offers US steelmakers raw materials. Today, Cliffs Natural Resources Inc. is also the largest iron ore producer of pellets in North America, while being one of the most cost-effective producers in the world. The company had a signal strength of 1278.41 and a predictability indicator of 0.64. In accordance with the algorithm’s prediction, the stock price increased 65.15%. CLF stock surged after the company’s announcement that in August 2016 it would be reopening its United Taconite mines in Minnesota. Additionally, Cliffs Natural Resources Inc. secured a 10-year steel agreement with a major client, ArcelorMittal.

Signal: 812.90

Signal: 812.90

Predictability: 0.5

Return: 0.00%

ReDiff.com India Limited is an Indian website that serves as a news, information, entertainment and shopping web portal. Founded in 1996 and headquartered in Mumbai, the company also has offices in Bangalore, New Dehli, and New York City.

Signal: 783.85

Predictability: 0.52

Return: 1.15%

Companhia Siderurgica Nacional is the second largest steel producer in Brazil. It’s products are largely used in the automotive industry, civil construction, home appliance, original equipment manufacturing, and packing and distribution segments. The company had a signal strength of 783.85 and a predictability indicator of 0.52. In accordance with the algorithm’s prediction, the stock price increased 1.15% over a 3-month span ranging from March 21st to June 21st. This can be attributed to the Economic and Trade Expansion Agreement signed between Brazil and Peru on April 29, which allows for free trade of passenger vehicles and pickup trucks, both of which are products that require a lot of steel to manufacture.

Signal: 619.85

Signal: 619.85

Predictability: 0.45

Return: 66.28%

Coeur Mining, Inc. is a company that mines precious metals. It is the world’s largest primary silver producer and as well as a major producer of low-cost gold. Its main office is located in Coeur d’Alene, Idaho. The company has a signal of 619.85 and predictability of 0.45. I Know First’s algorithm was correct in its prediction of an increase in the stock price of 66.28%. The price of gold has gone up over the last quarter due to the anticipation of market turmoil that could follow the vote for Britain’s exit from the European Union and gold is a safe-haven investment. The company has been earning a higher profit from its sale of silver due to a decrease in the company’s cost of retrieving silver from the ground.

Signal: 614.55

Signal: 614.55

Predictability: 0.57

Return: -13.05%

Avon Products, Inc., more commonly known as Avon, is an American international beauty and cosmetics company. The company specializes in the manufacturing and supplying of beauty products, cosmetics, household products, and personal care items. Avon is the 5th largest beauty company in the world. In 2016, Avon sold the rest of its American business and within 3 years will relocate its headquarters from New York City to the UK.

Signal: 567.60

Signal: 567.60

Predictability: 0.39

Return: 86.01%

Advanced Micro Devices, Inc. creates and develops computer processors and similar technologies for companies such as Dell, Lenovo, and HP. Advanced Micro Devices, Inc. has a signal strength of 567.60 and predictability of 0.39. I Know First’s algorithm accurately predicted an increase of 86.01%. Over the last quarter, there was such a significant return as a result of the unveiling of the company’s 7th generation AMD A-Series Processor lineup.

Signal : 562.64

Predictability : 0.58

Return: 71.65%

Founded in 1951, Denbury Resources Inc. is a company that engages in the exploration and production of natural gases and petroleum. With a signal strength of 562.64 and a predictability of 0.58, I Know First’s algorithm correctly forecast a positive return. Denbury Resources Inc. has a positive return of 71.65% at the end of the quarter. This is due to the rise in the price of crude oil, which hit $51.80 this past quarter, raising Denbury Resources Inc.’s profit margin.

Signal: 465.80

Predictability: 0.56

Return: 75.61%

Pioneer Energy Services Corp is a company that is contracted by oil and gas exploration and production companies for their drilling and production services. The company was founded in 1968 and currently operates 35 drilling rigs in the US and Columbia. Pioneer Energy Services Corp had a signal strength of 465.80 and a predictability indicator of 0.56. In accordance with the algorithm’s prediction, the stock price increased 75.61%. The marked increase this quarter came about because of the rise in price per barrel of crude oil, which makes the services of Pioneer Energy Services Corp more in demand by oil and gas exploration and production companies to secure more oil, which in turn get sold at a higher price than before.

Signal : 449.69

Predictability : 0.58

Return: 8.01%

GGB Bearing Technology is a company that manufactures bearings for different purposes within different industries. The company was founded in 1910 and is a subsidiary of EnPro Industries, Inc. JetBlue Airways Corporation had a signal strength of 449.69 and a predictability indicator of 0.58. In accordance with the algorithm’s prediction, the stock price increased 8.01%. This is due to the launch of new type of bearing called the GGB-SHB case hardened steel bearings for better resistance under heavier loads.

Signal: 418.02

Signal: 418.02

Predictability: .3

Return: 64.68%

Dawson Geophysical Company was founded in 1952 and is headquartered in Midland, Texas. The company provides onshore seismic data acquisition services primarily for companies that explore and develop oil and natural gases. Dawson Geophysical Company operates in the US and in Canada. The company has a signal strength of 418.02 with predictability of .3. The stock price increased 64.68% over the last quarter as predicted by I Know First’s algorithm. Recently, the price of crude oil has been on the rise, even hitting $50 at different points this past quarter. As a result, companies that explore oil are more eager to find oil and there is a higher demand for Dawson Geophysical Company’s services.

Business Disclosure: I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article. Read More From I Know First Research:

- Electric Buses Vs. Fuel Cell Buses: Plug Power Has A Stake In The Winner (View)

- Why BlackBerry Holds Long-Term Value For Investors (View)

- Tata Motors Is An Attractive Opportunity: An Algorithmic Analysis (View)

- Applied Material’s Venture Group Invests Into UV LED, An Interesting Portfolio Expansion With Growth Potential (View)

- Can Apollo Fight Online Education Any Longer? (View)