I Know First Reviews: June 15th, 2015

I Know First Reviews

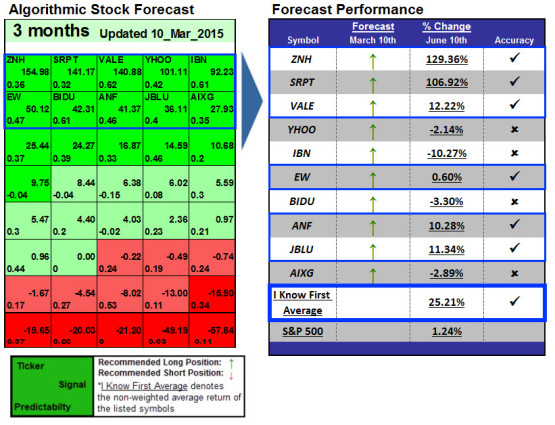

The stocks selected here are the top performing stocks from I Know First: Daily Market Forecast’s March 10th, 2015 stock forecast titled “Black Box Trading: Up to 129.36% In 3 Months“.

This forecast is part of the “Risk-Conscious” package, as one of I Know First’s quantitative investment solutions. The “I Know First Average” return was 25.21% over 3 months versus the S&P 500’s return of 1.24% over the same time period.

Learn how to read the predictions: Instructions

Learn how to strategize with the forecast: Algorithmic Trading Strategies

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.

Signal: 154.98

Predictability: 0.36

Return: 129.36%

China Southern Airlines is an airplane company. With its subsidiaries (CSN Group), China Southern company is the bigger airplane company in China. They offer international and domestic airlines. The company had a signal strength of 154.98 and a predictability indicator of 0.36. In accordance with the algorithm’s prediction, the stock price increased 129.36%. The China Southern Airline’s stock has surged after the price of crude oil plummeted and have remained exceptionally low. Moreover, while airline and Chinese stocks have been surging, China Southern Airlines is opening a number of new routes connecting the southern city of Guangzhou with cities in southwest Asia, Europe, and Africa.

Signal: 141.17

Predictability: 0.32

Return: 106.92%

Sarepta Therapeutics is a biopharmaceutical specializing in medical solutions to genetic mutations and diseases. The company had a signal strength of 141.17 and a predictability indicator of 0.32. In accordance with the algorithm’s prediction, the stock price increased 106.92%. Sarepta enjoyed massive stock price growth on May 20th when the FDA approved the company’s refilling plan for its Duchenne muscular dystrophy drug eteplirsen. The month was also highlighted by a 5.07% bump on June 5th after a lacklustre week of trading.

Signal: 140.88

Predictability: 0.62

Return: 12.22%

Vale S.A. engages in the research, production, and sale of iron ore and pellets, nickel, copper, coal, and precious metals in Brazil and internationally. It also invests in energy generation through operating hydroelectric plants and centers, and produces steel. Vale is the world’s largest producer of iron ore. The company was founded in 1942 and is headquartered in Rio de Janeiro, Brazil. The company had a signal strength of 140.88 and a predictability indicator of 0.62. In accordance with the algorithm’s prediction, the stock price increased 12.22%. While there were pressure on the iron ore prices due to an oversupply, Vale stock increased last week when the CEO said that China would increase its demand for iron ore in the second half of the year. In fact, it’s an important announcement as China is the world’s largest consumer of iron ore. Also on May, the stock price increased when investors received a positive signal about Vale’s margins.

Signal: 101.11

Signal: 101.11

Predictability: 0.42

Return: -2.14%

Yahoo! Inc. is a large American tech stock known principally for its popular search engine, Yahoo Search. Founded in 1994, Yahoo weathered the infamous Dot-com bubble burst and continued to grow into one of the largest companies internet companies today.

Signal: 92.23

Signal: 92.23

Predictability: 0.61

Return: -10.27%

ICICI Bank in an Indian banking and financial services institution servicing the entire world from Vadodara, Gujarat, India. As India’s second largest private bank, it boasted over 9 billion rupees (1.4 billion US dollars) in gross income in 2014, an increase of almost 8.5% over the previous year.

Signal: 50.12

Signal: 50.12

Predictability: 0.47

Return: 0.60%

Edwards Lifesciences Corp is a medical devices firm specializing in the heart valves. Edwards’ front end sales operations exist in over 100 countries, but the R&D mainly happens out of their headquarters in Santa Ana California. The company had a signal strength of 50.12 and a predictability indicator of 0.47. In accordance with the algorithm’s prediction, the stock price increased 0.60%. The first quarter revenue of the firm rose 13% thanks to the growing sales of its nonsurgical heart valves. Investors have confidence in the future of the company. They truly believe Edwards will maintain its leadership position.

Signal : 42.31

Signal : 42.31

Predictability : 0.61

Return: -3.30%

Founded in 2000, Baidu.com is an internet services company, globally recognized as the largest Chinese language search engine. Often ascribed as the “Chinese Google”, Baidu has seen incredible growth, more than tripling its revenues in just three years since 2011.

Signal: 41.37

Predictability: 0.46

Return: 10.28%

Abercrombie & Fitch Co. operates as a specialty retailer of apparel for men, women, and kids. It sells various products, such as jeans, shorts, sweaters, and accessories under the Abercrombie & Fitch, Abercrombie Kids, and Hollister brand names. The company was founded in 1892 and is headquartered in New Albany, Ohio. Abercrombie & Fitch had a signal strength of 41.37 and a predictability indicator of 0.46. In accordance with the algorithm’s prediction, the stock price increased 10.28%. ANF stock suffered a huge decline during the last year but since 3 months, we have seen a recovery. The stock rose after the company reported its first quarter earnings as its appeared not to be as bad as we expected. We notice improvement on Hollister brand sales.

Signal : 36.11

Predictability : 0.4

Return: 11.34%

JetBlue Airways Corporation, a passenger carrier company, provides air transportation services. The company was founded in 1998 and is based in Long Island City, New York. JetBlue Airways Corporation had a signal strength of 36.11 and a predictability indicator of 0.4. In accordance with the algorithm’s prediction, the stock price increased 11.34%. The company outperformed the earnings per share (EPS) estimation by reaching $0.40 EPS against the estimated $0.39 EPS during the first quarter. The firm has become larger last year by increasing its flight operations; for example setting up new flights to the region of Mexico.

Predictability: 0.35

Return: -2.89%

Aixtron SE is a German company which provides deposition equipments to the semiconductor industry. The company’s technology solutions are used by a diverse range of customers worldwide mainly from Asia, 13% from Europe and the others for the United-States.

Business Disclosure: I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article. Read More From I Know First Research:

- Electric Buses Vs. Fuel Cell Buses: Plug Power Has A Stake In The Winner (View)

- Why BlackBerry Holds Long-Term Value For Investors (View)

- Tata Motors Is An Attractive Opportunity: An Algorithmic Analysis (View)

- Applied Material’s Venture Group Invests Into UV LED, An Interesting Portfolio Expansion With Growth Potential (View)

- Can Apollo Fight Online Education Any Longer? (View)