I Know First Review: September 29th 2015

I Know First Review

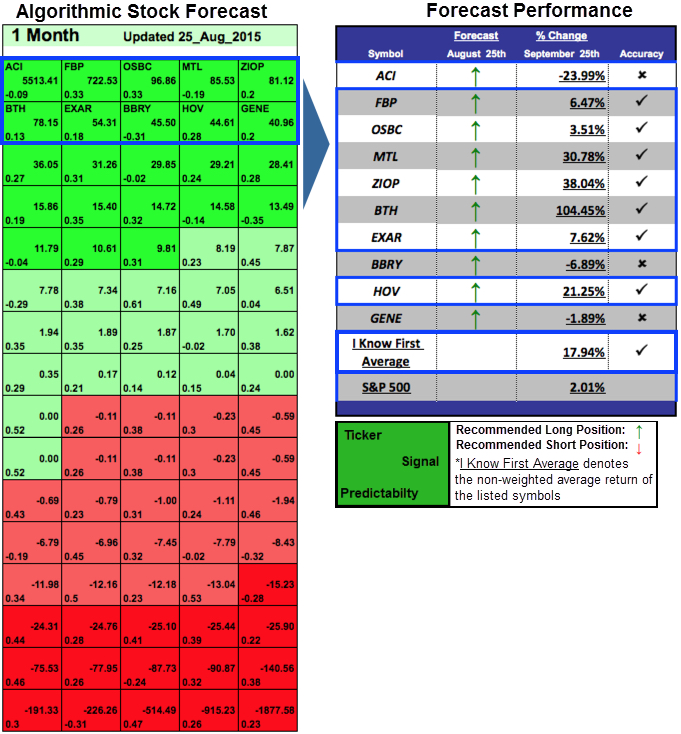

The stocks selected here are the top performing stocks from I Know First: Stocks Under 10 Dollars Package forecast for the last month found under the article titled Algorithmic Trading: Up To 104.45% Return In 1 Month.

This forecast is part of the Industry package, as one of I Know First’s quantitative investment solutions. The “I Know First Average” return for the long position was 17.94% over the 1 month period, a significant difference when comparing the S&P 500’s return of 2.01% over the same time period.

Signal: 5513.41

Predictability: -0.09

Return: -23.99%

Arch Coal Inc. (ACI) is an American coal mining and processing company. The company mines, processes, and markets bituminous and sub-bituminous coal with low sulfur content in the United States.

Signal: 722.53

Predictability: 0.33

Return: 6.47%

First BanCorp. (FBP) operates as the bank holding company for FirstBank Puerto Rico that provides a range of financial products and services to retail, commercial, and institutional clients.

First Bancorp has relatively high volume and an array of various factors affect their performance of positive return. For example the traded daily volume in the past month and the average dollar-volume is outstanding.

Signal: 96.86

Predictability: 0.33

Return: 3.51%

Old Second Bancorp Inc. (OSBC) Old Second Bancorp, Inc. operates as a holding company for Old Second National Bank that provides a range of banking services. It provides its services through 25 banking locations primarily in Aurora, Illinois and its surrounding communities, as well as in the Chicago metropolitan area. The company was founded in 1982 and is based in Aurora, Illinois.

As of the 15th of September the Board voted to amend the current bylaws of the company as well as the big announcement of the change in directors in the company will be effective by the 13th of October 2015. Even though the amendments are foregoing a slight change for the sake of the company’s future.

Signal: 85.53

Predictability: -0.19

Return: 30.78%

Mechel OAO (MTL) is one of Russia’s leading mining and metals companies, comprising producers of coal, iron ore in concentrate, steel, rolled steel products. Headquartered in Moscow, sells its products in Russia and overseas, and is formally known as Open Joint Stock Company Mechel.

Recently, Mechel announced the changes of the repayment schedule of the 13 and 14-series bondholders and the interest rate for the future periods. Conditions of restructure include a partial payment of the nominal value during four years at dates set for their ending periods and the rate will be a simple average of the Bank of Russia plus 4% and the fixed coupon rate per year. Many of the changes announced are reflected on their stock price and their fantastic returns.

Signal: 81.12

Predictability: 0.2

Return: 38.04%

ZIOPHARM Oncology, Inc. (ZIOP), a biotechnology company, employs gene expression, control, and cell technologies to deliver cell-based therapies for the treatment of cancer. Its synthetic immuno-oncology programs, in collaboration with Intrexon Corporation and the MD Anderson Cancer Center, comprise chimeric antigen receptor T cell (CAR-T) and other adoptive cell based approaches that use both non-viral and viral gene transfer methods for broad scalability.

Uniting forces in the medical industry of research and biotechnology development of inmmunotherapies for treatment of Graft-Versus-Host disease Intrexon and Ziopharm are paving the pathway to pursue Cellular therapy approaches to Autoimmune Disorder.

Signal: 78.15

Predictability: 0.13

Return: 104.45%

Blyth, Inc. (BTH), The company operates through two segments: Candles & Home Décor and Catalog & Internet. Blyth, Inc. was founded in 1976 and is headquartered in Greenwich, Connecticut.

Recent amendments to the Departure of Directors took place in response to the relocation of the headquarters from Connecticut to Massachusetts and the main discussion was the compensation of the committee on the Board. This increase in their return allowed them to also increase the living allowances and compensation at the end of their severance agreement.

Signal: 54.31

Predictability: 0.18

Return: 7.62%

Exar Corporation (EXAR), a fabless semiconductor company, designs, develops, and markets high performance analog mixed-signal integrated circuits and sub-system solutions for the industrial and embedded systems, high-end consumer, and infrastructure markets. Exar Corporation sells its products through a direct sales force, independent sales representatives, non-exclusive distributors, and catalog distributors in the United States, as well as through various regional and country specific distributors, and manufacturers representatives internationally. The company was founded in 1971 and is headquartered in Fremont, California.

Less than two weeks ago Exar announced the release of their new video surveillance camera with high resolution. The VRCC7008E has the ability to encode up to eight channels in NTSC/PAL video at full resolution and frame rate providing 33% higher resolution for horizontal field-of-view (FOV) than a regular CCTV video camera. The release of this new product line has come back to the company profit wise and their returns are positive.

Signal: 45.50

Predictability: -0.31

Return: -6.89%

BlackBerry Limited (BBRY) provides wireless communications solutions worldwide. Which include the sale of BlackBerry handheld devices; and the provision of data communication, and compression and security infrastructure services enabling BlackBerry handheld wireless devices to send and receive wireless messages and data. The company was formerly known as Research In Motion Limited and changed its name to BlackBerry Limited in July 2013. BlackBerry Limited was founded in 1984 and is headquartered in Waterloo, Canada.

Signal: 44.61

Predictability: 0.28

Return: 21.25%

Hovnanian Enterprises, Inc. (HOV). Designs, constructs, markets, and sells residential homes in the United States. It constructs single-family detached homes, attached townhomes and condominiums, urban infill, and active adult homes. The company markets its build homes for first-time buyers, first-time and second-time move-up buyers, luxury buyers, active adult buyers, and empty nesters in 201 communities in 34 markets. It also provides financial services comprising originating mortgages from homebuyers and selling such mortgages in the secondary market, as well as offers title insurance services. Hovnanian Enterprises, Inc. was founded in 1959 and is headquartered in Red Bank, New Jersey.

After the third quarter miss they had on their earnings report with a 19% decline they caught up with an outstanding return of 21.25%. The comeback at the end of the third quarter is due to the guidance given by the CEO Ara K. in a conference call. The main emphasis is the fact that even though profit margins were down, gross margins turned and grew 170 basis points from the second quarter levels. Expecting revenues to top the 745$ million. The path Ara K. has painted is very colorful and it has potential to be a colossal achievement for this financial year.

Signal: 40.96

Predictability: 0.2

Return: -1.89%

Genetic Technologies Limited (GENE), operates as a molecular diagnostics company that offers predictive testing and assessment tools to help physicians in managing womens health. The companys lead product is the BREVAGenplus, a clinically validated risk assessment test for non-hereditary breast cancer. Genetic Technologies Limited markets BREVAGenplus to healthcare professionals in breast health care and imaging centers, as well as to obstetricians/gynecologists and breast cancer risk assessment specialists, such as breast surgeons primarily in Australia and the United States. The company has partnerships with various suppliers, clinical researchers, and academic collaborators. Genetic Technologies Limited was founded in 1989 and is headquartered in Fitzroy, Australia. Genetic Technologies Limited is a subsidiary of National Nominees Limited.