I Know First Review: October 25th 2015

I Know First Review

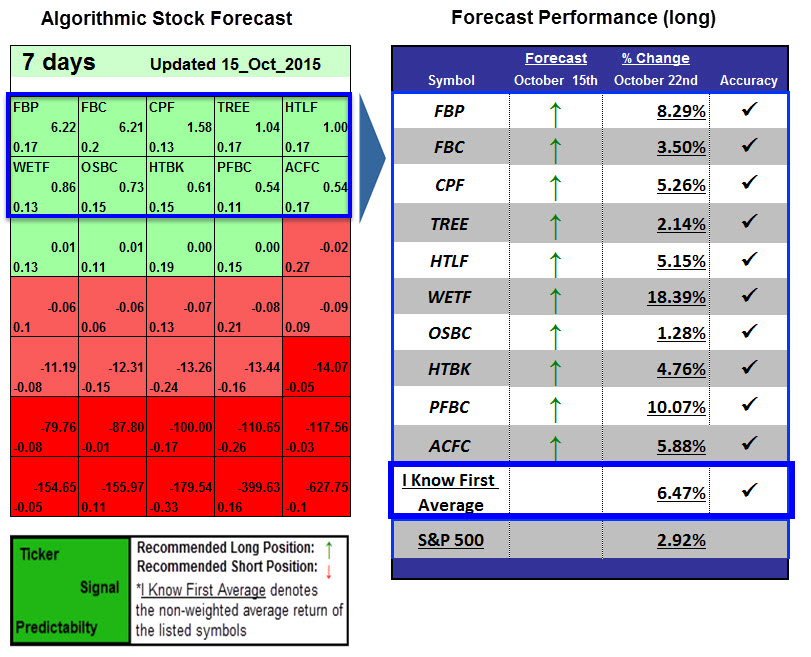

The stocks selected here are the top performing stocks from I Know First: Bank Stocks Package forecast for the last 7 days found under the article titled Best Bank Stocks Utilizing Self-Learning Algorithms Up To 18.39% Return In 7 Days

This forecast is part of the Bank Stocks package, as one of I Know First’s quantitative investment solutions. The “I Know First Average” return for the long position was 6.47% over the 7-day period, a significant difference when comparing the S&P 500’s return of 2.92% over the same time period.

Learn how to read the predictions: Instructions

Learn how to strategize with the forecast: Algorithmic Trading Strategies

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.

Si-logo.gif) gnal: 6.22

gnal: 6.22

Predictability: 0.17

Return: 8.29%

First BanCorp (FBP) is a financial holding company. The Company serves as the bank holding company for FirstBank Puerto Rico (FirstBank) and FirstBank Insurance Agency, Inc. (FirstBank Insurance Agency). Through its wholly owned subsidiaries, the Company provides financial services and products with operations in Puerto Rico, the United States and the United States Virgin Islands and British Virgin Islands. It focuses on commercial banking, residential mortgage loan originations, finance leases, credit cards, personal loans, small loans, auto loans, and insurance agency and broker-dealer activities.

First BanCorp announced that it expects to report its financial results for the third quarter ended September 30, 2015, prior to the opening of the market on Monday, October 26, 2015. Usually companies profit more on the thir quarter, so the news of the report made the company stock raise 8.29%.

Signal: 1.58

Predictability: 0.13

Return: 5.26%

Flagstar Bancorp, Inc. (FBC) operates as a savings and loan holding company for Flagstar Bank, FSB that offers financial products and services to individuals and businesses in the United States. The company operates through four segments: Mortgage Originations, Mortgage Servicing, Community Banking, and Other.

Since FBC anounced the the intructions for the realises of the thrid quarter earnings on October 1 the stocks had rise almost 7,5%. Companies usualy increase their profit on the third quarter and the same is expected from Flagstar Bancorp, Inc.

Signal: 6.21

Predictability: 0.2

Return: 3.5%

Central Pacific Financial Corp. (CPF) operates as the holding company for Central Pacific Bank that provides commercial banking products and services to businesses, professionals, and individuals in Hawaii. The company operates in three segments: Banking Operations, Treasury, and All Others. It offers various deposit products and services, including personal and business checking and savings accounts, money market accounts, and time certificates of deposit.

Moody’s Investors Service upgraded New Europe Property Investments plc’s (NEPI) rating on October 20, assigning a long-term issuer rating of Baa3 and withdrawing the Ba1 corporate family rating and Ba1-PD probability of default rating (PDR). “The upgrade of NEPI’s rating to Baa3 reflects the company’s continuing strong operating performance, increased rental income and reduced development pipeline as well as the stable outlook for the Romanian economy and its retail property sector”, said Roberto Pozzi, Moody’s Vice President and lead analyst on the company.

Signal: 1.04

Signal: 1.04

Predictability: 0.17

Return: 2.14%

LendingTree, Inc. (TREE), through its subsidiaries, operates an online loan marketplace for consumers seeking an array of loan types and other credit-based offerings in the United States. The company operates in four segments: Lending, Auto, Education, and Home Services.

Microsoft will report earnings Thursday, so it’s no surprise that Jim Cramer’s viewers were asking his opinion about the company on social media Tuesday. Cramer says he expects Microsoft will report a decent quarter thanks to Windows 10, but he wishes the company would make an acquisition.”I actually wish they would buy Salesforce.com in order to be able to get to that cloud growth, which we know from IBM is so key,” said Cramer. Cramer said that $43 or $44 a share is a terrific price for Microsoft, but even at its current levels around $47, he thinks it can move up to $48 or $49.

Signal: 1.00

Signal: 1.00

Predictability: 0.17

Return: 5.15%

Heartland Financial USA, Inc. (HTLF), a diversified financial services company, provides banking services to individuals and businesses in the United States. It accepts various deposit products, including checking and other demand deposit accounts, NOW accounts, savings accounts, money market accounts, certificates of deposit, individual retirement accounts, health savings accounts, and other time deposits. The company also offers commercial and industrial loans; small business loans; agricultural loans; real estate mortgage loans; consumer loans comprising motor vehicle loans, home improvement loans, home equity line of credit, and fixed rate home equity loans; and commercial real estate loans.

Heartland Financial USA, one of the nation’s most active bank acquirers, has an agreement to acquire its fourth bank this year, and this time the action is getting a bit closer to Kansas City. Heartland is the parent of Merriam’s Morrill & Janes Bank & Trust. Pending regulatory approval, Heartland Financial will spend $83.5 million to acquire CIC Bancshares Inc., the parent company of Centennial Bank in Denver.

Signal: 0.86

Predictability: 0.13

Return: 18.39%

WisdomTree Investments, Inc. (WETF), through its subsidiaries, operates as an exchange-traded funds (ETFs) sponsor and asset manager. It offers ETFs in equities, currency, fixed income, and alternatives asset classes. The company also licenses its indexes to third parties for proprietary products, as well as offers a platform to promote the use of WisdomTree ETFs in 401(k) plans.

Now that Mario Draghi came out and said he wants more inflation and that the European Central Bank will re-evaluate its economic stimulus at the next meeting, most investors are seeing a massive interest in stocks again. The way to play the international market ETFs under a period of quantitative easing is magnified through hedged ETFs.

Signal: 0.73

Predictability: 0.15

Return: 1.28%

Old Second Bancorp, Inc. (OSBC) operates as a holding company for Old Second National Bank that provides a range of banking services. It offers checking, demand, NOW, money market, savings, time deposit, individual retirement, and Keogh deposit accounts; lines of credit for working capital; lending for capital expenditures on manufacturing equipment; and lending to small business manufactures, service companies, and medical and dental entities, as well as specialty contractors. The company also provides commercial real estate loans; construction loans; residential real estate loans comprising residential first mortgages, second mortgages, and home equity line of credit mortgages; consumer loans, including motor vehicle, home improvement, and signature loans; and installment loans, student loans, agricultural loans, and overdraft checking.

On October 21, 2015, Old Second Bancorp, Inc. issued a press release announcing its earnings for the third fiscal quarter ended September 30, 2015. This possibily made their stock rise giving a return of 1.28%.

Signal: 0.61

Signal: 0.61

Predictability: 0.15

Return: 4.76%

Heritage Commerce Corp (HTBK) operates as the bank holding company for Heritage Bank of Commerce that provides various commercial and personal banking services to residents and the business/professional community in California. It offers a range of deposit products for retail and business banking markets, including checking accounts, interest-bearing transaction accounts, savings accounts, time deposits, and retirement accounts.

Heritage Commerce Corp parent company of Heritage Bank of Commerce, announced that it has been admitted to the Sandler O’Neill Sm-All Stars Class of 2015, an elite group of 34 publicly traded banks and thrifts with a market cap below $2.5 billion. This is the second year Heritage Commerce Corp has been accepted to the Sandler O’Neill Sm-All Star list.

Signal: 0.54

Predictability: 0.11

Return: 10.07%

Preferred Bank (PFBC) provides various commercial banking products and services to small and mid-sized businesses and their owners, entrepreneurs, real estate developers and investors, professionals, and high net worth individuals in the United States. The companys deposit products include checking, savings, negotiable order of withdrawal, and money market deposit accounts; fixed-rate and fixed maturity retail certificates of deposit; and individual retirement accounts and non-retail certificates of deposit.

PFBC reported results for the quarter ended September 30, 2015. Preferred Bank reported net income of $7.9 million or $0.57 per diluted share for the third quarter of 2015. This compares to net income of $6.4 million or $0.46 per diluted share for the third quarter of 2014 and compares to net income of $7.6 million or $0.55 per diluted share for the second quarter of 2015. The news of rise per diluted on the third quarter made the stock rise even more.

Signal: 0.54

Predictability: 0.17

Return: 5.88%

Atlantic Coast Financial Corporation (ACFC) operates as the holding company for Atlantic Coast Bank that provides various banking services to individual and business customers primarily in northeast Florida and southeast Georgia. It accepts various deposit products, including savings, money market, demand deposit, time deposit, and checking accounts, as well as certificates of deposit.

Because ACFC is a financial company the regulation disclosure is important to how the company can profit. The recent one was possitive so it increase the stock of the company.