I Know First Review: July 22nd

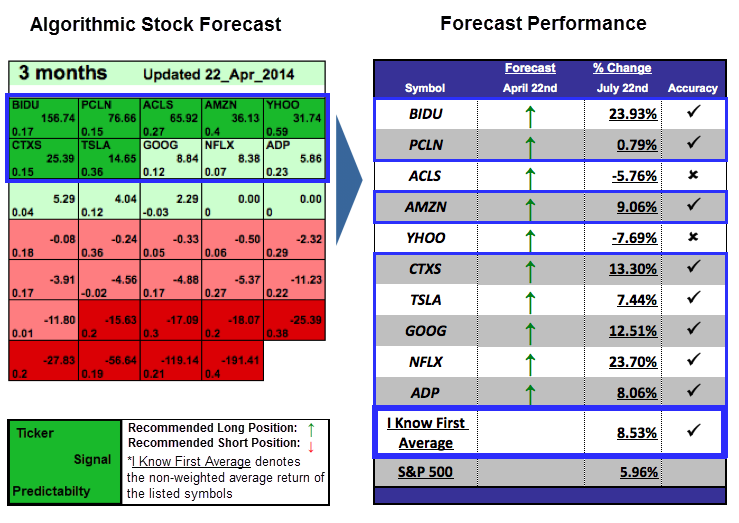

The stocks selected here are the top performing stocks from I Know First: Daily Market Forecast’s April 22nd 2014 Stock Forecast titled, Algorithmic Trading : 23.93% Gain in 3 Months. The “I Know First Average” return was 8.53% versus the S&P 500’s return of 5.96% over the same time period.

Learn how to read the predictions: Instructions

Learn how to strategize with the forecast: Algorithmic Trading Strategies

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.

Signal (3 months): 14.65

Predictability (3 months): 0.36

Return: 7.44%

Tesla Motors, Inc. designs, develops, manufactures and sells electric vehicles and electric vehicle components. Tesla owns its own sales and service network.The company is considering building a multibillion dollar factory to produce its own batteries which could be finished in the next few years. Tesla provides services for the development of electric powertrain components and sells electric powertrain components to other automotive manufacturers.

Signal (3 months): 76.66

Predictability (90 days): 0.15

Return: 0.79%

Priceline Group Inc, formerly Priceline Com Incorporated, is an online travel company that offers its customers hotel room reservations at over 295,000 hotels worldwide through the Booking.com, priceline.com and Agoda brands. The group is still expanding, as Priceline bought OpenTable, a massive international real-time restaurant-reservation service, on June 13th for 2.6 billion in cash.

Signal (3 months): 156.74

Predictability (3 months): 0.17

Return: 23.93%

Baidu, Inc. (Baidu) is a Chinese-language Internet search provider. The Company offers a Chinese-language search platform on its Website Baidu.com. It provides Chinese-language Internet search services to enable users to find relevant information online. Baidu will post its second quarter financial results on July 24, and analysts expect them to be impressive, up 59% compared to last year’s second quarter.

Signal (3 months): 8.84

Predictability (3 months): 0.12

Return: 12.51%

Google Inc. (Google) is one of the biggest technology companies in the world. Google primarily focuses around search, advertising, operating systems and platforms, enterprise and hardware products. The majority of its revenue comes from online advertising. Google provides its products and services in more than 100 languages and keeps expanding. For instance, on June 25, 2014, Google acquired Appurify Inc, a San Francisco-based developer of mobile bugging application software.

Signal (3 months): 8.38

Predictability (3 months): 0.07

Return: 23.70%

Netflix, Inc. is an Internet television network with more than 44 million members in over 40 countries. Netflix members can watch as much online content as they want, no matter the time or the place. Netflix is currently trading at a historical high: the stock is up 43.7% since last January. Netflix plans to enter 6 European markets by the end of 2014, and it should reach over 60 million customers by 2017 (compared to 10.9 in 2013).

Signal (3 months): 25.39

Predictability (3 months): 0.15

Return: 13.30%

Citrix Systems, Inc. is a cloud computing company. The Company designs, develops and markets technology solutions that enable information technology (IT) services. With annual revenue in 2013 of $2.9 billion, Citrix solutions are in use at more than 330,000 organizations and by over 100 million users globally. CTXS reported its second quarter financial results on Wednesday: the company’s quarterly revenue are up 7% on a year-over-year basis. “I’m pleased with our performance and results for Q2,” commented Mark Templeton, president and CEO at Citrix.

Signal (3 months): 36.13

Predictability (3 months): 0.4

Return: 9.06%

Amazon.com, Inc. (Amazon.com) serves consumers through its retail websites and focus on selection, price, and convenience. Amazon offers programs that enables sellers to sell their products on its Websites and their own branded Websites and to fulfill orders through them. On June 18th, Amazon unveiled the Fire Phone after five years in the making. The Fire Phone marks Amazon’s first step into the smartphone hardware market.

Signal (3 months): 5.86

Predictability (3 months): 0.23

Return: 8.06%

Automatic Data Processing, Inc. (ADP) is a provider of business outsourcing solutions. ADP offers a wide range of human resource, payroll, tax and benefits administration solutions from a single source. The Company last announced its earnings results on Wednesday, April 30th: the company’s quarterly revenue was up 6.8% on a year-over-year basis.

Business Disclosure: I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article.

Read More From I Know First Research: