I Know First Review: July 1st 2014

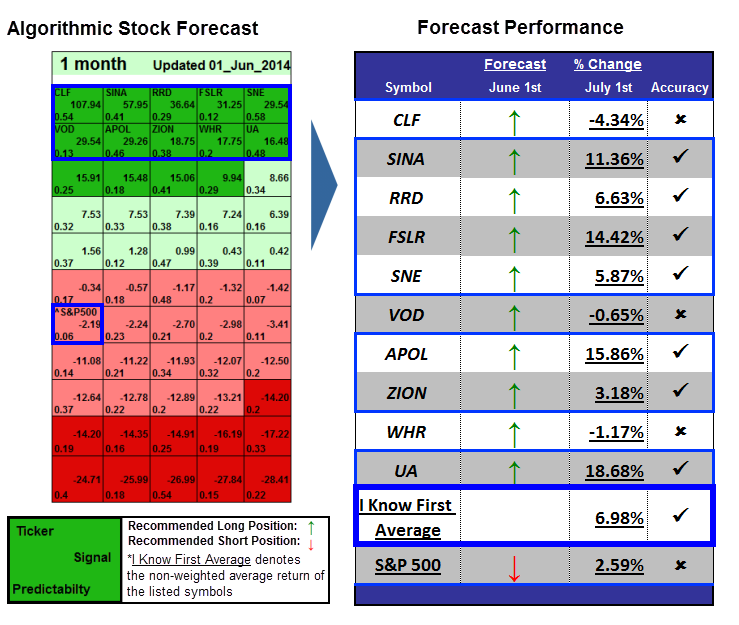

The stocks selected here are the top performing stocks from I Know First: Daily Market Forecast’s June 1st 2014 Stock Forecast titled, Best Investments Based on Algorithms: 18.68% Gain in 30 days. The “I Know First Average” return was 6.98% versus the S&P 500’s return of 2.59% over the same time period.

Learn how to read the predictions: Instructions

Learn how to strategize with the forecast: Algorithmic Trading Strategies

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.

Signal (30 days): 57.95

Predictability (30 days): 0.41

Return: 11.36%

SINA Corporation is an online media company serving China and the global Chinese communities. Its main products include SINA.com, SINA.cn, and Weibo.com. These digital networks enable users to access and share user generated media and professional media with their friends and acquaintances. In a recent conversation with Christine Tan of CNBC, CEO of SINA Corp, Charles Cao, stated SINA plans to spend more money and energy on growing their user base. However, the company faces fierce competition from Tencent’s messaging application, a rival in the Chinese Market for Weibo. While there are a few product differentiators when looking at the two products, there is no question that Chinese internet market will continue to grow even more competitive.

Signal (30 days): 36.64

Predictability (30 days): 0.29

Return: 6.63%

R.R. Donnelley & Sons Company provides integrated communication solutions to private and public sectors worldwide. It operates through Publishing and Retail Services, Variable Print, Strategic Services, and International segments. The company’s strength lies in its revenue growth, where it has slightly outpaced the industry average by 5.3%. However, this revenue growth has not had an effect on the bottom line, as shown by a decline in earnings per share. Over the past year RRD has outperformed its competition and its share price has grown 22%.

Signal (30 days): 16.48

Predictability (30 days): 0.48

Return: 18.68%

Under Armour develops, markets, and distributes apparel, footwear, and accessories. The Company specializes in athletic gear and sells its products worldwide and to athletes at all levels. Under Armour has posted 16 consecutive quarters of other 20% growth in its top line. During this time, the company has managed to triple its revenues. Furthermore, the company announced a goal to increase its revenue to $4 billion by 2016, which is almost twice its current revenue of $2.33 billion. To meet this goal, Under Armour will need to continue to expand internationally and strengthen its products.

Signal (30 days): 31.25

Predictability (30 days): 0.12

Return: 14.42%

First Solar Inc. provide solar energy solutions through two segments, Components and Systems. The component segment designs, manufactures, and sells solar modules. The Systems segment provides turn-key solar photovoltaic (PV) power systems, such as project development, operating and maintenance, and PV power system owners. The Solar Energies Industries Associated reported a 79% jump in PV units installed year over year. This translated into a 26% revenue gain for FSLR and a 3% jump in their profit margin. First Solar has just received the approval for financing Latin America’s largest photovoltaic solar power plant.

Signal (30 days): 29.26

Predictability (30 days): 0.46

Return: 15.86%

Apollo Education (APOL) offers educational programs and services at the undergraduate, masters and doctoral levels, most notably through The University of Phoenix Inc. APOL last posted its quarterly earnings results on Wednesday, June 25th. The company reported an EPS of $0.59 for the quarter, missing the consensus of $0.66 by $.0.07. The company had revenues of $799.90 million for the quarter, compared to the consensus estimate of $794.43 million. However, the company’s quarterly revenue was still down 15.5% on a year-over-year basis.

Signal (30 days): 18.75

Predictability (30 days): 0.38

Return: 3.18%

Zions Bancorporation is a financial holding company that focuses on providing community banking services by its core business lines of small and medium sized enterprises (SMEs) and corporate banking. Zions Bancorporation is one of the USA’s premier financial services companies, with combined total assets exceeding $55 billion. A Zacks’ investment analyst recently wrote, “Zions’ first-quarter 2014 adjusted earnings were in line with the Zacks Consensus Estimate. Improvement in non-interest income and prudish expense management were the tailwinds. However, a decrease in net interest income (NII), lower benefit from provisions for loan losses, deterioration in capital as well as profitability ratios were the dampeners. Nevertheless, we believe improving credit quality and initiatives undertaken to enhance balance sheet position will augur well for the company’s financials going forward. However, we remain concerned about a still low interest-rate environment, elevated expense level, asset-sensitive balance sheet and regulatory restrictions.”

Business Disclosure: I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article.

Read More From I Know First Research:

- Algorithm Predicts That Amazon Is Still Hot, Even If The Fire Phone Goes Up In Smoke

- Algorithmic Market Check-Up: Pfizer

- Amazon Has Been Flexing Its Muscle And This Assertiveness Will Reward Shareholders

- Google’s Choice: To Be A Complacent Advertiser Or A Pioneer In The ‘Internet Of Things’

- Tesla Stock Forecast Based On Predictive Analytics