I Know First Review: December 2nd

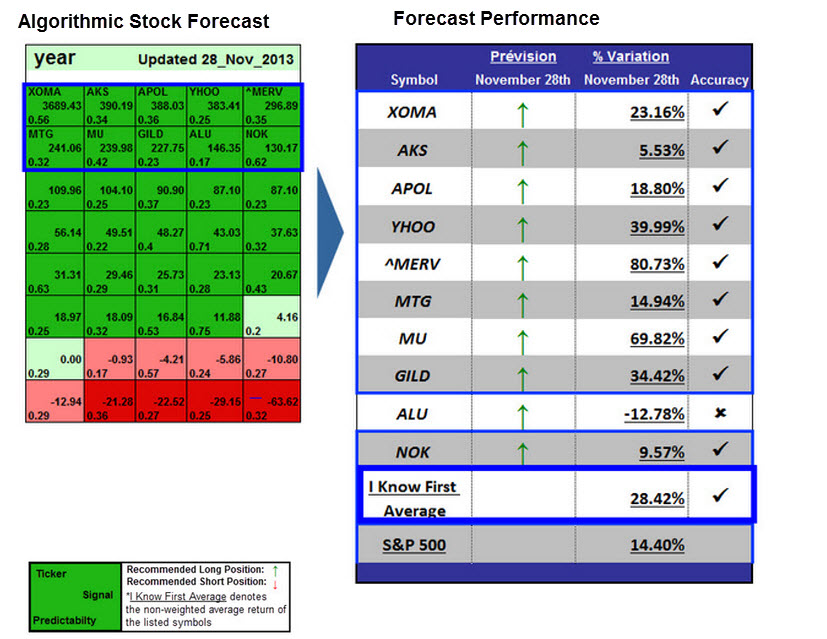

The stocks selected here are the top performing aggressive stocks from I Know First: Daily Market Forecast’s December 2nd, 2014 stock forecast titled Stock Market Recommendations Based On Algorithms: Up To 80.73% Return In 1 Year. This forecast is part of the “Risk-Conscious” package, as one of I Know First’s quantitative investment solutions. The “I Know First Average” return was 28.42% versus a S&P500’s return of 14.40% over the same time period.

Learn how to read the predictions: Instructions

Learn how to strategize with the forecast: Algorithmic Trading Strategies

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.

Signal (1 year): 3689.43

Predictability (1 year): 0.56

Return: 23.16%

XOMA Corporation (XOMA) is engaged in the discovery and development of antibody-based therapeutics. The Company’s lead drug candidate is gevokizumab (formerly XOMA 052), a humanized monoclonal allosteric modulating antibody designed to inhibit the pro-inflammatory cytokine interleukin-1 beta (IL-1 beta).The company had a signal of 3689.43 and a predictability of 0.56. In accordance with the algorithm prediction, the stock returned 23.16% in a one-year time horizon. On Monday,December 1st, XOMA Corp’s, VP Patrick J. Md Phd Scannon, unloaded 5,000 shares of the stock in a transaction. The shares were sold at an average price of $5.51, for a total value of $27,550.00.

Signal (1 year): 390.19

Predictability (1 year): 0.34

Return: 5.53%

AK Steel Holding Corporation (AK Holding) is an integrated producer of flat-rolled carbon, stainless and electrical steels and tubular products through its wholly-owned subsidiary, AK Steel Corporation (AK Steel and, together with AK Holding, the Company). The Company’s operations consist primarily of nine steelmaking and finishing plants and tubular production facilities located in Indiana, Kentucky, Ohio and Pennsylvania. The company had a signal of 390.19 and a predictability of 0.34. In accordance with the algorithm prediction, the stock returned 5.53% in a one-year time horizon. Shares of AK Steel Holding (NYSE:AKS) have been given an average rating of “Hold” by the twelve ratings firms that are covering the stock, American Banking & Market News reports. This can be an explanation of the rise of the stock these past year.

Signal (1 year): 388.03

Predictability (1 year): 0.36

Return: 18.80%

Apollo Education Group, Inc. offers educational programs and services, online and on-campus, at the undergraduate, master’s and doctoral level. The company had a signal of 388.03 and a predictability of 0.36. In accordance with the algorithm prediction, the stock returned 18.80% in a one-year time horizon. Apollo is consistently enhancing and expanding its services and investing in academic quality to improve student experience and outcomes. The company’s initiatives include investments in adaptive learning, new degree and certificate-based programs, modernized and significantly upgraded online classroom and new learning and service platform. Additionally, innovation and recent price cuts should improve student value proposition and retention rates.

Signal (1 year): 383.41

Predictability (1 year): 0.25

Return: 39.99%

Yahoo! Inc. (Yahoo!) is a global technology company. Through the Company’s technology and insights, Yahoo! delivers digital content and experiences, across devices and globally. The Company provides online properties and services (Yahoo! Properties) to users, as well as a range of marketing services designed to reach and connect with those users on Yahoo! and through a distribution network of third-party entities. The company had a signal of 383.41 and a predictability of 0.25. In accordance with the algorithm prediction, the stock returned 39.99% in a one-year time horizon. It’s the season to shine for Yahoo! Inc. after many years of decline. Yahoo is making some interesting and strategic acquisitions that are powering its revenue growth. The acquisition of San Francisco-based Coolris follows the recent acquisition of BrightRoll for $640 million.

Signal (1 year): 296.89

Predictability (1 year): 0.35

Return: 80.73%

The Argentina Merval Index, a basket weighted index, is the market value of a stock portfolio, selected according to participation in the Buenos Aires Stock Exchange, number of transactions of the past 6 months and trading value. The index had a signal of 296.89 and a predictability of 0.35. In accordance with the algorithm prediction, the stock returned 80.73% in a one-year time horizon. Argentine stocks have been one of the world’s hottest investments this year, with the Mercado de Valores De Buenos Aires, or Merval, the country’s benchmark stock exchange, up 52% for 2014 and a whopping 136% in the past 12 months. One of the biggest reasons investors still like Argentina is that the country’s stock market remains exceptionally cheap compare to other indexes such as The S&P 500.

Signal (1 year): 241.06

Predictability (1 year): 0.32

Return: 14.94%

MGIC Investment Corporation (MGIC) is a holding company and through wholly owned subsidiaries is a private mortgage insurer in the United States. The company had a signal of 241.06 and a predictability of 0.32. In accordance with the algorithm prediction, the stock returned 14.94% in a one-year time horizon. Recently, MGIC investment Corp. was upgraded by equities research analysts at Goldman Sachs from a “buy” rating to a “conviction-buy” rating in a research note issued to investors. This led to a shift in the company’s shares’ prices.

Signal (1 year): 239.98

Predictability (1 year): 0.42

Return: 69.82%

Micron Technology, Inc., is a global manufacturer and marketer of semiconductor devices, principally NAND Flash, DRAM and NOR Flash memory, as well as other memory technologies, packaging solutions and semiconductor systems for use in computing, consumer, networking, automotive, industrial, embedded and mobile products. In addition, the Company manufactures semiconductor components for CMOS images sensors and other semiconductor products. The company had a signal of 239.98 and a predictability of 0.42. In accordance with the algorithm prediction, the stock returned 69.82% in a one-year time horizon. Recently, TheStreet Ratings team rates MICRON TECHNOLOGY INC as a Buy with a ratings score of A-. This is based on the convergence of positive investment measures, which should help this stock outperform the majority of stocks that we rate. The company’s strengths can be seen in multiple areas, such as its robust revenue growth, solid stock price performance, notable return on equity, attractive valuation levels and expanding profit margins.

Signal (1 year): 227.75

Predictability (1 year): 0.23

Return: 34.42%

Gilead Sciences, Inc. (Gilead) is a research-based biopharmaceutical company that discovers, develops and commercializes medicines. The company had a signal of 227.75 and a predictability of 0.23. In accordance with the algorithm prediction, the stock returned 34.42% in a one-year time horizon. Recently, Gilead purchased a priority review voucher for $125 million, which it may decide to use for its NASH (Nonalcoholic statohepatitis) drug, deterring the competition from Intercept. Given the high number of people afflicted with the disease, it is expected that by 2025, NASH will become the primary reason for liver transplant. According to Alethia Young, analyst at Deutsche Bank AG (USA), the market for NASH drugs will be around $35-40 million by 2025.

Signal (1 year): 146.35

Predictability (1 year): 0.17

Return: – 12.78%

Alcatel Lucent SA is a France based company that proposes solutions used by service providers, businesses, and governments worldwide to offer voice, data, and video services to their own customers. It is also engaged in mobile, fixed, Internet Protocol (IP) and optics technologies, applications and services.

Signal (1 year): 130.17

Predictability (1 year): 0.62

Return: 9.57%

Nokia Corporation invest in technological devices. The Company is focused on three businesses: network infrastructure software, hardware and services, which it offers through Networks; location intelligence, which the Company provides through HERE, and advanced technology development and licensing, which the Company pursues through Technologie. The company had a signal of 130.17 and a predictability of 0.62. In accordance with the algorithm prediction, the stock returned 9.57% in a one-year time horizon. In terms of market cap, Nokia Corporation (ADR)(NYSE:NOK) is now valued at 31.32 billion. The company last reported earnings per share of 0.13 on Apr 21st. The company is expected to report earnings per share next year 15.62% higher than this year. The five year earnings per share estimate is at 27.00%.

Business Disclosure: I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article. Read More From I Know First Research:

- IBM Fundamental And Algorithmic Analysis: Will Big Blue Bring Big-Time Blues?

- Google Can Grow Forever, But Is It The Best Investment Right Now?

- BlackBerry Is A Risky Fruit: Making 232% In A Year Using Fundamental And Algorithmic Trading

- Coca Cola – Undervalued: Stock Valuation Using A 10-Year Cash Flow Projection And Algorithmic Analysis

- Tesla Motors – Summative And Algorithmic Evaluation