I Know First Review: April 28th, 2016

I Know First Review

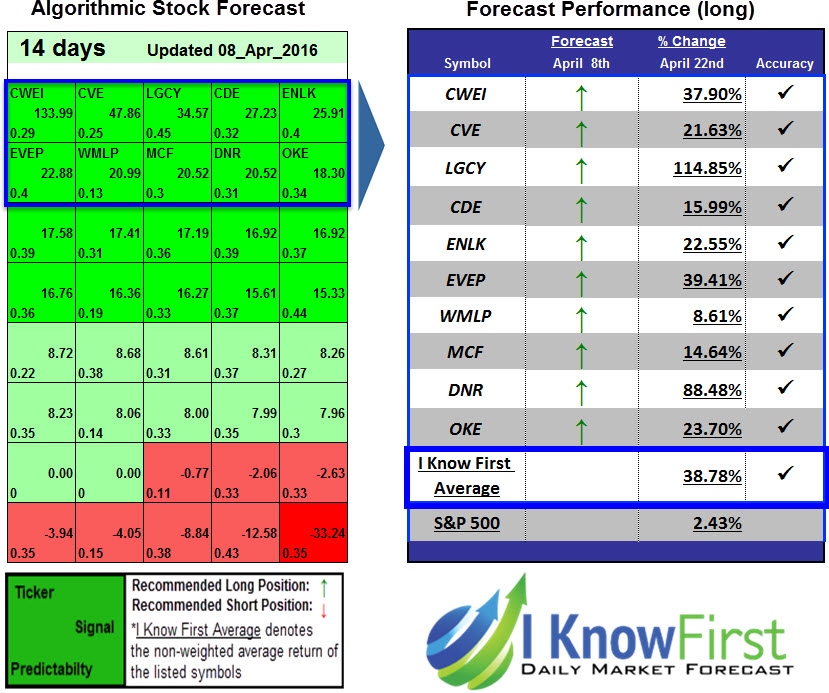

The stocks selected here are the top performing stocks from I Know First Review selection: Energy Stocks Forecast for 14 Days found in the article titled “Algorithmic Trading”. This forecast is part of the Top 10 Stocks package, as one of I Know First’s quantitative investment solutions. The “I Know First Average” return for the long position was 38.78% over the 14 Days outperforming the S&P 500’s 2.43% return by a wide margin.

Learn how to read the predictions: Instructions

Learn how to strategize with the forecast: Algorithmic Trading Strategies

Predictability: 0.29

Return: 37.90%

Clayton Williams Energy, Inc., an independent oil and gas company, explores for, and develops and produces oil and natural gas primarily in Texas and New Mexico. The companys principal properties are located in the Permian Basin of West Texas and Southeastern New Mexico, as well as the Giddings Area in East Central Texas. The company ( CWEI) will hold its first quarter result conference call on Thursday , May ,5th 2016. The Company expects to issue the news release sometime before the market opens on Thursday , May 5 ,2016.

Predictability: 0.25

Return: 21.63%

Cenovus Energy Inc. develops, produces, and markets crude oil, natural gas liquids (NGLs), and natural gas in Canada. Its Oil Sands segment develops and produces bitumen assets at Foster Creek, Christina Lake, Narrows Lake, and the Athabasca natural gas assets, as well as projects in the early stages of development. Cenovous Energy will release its first quarter 2016 on Wednesday , 27 April 2016. The news release will provide consolidated first quarter 2016 operating and financial operation.

Predictability: 0.45

Return: 114.85%

Legacy Reserves LP acquires and develops oil and natural gas properties primarily in the Permian Basin, East Texas, Rocky Mountain, and Mid-Continent regions of the United States. On April 25th ,The Stock Expert is issuing a report on four stocks that are performing well this Friday. TPUB, AVXL, NEOT, and LGCY are on high breakout alert. Continue reading to find out why. – To get daily alerts on the hottest stocks on the Nasdaq/NYSE.

Predictability: 0.32

Return: 15.99%

Coeur Mining, Inc. owns, operates, explores for, and develops silver and gold properties. The company holds interests in the Palmarejo silver-gold mine located in Mexico; Rochester silver and gold mine in northwestern Nevada; Kensington gold mine located to the north of Juneau, Alaska. Investors are always looking for stocks that are poised to beat at earnings season and Coeur Mining, Inc. CDE may be one such company. The firm has earnings coming up pretty soon, and events are shaping up quite nicely for their report. That is because Coeur Mining is seeing favorable earnings estimate revision activity as of late, which is generally a precursor to an earnings beat

Predictability: 0.4

Return: 22.55%

EnLink Midstream Partners, LP, through its subsidiary, EnLink Midstream Operating, LP, provides midstream energy services. The company provides gathering, transmission, processing, fractionation, brine, and marketing services to producers of natural gas, natural gas liquids (NGL), crude oil, and condensate. On April 21, The Enlik Midstream companies announced quarterly distributions for Enlik Midstream Partners ( ENLK) LLC for the first quarter of 2016. Additionally , The quarterly distribution on the Master Limited Partnership’s common units will be $0.39 per common unit, which represents a flat distribution compared to the fourth quarter of 2015 and a year-over-year increase of approximately three percent compared to the first quarter of 2015.

Signal: 22.08

Predictability: 0.4

Return: 39.41%

EV Energy Partners, L.P. engages in the acquisition, development, and production of oil and natural gas properties in the United States. Its properties are located in the Barnett Shale; the Appalachian Basin; the San Juan Basin; Michigan; Central Texas; the Mid-Continent areas in Oklahoma, Texas, Arkansas, Kansas, and Louisiana. On April 11, 2016, EV Energy Partners (EVEP) presented at the IPAA (Independent Petroleum Association of America) OGIS (Oil and Gas Investment Symposium) in New York. EV Energy revealed that its borrowing base under its senior credit facility has decreased to $450 million, from $650 million. The company also outlined the covenants for its senior secured credit facility set by its banks.

Predictability: 0.13

Return: 8.61%

Westmoreland Resource Partners, LP produces and markets thermal coal in the United States. It also produces surface mined coal in Ohio. As of December 31, 2015, the company managed 16 active surface mines;and managed these mines as 5 mining complexes located in eastern Ohio, as well as 1 mine situated in Wyoming. On April 26th , Westmoreland Resources GP , LLC , general partner of Westmoreland Resource Partners , LP WMLP , declared a cash distribution for all unitholders and warrant holders of $0.20$ per unit for its first quarter ended March 31 , 2016.

Predictability: 0.3

Return: 14.64%

Contango Oil & Gas Company, an independent oil and natural gas company, acquires, explores, develops, exploits, and produces crude oil and natural gas properties in the offshore shallow waters of the Gulf of Mexico, and in the onshore Texas Gulf Coast and Rocky Mountain regions in the United States. On April 20th , Contango Oil&Gas Company has updated its investor’s presentation which included updated information about the Company’s operations.

Signal: 20.52

Signal: 20.52

Predictability: 0.31

Return: 88.48%

Denbury Resources Inc. operates as an independent oil and natural gas company in the United States. The company primarily focuses on enhanced oil recovery utilizing carbon dioxide. Last Tuesday , Denbury Resource Stock was downgraded to “sector weight’ from ‘overweight” at Keybanc. The lower rating is primarily due to valuation as the oil and natural gas company’s shares have surpassed the firm’s $3 per share price target.

Predictability : 0.34

Return : 23.70%

ONEOK, Inc., through its general partner interests in ONEOK Partners, L.P., engages in the gathering, processing, storage, and transportation of natural gas in the United States. It operates through the Natural Gas Gathering and Processing, the Natural Gas Liquids, and the Natural Gas Pipelines segments. On April 25th , ONEOK (OKE) and ONEOK Partners ( OKS) are scheduled to report their 1Q16 results on May 3 ,2016. Analysts expect good result about EBITDA to be $409 million.