I Know First Portfolio Allocation Strategies: Small Cap Stocks, June 26th, 2015

I Know First Portfolio Allocation Strategies

Portfolio Strategies: There are multiple algorithmic trading strategies investors can apply when using I Know First’s self-learning algorithm as seen here. After fully understanding how to interpret the heat map, you can construct your own personal portfolio to further optimize returns.

The algorithm works by analyzing the flow of money from one market to another by following over 2,000 different assets including stocks, ETF’s, currencies, world indexes, interest rates, and commodities including gold, oil, and many more. The machine utilizes fifteen years of data and is updated daily as new information is introduced producing market forecasts from 3 days to 1-year.

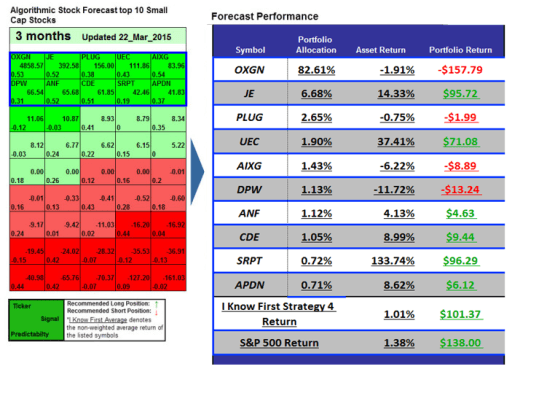

The model portfolio used in the following strategies is based off of a 3 Months forecast from March 22nd, 2015 – using the Top 10 recommended Short Cap positions.

Strategy 1: Equal Allocation Strategy

The most popular approach is to purchase all the assets of the forecast in equal weights. This strategy will help diversify your portfolio, ultimately reducing risk and enhancing returns. The I Know First Average Return reflects the return an investor will receive implementing this strategy.

In this example, we demonstrated how this trading strategy would look like for a $10,000 portfolio.

While in this scenario the strategy managed to return 18.66% (a great S&P beat), it is important to keep in mind that this is the most conservative and diversified strategy. During difficult market conditions this portfolio allocation would also be your best bet for mitigating losses. For more information, check out our complete write-up on the strategy.

Strategy 2: Allocating Your Portfolio Based on Predictability

When looking at the heat map, the predictability represents the strength of the signal, or more specifically, the historical correlation between the prediction and actual market movement. The predictability ranges from negative one to one. One approach to creating your portfolio is to weigh your investments in proportion to the stock’s predictability, as seen below.

As you can see above, each stock’s allocation is the product of the stock’s predictability divided by the total predictability. The total predictability is simply the collective predictability of the top 10 stocks. In this scenario, the predictability weighted portfolio returned 11.76% over 3 months, generating $1,176.36 – also soundly beating the S&P 500 average by over 10%.

Strategy 3: Allocating Your Portfolio Based on Signal

This strategy uses the same approach as the Predictability Weighted Portfolio, with the difference being that each asset’s allocation is determined by its signal. The signal represents the predicted movement direction, or how much the current price deviates from what the system considers are fair equilibrium prices.

As you can see, as a result of allocating over 80% of the portfolio on one asset which had negative short-term results, this strategy returned a disappointing 1.01% which means a return of $101.37 over a 3-month time frame.

Because this strategy is recommended for long-term forecasts, ideally up to 1-year, we would recommend our clients to stick with this stock as experience has proven us that stocks with such a strong signal almost definitely rise.

Strategy 4: Allocating Strategy

This approach requires some basic math skills, specifically multiplication. When you multiply the signal and predictability, you basically create your own new indicator. You can then use this new indicator to weight your portfolio.

As shown, this strategy returned 3.71% for our sample portfolio. The high signal of OXGN and it’s disappointing short-run results clearly had a negative impact on our average return. Despite that, the algorithm still beat the S&P 500 average of 1.38% in the same time period

Strategy optimization

Each of these simplified algorithmic trading strategies helps you getting an overview how you can utilize our algorithmic forecasts. In practice we recommend using further information about the stock before investing. Since the forecasts are projecting the development over a certain time span, a stock with a bullish signal might fall in short term before it goes up. In order to optimize we recommend using the 5 Day SMA (simple moving average) of the stock price to indicate whether a stock is already going up. We also mark the stocks in the forecast which went above the 5 Day simple moving average and that for are good investment opportunities. See how this looks like here.

Conclusion

every forecast to its fullest potential in your own algorithmic trading. Our most popular forecast is our Stock Forecast & S&P 500 Forecast available with our Top 5, Top 10 and Top 20 stock predictions. These strategies are applicable to all our forecasts and are excellent tools for active investors and traders. For those of you who are more passive, the equal weight portfolio is an excellent strategy that is used to calculate the I Know First Average. There are many more strategies than those listed, and we encourage you develop your own strategies as you become more acquainted with the system.

I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article.