I Know First Algorithmic Review: April 19th, 2015

I Know First Algorithmic Review

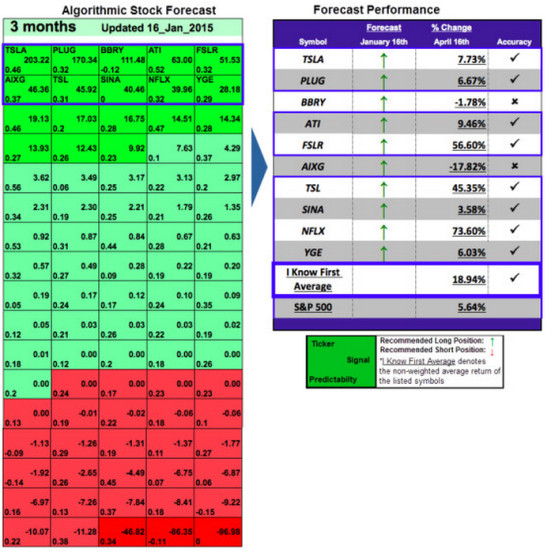

The stocks selected here are the top performing stocks from I Know First: Daily Market Forecast’s January 16th, 2015 stock forecast titled Stock Forecast Based On Big Data:Up To 73.60% In 3 Months This forecast is part of the “Tech Stocks” package, as one of I Know First’s quantitative investment solutions. The “I Know First Average” return was 18.94% over 3 months versus the S&P 500’s return of 5.64% over the same time period.

Learn how to read the predictions: Instructions

Learn how to strategize with the forecast: Algorithmic Trading Strategies

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.

Signal : 161.27

Predictability : 0.28

Return: 110.84%

Tesla Motors, Inc. designs, develops, manufactures, and sells electric vehicles, electric vehicle powertrain components, and stationary energy storage systems in the United States, China, Norway, and internationally. It also provides development services to develop electric vehicle powertrain components and systems for other automotive manufacturers.Tesla Motors,, Inc. had a signal strength of 203.22 and a predictability indicator of 0.46. In accordance with the algorithm’s prediction, the stock price increased 7.73%. Tesla Motors Inc plans to offer a home battery that can be used in houses or business very soon, CEO Elon Musk told analysts. Musk mentioned that the product could be showcased in a couple of months.

Signal : 170.34

Predictability : 0.32

Return: 6.67%

Plug Power Inc., an alternative energy technology provider, engages in the design, development, manufacture, and commercialization of fuel cell systems for the industrial off-road markets worldwide. It focuses on proton exchange membrane (PEM) fuel cell and fuel processing technologies, and fuel cell/battery hybrid technologies. The company had a signal strength of 170.34 and a predictability indicator of 0.32. In accordance with the algorithm’s prediction, the stock price increased 6.67%. Please view our Seeking Alpha Article on PLUG.

Predictability : -0.12

Return: -1.78%

BlackBerry Limited is a provider of wireless solution, comprised of smartphones, service and software. The Company provides hardware, software and services that support multiple wireless network standards, it provides platforms and solutions for seamless access to information, including email, voice, instant messaging, short message service, internet and intranet-based applications and browsing.

Predictability : 0.52

Return: 9.46%

Allegheny Technologies Incorporated produces and sells specialty materials and components worldwide. The company operates through two segments, High Performance Materials and Components; and Flat-Rolled Products.The company had a signal strength of 63.00 and a predictability indicator of 0.52. In accordance with the algorithm’s prediction, the stock price increased 9.46%.

Signal : 51.53

Predictability : 0.32

Return: 56.60%

First Solar, Inc manufactures and sells photovoltaic solar modules with an advanced thin-film semiconductor technology, and it designs, constructs, and sells PV solar power systems. The Company is a thin-film PV solar module manufacturer and a PV solar module manufacturer. The company had a signal strength of 51.53 and a predictability indicator of 0.32. In accordance with the algorithm prediction, the stock returned 56.60% in the 3-month time horizon. First Solar, Inc. stock is up on its yield co with SunPower Corporation. FirstSolar. The company announced the joint yield co last month. Both companies will choose solar assets from their portfolios and integrate them as part of the deal.The deal will have an IPO once both companies have approved it. Proceeds may later be used to fund new projects for First Solar.

Signal : 46.36

Predictability : 0.37

Return: -17.82%

Aixtron SE is a provider of deposition equipment to the semiconductor and compound-semiconductor industry. The Company’s technology solutions are used by a diverse range of customers worldwide to build advanced components for electronic and opto-electronic applications based on compound, silicon, or organic semiconductor materials.

Predictability : 0.31

Return: 45.35%

Trina Solar Limited is an integrated solar-power products manufacturer based in China with a global distribution network covering Europe, North America and Asia. The Company produces standard monocrystalline photovoltaic (PV) modules ranging from 165 Watts to 185 Watts in power output and multicrystalline PV modules ranging from 215 Watts to 240 Watts in power output. Trina Solar Limited had a signal strength of 45.92 and a predictability indicator of 0.31. In accordance with the algorithm’s prediction, the stock price increased 45.35%. China-based photovoltaic (“PV”) module producer Trina Solar Limited TSL was selected by Toyo Engineering Corporation to supply 116 MW of high efficiency modules to the largest solar power project in Japan. This solar project will be built in Setouchi City, Okayama Prefecture and will be managed by Setouchi Future Creations LLC.

Signal : 40.46

Predictability : 0

Return: 3.58%

SINA Corporation, is an online media company serving China and the global Chinese communities. Its digital media network of SINA.com (portal), SINA.cn (mobile portal) and Weibo.com (social media), enable Internet users to access professional media and user generated content (UGC) in multi-media formats from the Web and mobile devices and share their interests to friends and acquaintances.SINA Corporation had a signal strength of 40.46 and a predictability indicator of 0. In accordance with the algorithm’s prediction, the stock price increased 3.58%. The company reported $0.24 earnings per share for the quarter, beating the analysts’ consensus estimate of $0.18 by $0.06. The company had revenue of $208.50 million for the quarter, compared to the consensus estimate of $207.61 million. During the same quarter last year, the company posted $0.47 earnings per share. SINA Corp’s revenue was up 5.8% compared to the same quarter last year.

Predictability : 0.32

Return: 73.60%

Netflix, Inc is an Internet television network with more than 53 million members in over 50 countries. Its members can watch as much as they want, anytime, anywhere, on nearly any Internet-connected screen. Members can play, pause and resume watching, all without commercials or commitments Additionally, in the United States, its members can receive digital versatile discs (DVDs) delivered quickly to their homes.Netflix, Inc had a signal strength of 39.96 and a predictability indicator of 0.32. In accordance with the algorithm’s prediction, the stock price increased 73.60%. Please view our Seeking Alpha Article on Netflix.

Predictability : 0.29

Return: 6.03%

Yingli Green Energy Holding Company Limited is a supplier of vertically integrated photovoltaic module. The Company’s products and services cover the entire PV industry value chain, ranging from crystalline polysilicon ingots and wafers, PV cells and PV modules to the manufacture of PV systems and the installation of PV systems. The company had a signal strength of 28.18 and a predictability indicator of 0.29. In accordance with the algorithm prediction, the stock returned 6.03% in 3 Months. The Chinese government has ambitious plans to reduce its carbon dioxide emissions. It plans to produce 70 gigwatt with solar power plants by 2017. Furthermore China has the plan to generate 20% of its total energy consumption from renewables by 2030. Yingli is one of China’s biggest solar companies and will play an essential role in the fulfillment of this plan. Despite that, the pressure on the solar industry is growing due to increasing competition and over capacities.

Business Disclosure: I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article. Read More From I Know First Research:

- Electric Buses Vs. Fuel Cell Buses: Plug Power Has A Stake In The Winner (View)

- Why BlackBerry Holds Long-Term Value For Investors (View)

- Tata Motors Is An Attractive Opportunity: An Algorithmic Analysis (View)

- Applied Material’s Venture Group Invests Into UV LED, An Interesting Portfolio Expansion With Growth Potential (View)

- Can Apollo Fight Online Education Any Longer? (View)