I Know First Algorithm Review: August 8th 2016

I Know First Algorithm Review

I Know First Algorithm Review

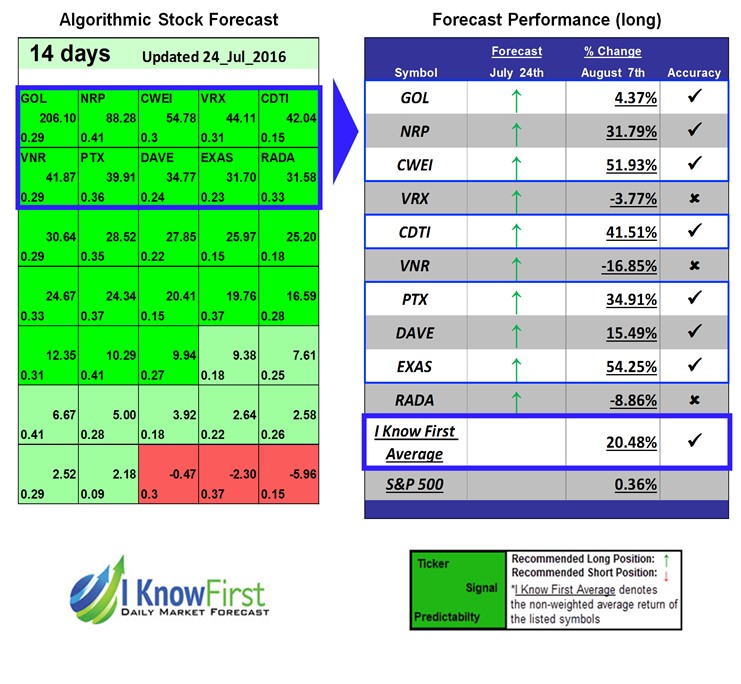

The stocks selected here are the top performing stocks from I Know First: Daily Market Forecast’s July 24th, 2016 stock forecast titled “Stock Predictions Based on Genetic Algorithm: 54.25% in 14 days”

This forecast is part of the “Aggressive Stock Forecast” package, as one of I Know First’s quantitative investment solutions. The “I Know First Average” return was 20.48% over 14 days versus the S&P 500’s return of 0.36% over the same time period.

Learn how to read the predictions: Instructions

Learn how to strategize with the forecast: Algorithmic Trading Strategies

Please note – for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.

Gol Linhas Aéreas Inteligentes S.A (GOL)

Signal: 206.1

Signal: 206.1

Predictability: 0.29

Return: 4.37%

Gol Linhas Aéreas Inteligentes S.A. is the largest low-cost airline in South America and the second largest Brazilian airline company by market share and fleet size. The company had a signal strength of 206.1 and a predictability indicator of 0.29. In accordance with the algorithm’s prediction, the stock price increased 4.37%. This can be attributed to the sale which Looks Imminent as Brazil lifts restriction on foreign ownership.

Natural Resource Partners L.P (NRP)

Signal: 88.28

Predictability: 0.41

Return: 31.79%

Natural Resource Partners L.P. owns, operates, manages and leases a portfolio of mineral properties in the United States, including interests in coal, trona and soda ash, natural gas and crude oil, construction aggregates, frac sand and other natural resources. The company had a signal strength of 88.28 and a predictability indicator of 0.41. The I Know First algorithm accurately predicted a positive return of 31.79%.

Clayton Williams Energy, Inc. (CWEI)

Signal: 54.78

Signal: 54.78

Predictability: 0.3

Return: 51.93%

Clayton Williams Energy, Inc., an independent oil and gas company, explores for, and develops and produces oil and natural gas primarily in Texas and New Mexico. CWEI has a signal strength of 54.78 and predictability of 0.3. I Know First’s algorithm accurately predicted an increase of 51.93%. This can be attributed to the fact that American oil producers reduced their Production Costs because of OPEC Glut Pressure.

Valeant Pharmaceuticals International, Inc (VRX)

Signal: 44.11

Signal: 44.11

Predictability: 0.31

Return: -3.77%

Valeant Pharmaceuticals International, Inc. is a multinational pharmaceutical company based in Laval, Quebec, Canada. Valeant manufactures mostly generic pharmaceuticals and over-the-counter products. The company had a signal strength of 44.11 and a predictability indicator of 0.31 but it has a negative return of -3.77%. Valeant now has a massive debt pile due to its acquisitions of cheaper assets, which are not generating enough revenue to patch up the decline. The company’s dermatology segment is also showing stagnant growth due to its distribution agreement with Philidor RX Services.

Clean Diesel Technologies, Inc. (CDTI)

Signal: 42.04

Signal: 42.04

Predictability: 0.15

Return: 41.51%

Clean Diesel Technologies, Inc. is a global vehicle emissions control system provider focusing on heavy duty and light duty diesel pollution control. CDTI has a signal strength of 42.04 and predictability of 0.15. I Know First’s algorithm accurately predicted an increase of 41.51%. It is the consequence of the announcement that CDTI will provide Mixed Phase Catalyst (MPC®) technology to Honda for its newly designed 2017 Accord Hybrid model. The model has been in production since the beginning of 2016 and is now being delivered to dealerships throughout North America.

Vanguard Natural Resources (VNR)

Signal: 41.87

Signal: 41.87

Predictability: 0.29

Return: -16.85%

Vanguard Natural Resources, LLC, through its subsidiaries, acquires and develops oil and natural gas properties in the United States. It owns properties, and oil and natural gas reserves primarily located in 10 operating basins, including the Green River Basin in Wyoming; the Permian Basin in West Texas and New Mexico. The company had a signal strength of 41.87 and a predictability indicator of 0.29 but it has a negative return of -16.85%.

Pernix Therapeutics (PTX)

Signal: 39.91

Signal: 39.91

Predictability: 0.36

Return: 34.91%

Pernix Therapeutics is a specialty pharmaceutical business with a focus on acquiring, developing and commercializing prescription drugs primarily for the U.S. market. Pernix has a signal strength of 39.91 and predictability of 0.36. I Know First’s algorithm accurately predicted an increase of 34.91%. The new CEO and the massive changes to restructures the company into better position are the reason of that increase.

Famous Dave’s of America (DAVE)

Signal: 34.77

Signal: 34.77

Predictability: 0.24

Return: 15.49%

Famous Dave’s of America is a chain of barbecue restaurants serving pork ribs, chicken, beef brisket, and several flavors of barbecue sauce. The company had a signal strength of 34.77 and a predictability indicator of 0.24. As predicted by the algorithm, DAVE has a positive return of 15.49%. This is due to the fact that DAVE hires Colle+McVoy to boost brand. They will help him modernize the restaurant chain’s brand with strategic and creative services.

Exact Sciences Corp (EXAS)

Signal: 31.7

Signal: 31.7

Predictability: 0.23

Return: 54.25%

Exact Sciences Corp. is a molecular diagnostics company with an initial focus on the early detection and prevention of colorectal cancer. Exact Sciences Corp has a signal strength of 31.7 and predictability of 0.23. I Know First’s algorithm accurately predicted an increase of 54.25%.

RADA Electronic Industries Ltd. (RADA)

Signal: 31.58

Signal: 31.58

Predictability: 0.33

Return: -8.86%

RADA Electronic Industries Ltd. develops, manufactures, and sells defense electronics to various air forces and companies worldwide. The company offers military avionics systems. The company had a signal strength of 31.58 and a predictability indicator of 0.33 but it has a negative return of -8.86%.

Business Disclosure: I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article