Home Depot Stock Analysis: The Long-Term Future of Home Depot

Reuben Bor is a Financial Analyst Intern at I Know First.

Reuben Bor is a Financial Analyst Intern at I Know First.

Home Depot Stock Analysis

Summary

- Management laid out a strong, achievable, 3-year plan

- HD has one of the strongest e-commerce presence among brick and mortar retailers

- Housing data supports the idea that home improvement spending could increase in the coming years

38 Year’s after Ken Langone first founded Home Depot to serve the growing needs of the Do-It-Yourself consumer, it has become the largest home improvement retailer, with over 2,200 stores in the US, Canada, Mexico and operations in China, and 371,000 employees. Prior to 2007, Home Depot was operating through a rapid expansion phase, where they where opening 200 new stores a year, by 2010 they had only opened one store in the U.S and five stores in Mexico, marking the beginning of a strategic transition away from domestic expansion, and towards building their international brand. International expansion has not been smooth; in 2012 HD closed its Chinese stores. Domestically, however, Home Depot is focused on improving strong customer retention through service and innovation in their consumer retail operations, especially after they have completely sold off their stake in what was once their industrial distribution division, HD Supply.

Home Depot first established itself through its massive warehouse-style stores, designed to be more robust than any other retailer in the market. Today Home Depot stores have an average size of 104,000 square feet of indoor retail space, as well as an additional 24,000 square feet for their garden centers. Home Depot stores cater to three groups of customers, DIY, DIFM and Professionals. Do-It-Yourself and Do-It-For-Me are typical homeowners who purchase home improvement materials for their own personal projects and installations. Additionally, Home Depot serves professionals, which includes contractors, builders, remodelers and repair people. By catering to both amateur and professional customers, HD has carved out their space as a go-to retailer for home improvement purposes.

Home Depot generates the most revenue from its kitchen department, which makes up 10% of 2015 revenue, indoor gardening, which makes up 9.1% of revenue, the paint department, which makes up 8.8% of revenue and outdoor garden, which makes up 7.7% of revenue. With its stock price already up over 25% for the year, we believe that due to Home Depot’s reputation for strong management, and increases in home ownership, interest rates, and home prices will fuel further growth in stock price in 2016.

(Source: Google Images)

Management’s 3-Year Plan

No one disputes Home Depots manager’s abilities as excellent stewards of shareholder capital. After Frank Blake stepped down as CEO in 2014, committed HD veteran Craig Menear filled in the role, and would continue to improve management’s image by scaling back on executive lavish and taking two-thirds of his compensation in the form of stock option. In early December, management laid out their three-year financial targets. It is worth noting that Home Depot is generally conservative with their guidance, and have a track record of beating their long-term targets.

According to their financial guidance, HD predicts that store comps, a measurement of stores year-to-year revenue growth will remain at 4% until 2018. They have detailed plans to repurchase $23 billion, and maintain a dividend ratio of 50%. They expect sales to grow from $88.0 billion in 2015 to $100.9 billion in 2018. They project EBIT to grow from $11.9 billion to $14.7 billion, however, what is most interesting is the plans they laid out for how to improve EBIT margins from 13.5% to 14.5% by improving supply chain efficiency through an initiative that management calls “Project Sync”. HD has already started to make improvements, by having vendors ship directly to stores and rapid deployment centers. Through Project Sync, HD plans on collaborating with vendors to send fuller truckload deliveries, less frequently. This initiative will reduce lead-time from 11 days to 5 days, improve inventory and decrease costs, all of which will improve margins. Beyond this improved collaboration with vendors, HD management described how they will be leveraging innovation and technology within their stores to create improved efficiency. They will be using a new IT system that will speed up the unloading of trucks, and allow employees to more efficiently unpack and assemble merchandise. Overall these initiatives are expected to increase inventory turnover from 4.97x in 2014 to 5.7x.

In addition to Home Depot’s strategy of improved efficiency, management laid out their strategy to capture a greater share of the professional market. Currently, Home Depot represents less than 5% of Pro market share. Management would like to increase that number to 13% by 2018. Some tactics they plan to use include promoting greater financing solutions to professionals, introducing an attractive loyalty rewards program, and they even plan on introducing delivery to professional job sites, a major accommodation for construction teams.

(Source: Google Images)

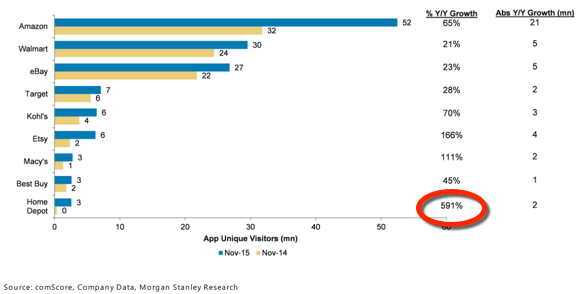

Another point about Home Depot is that among major brick-and-mortar retailers, Home Depot stands out in the e-commerce space. In the third quarter alone HD’s online sales have grown by 25%, making up 5.1% of total sales. These numbers are quite impressive, especially compared to other large-scale retailers. Costco’s online sales only make up little over 3%, and Target’s are only 2.7%. What is most impressive, however, is Home Depot’s mobile presence, in which they have managed to grow individual app visitors by over 500% since last year.

(Source: ComScore)

Housing Data

According to the Standard & Poor’s/Case-Shiller 20-city home price index, throughout 2015 housing prices have risen at a pace of around 5%. If home prices continue to rise, homeowners will once-again consider their houses to be an investment, and will be compelled to spend more on home improvement projects. Bank of America Merrill Lynch research explains that new household formation has been growing its fastest pace since 2005, with an expected 1.5 million new households to have been formed in 2015. Since the recession of 2008, the annual pace of household formation growth had been around 650,000 households per year.

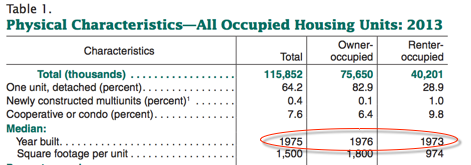

S&P analyst E. Levy explains that we are at a point in time that is a “sweet spot” for home refurbishment. This sweet spot occurs when homes have existed for 25 or more years. Census bureau data indicates that 71% of homes are more than 25 years old, the median age being 35 years. The implication for Home Depot is that these aging homes are at a the point where they will become renovated, leading more customers into Home Depot Centers. Finally, after the Federal Reserve raised interest rates for the first time in years, we are in what is believed to be the end of the “zero-rate” era. If the Fed continues on their path of raising interest rates, mortgages will become more expensive and people will opt to renovate their current homes, instead of purchasing new ones.

(Source: 2013 American Housing Survey)

Forecast

I Know First supplies financial services, mainly through stock forecasts based on a predictive algorithm. The algorithm incorporates a 15-year database and utilizes it to predict the flow of money across 2000 markets. The self-learning algorithm uses artificial intelligence, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets.

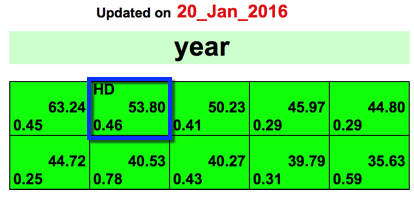

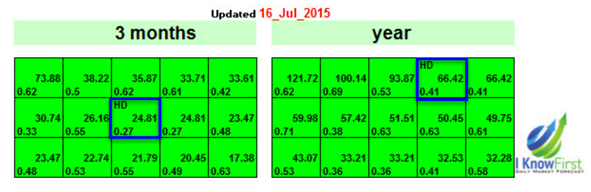

The algorithm produces a forecast with a signal and a predictability indicator. The signalis the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

I Know First originally received a bullish forecast for Home Depot in July 2015, which lead to an article published on Seeking Alpha, discussing Home Depot’s rising revenues and strong ROE. Since the article was written, the stock had steadily gained about 15% coming into the New Year.

Conclusion

With the current selloff of equities, HD shares have been lower with the rest of the market, however, we believe that HD is still in a position for long term returns and that this is a good opportunity to buy HD. We believe that management will be able to achieve the conservative plans that they have laid forth. Furthermore, if the market continues to panic, consumers may look towards their houses as a more reliable investment, and the overall housing data supports that housing is rapidly recovering from the 2008 collapse. Our most current forecast continues to support a bullish signal for Home Depot with a strength of 53.80, and a reliability of 0.46.