HIMX Stock: Himax’s Recent Crash Isn’t Indicative of Future

Zack Tobin is a Financial Analyst at I Know First.

Zack Tobin is a Financial Analyst at I Know First.

HIMX Stock

Himax stock has fallen 7% in the past week

Himax stock has fallen 7% in the past week- The company has grown exponentially since becoming partners with Google

- AR & VR products are expected to become more widespread.

- China will sell more smartphones and tablets

- I Know First is Bullish on HIMX stock movement for the long term

Himax Technologies, Inc. (HIMX), is a fabless semiconductor solution provider, based in China. The Company is engaged in display driver integrated circuits (IC) and timing controllers used in televisions, laptops, monitors, mobile phones, tablets, digital cameras, car navigation and other consumer electronics devices.

Last Friday Himax stock crashed and is trading at slightly above $10.00, which is 7.23% fall from Thursday. This crash has not been following the trend Himax has had over the past five months. Since August 12th, 2015 the company has been up 61.39% and has outperformed the S&P 500 by 59.16%. Despite the crash, you can expect to see the company continue growing. After the stock’s recent fall now is a particularly good time to invest in Himax, as the potential profits are even higher.

Augmented and Virtual Reality Products Set to Taking Off

One industry that Himax is heavily involved in is virtual reality and augmented reality products. Many are expecting AR & VR products to become more widespread and mainstream in the near future. Two of their most well-known products, Liquid Crystal on Silicon (LCoS) and Wafer-Level Optics (WLO) are functioned with AR & VR products. Management expects revenue from both LCoS and WLOs to double quarter-over-quarter as AR & VR products become more widespread.

Currently, virtual reality and augmented reality are still in their infant stages but still have enormous potential. According to digi-capital.com revenue from augmented/virtual reality software only generated a little over $1billion in worldwide revenue in 2015, but is expected to hit over $120 billion by 2020.

Himax first came onto the scene when they were hired by Google to design a Google Glass display. While Google Glass never quite lived up to the hype, it was enough for people to gain interest in Himax. Google has a new “Glass Enterprise Edition” patented, which will be sold exclusively to businesses. The new Google Glass will be released later in the year.

Google is also planning on releasing cardboard virtual reality headsets, that doesn’t rely on a smartphone, computer or game console, making it the first of its kind. The headsets, which will sell for a mere $20, will include computer chips and sensors supplied by Himax.

Smartphones and tablets on the rise in China

One of the main benefits Himax has is that it located in China, where smartphones and tablets are only now beginning to take off. China currently has 624.7 million smartphone users. Statistsa.com predicts that by 2018 it will have 704.1 million smartphone users. This may seem like a lot, but that number still only makes up 51% of their population. In comparison, 71% of the United States population is a smartphone user.

Projections for tablet sales in China aren’t expected to grow as much as smartphones but are still expected to increase from 370.5 million users to 435.5 million by 2018. With smartphone and tablet sales expected to grow, there will be an increase in demand for Himax’s, S&M display drivers, which will increase revenue.

(Source: Google)

Earnings and Surprises

One benefits Himax has is that it has a long history of beating EPS analysts’ forecasts. In the past four years, they have only missed the EPS forecast in one quarter. Constantly beating the EPS has caused analysts to raise their estimates by 66%. The next earning report will be released on May 12th and expectations are high as already like you can observe on the graph below.

(Source: Nasdaq)

Nasdaq.com is bullish towards Himax with five analysts labeling it as a strong buy, two labeling it as a buy, and one labeling it as a hold. In December, Himax nearly doubled Nasdq.com’s EPS forecasts by increasing .04. Nasdaq’s consensus EPS forecast for Himax is 0.1 for December 2016.

(Source: Nasdaq)

Conclusion

Don’t let the last week fool you. There is a lot to be excited about Himax, given its incredible potential over the long term. As augmented and virtual reality technology improves, sales will go up, and Himax will gain more revenue. Himax will continue to also benefit from China’s technology boom. With the stock trading at a low price and offering a very nice dividend yield of 2.75%, now would be a great time to buy the company before the stock rebounds and becomes too expensive.

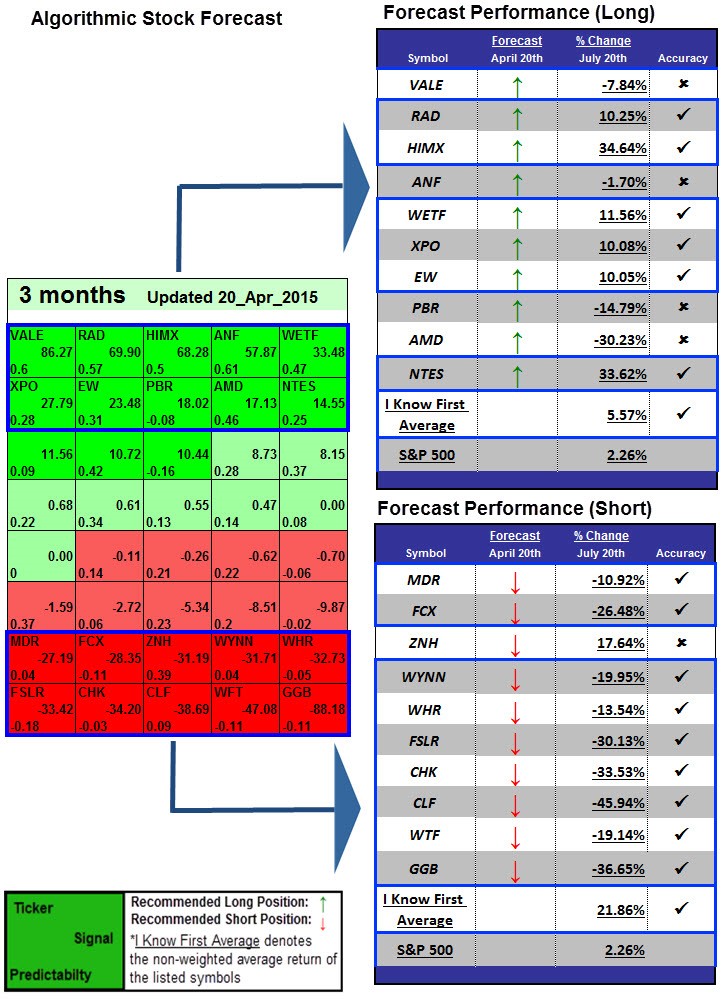

I Know First is a FinTech company that created an advanced state of the art algorithm based on artificial intelligence and machine learning to foresee market performance for more than 3,000 markets including stock forecasts, world indices, commodities, interest rates, ETFs, and currencies. In essence, the algorithm generates a with a signal and a predictability indicator. The signal is the number at the center of the box. The predictability is the figure at the bottom of the box. At the top, a particular asset is identified. This format is standardized across all forecasts the results of these predictions are shown on a daily basis on the I Know First website.

As you can see above I Know First is Bullish for Himax in the one month, three months and year forecast. The signal for the one month is 84.41 and predictability of 0.23, for the three months is 150.53 and the predictability 0.3 and for the 1-year forecast, the signal is 7.89 and predictability 0.32.

In the past, I Know First has published an article about HIMX on Seeking Alpha the past 22nd of August. The article claimed that China’s booming smartphone market would bring the stock price up as well as their strike of swoop awards. The article forecasted a bullish signal for HIMX Stock for the 3 months and 1-year time horizons which indeed rose to about 67% until March 11th, 2016.

Previously I Know First predicted Himax’s stock movement in this Forecast from the 21st of July 2015. It had a signal of 68.28 and predictability of 0.5 bringing after a 3-Months a return of 34.64%. The Algorithm correctly predicted 15 out of 20 stocks in the forecast and brought returns greater than 5.57% for the long position and 21.86% for the short position. For more forecasts on HIMX stock visit, I Know First’s Website.

Himax stock has fallen 7% in the past week

Himax stock has fallen 7% in the past week