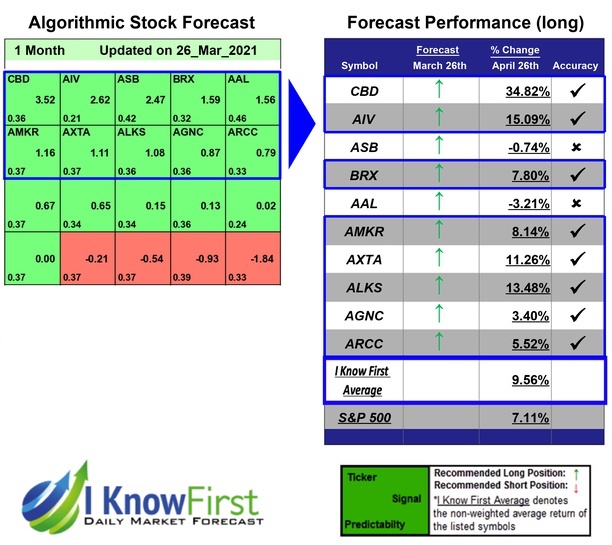

High Volume Stocks Based on a Self-learning Algorithm: Returns up to 34.82% in 1 Month

High Volume Stocks

The High Volume Low Price Stocks Package is designed for investors and analysts who need predictions for stocks currently trading between $5 and $10, and with an average daily trading volume above one million dollars. It includes 20 stocks with bullish and bearish signals and indicates the best shares to buy and sell:

- Low Price High Volume Stocks Top 10 stocks for the long position

- Low Price High Volume Stocks Top 10 stocks for the short position

Package Name: Low Price High Volume Stocks

Recommended Positions: Long

Forecast Length: 1 Month (3/26/21 – 4/26/21)

I Know First Average: 9.56%

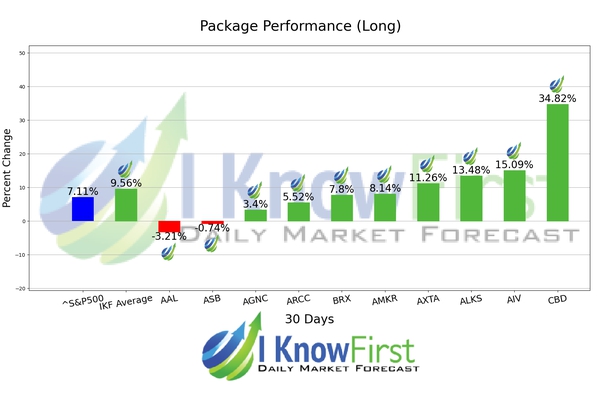

Several predictions in this 1 Month forecast saw significant returns. The algorithm had correctly predicted 8 out 10 stock movements. CBD was the highest-earning trade with a return of 34.82% in 1 Month. Further notable returns came from AIV and ALKS at 15.09% and 13.48%, respectively. The Low Price High Volume Stocks package had an overall average return of 9.56%, providing investors with a premium of 2.45% over the S&P 500’s return of 7.11%.

Companhia Brasileira de Distribuição engages in the retail of food, clothing, home appliances, electronics, and other products through its chain of hypermarkets, supermarkets, specialized stores, and department stores primarily in Brazil. The company operates through four segments: Food Retail, Cash and Carry, Home Appliances, and E-Commerce. It sells non-perishable food products, beverages, fruits, vegetables, meat, bread, cold cuts, dairy products, cleaning products, disposable products, and personal care products; non-food products, which include clothing items, baby items, shoes and accessories, household articles, books, magazines, CDs and DVDs, stationery, handcraft, toys, sports and camping gear, furniture, mattresses, pet products, and gardening products; and electronic products, such as personal computers, software, computer accessories, and sound and image systems. The company also provides medications and cosmetics at its drugstores; and non-food products at gas stations. In addition, it is involved in e-commerce operations through the Websites, including Extra.com.br, PontoFrio.com.br, CasasBahia.com.br, Barateiro.com.br, PartiuViagens.com.br, and Cdiscount.com primarily in France; wholesale activities, such as B2B; E-Hub operations; and the rental of commercial spaces. The company operates its stores primarily under the Pão de Açúcar, Barateiro, Extra Supermercado, Minuto Pão de Açúcar, Pontofrio, Extra Hiper, Extra Super, Minimercado Extra, Assaí, Ponto Frio, Casas Bahia, and Conviva names. As of December 31, 2015, it operated 1,941 stores, 83 gas stations, and 157 drugstores in 20 Brazilian states and the Federal District. Companhia Brasileira de Distribuição was founded in 1948 and is headquartered in São Paulo, Brazil.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.