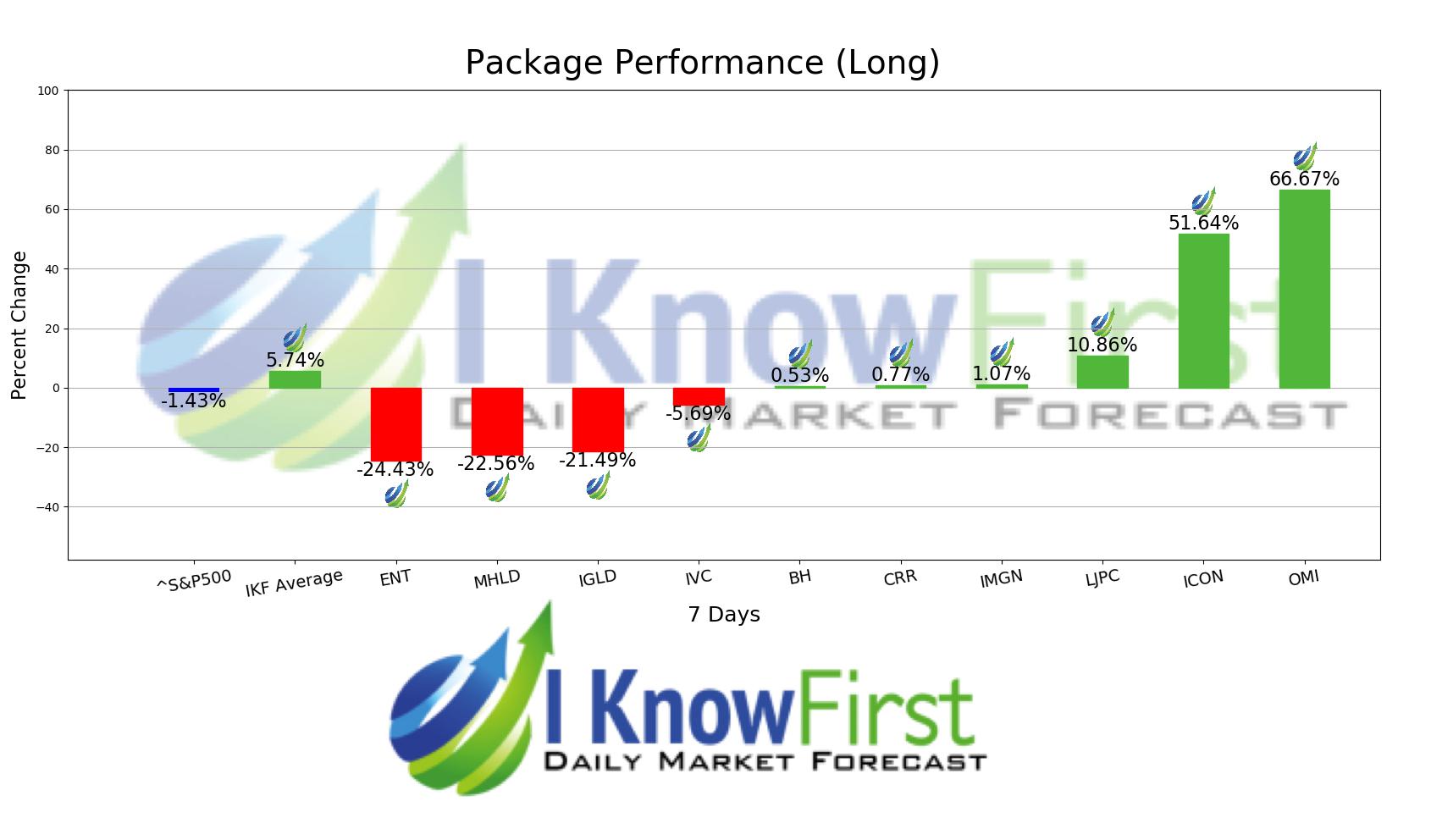

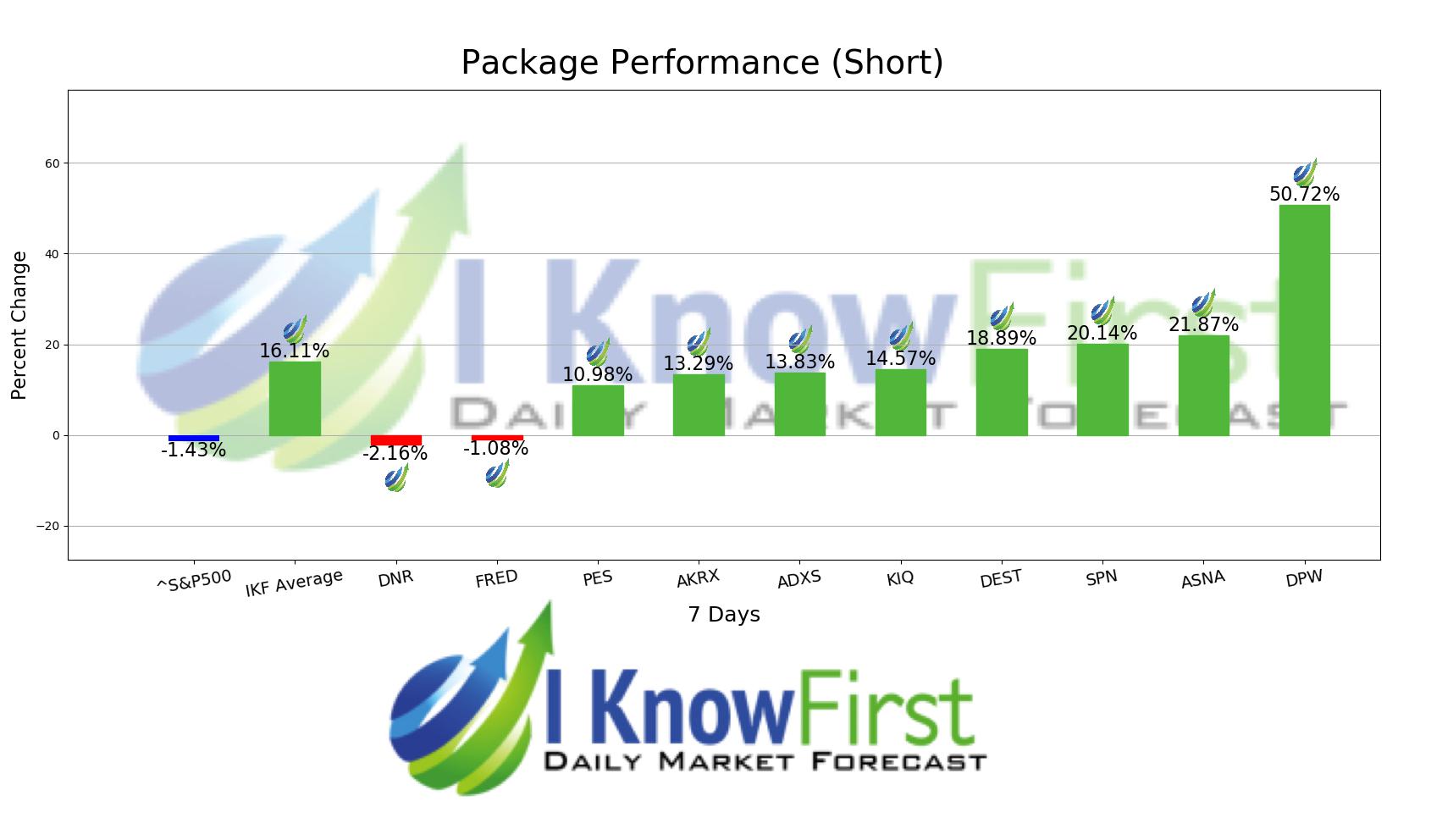

High Risk Stocks Based on Deep Learning: Returns up to 66.67% in 7 Days

High Risk Stocks

This forecast is part of the Risk-Conscious Package, as one of I Know First’s equity research solutions. We determine our aggressive stock picks by screening our algorithm daily for higher volatility stocks that present greater opportunities but are also high risk. The full Risk-Conscious Package includes a daily forecast for a total of 40 stocks divided into four main categories:

- Top 10 Aggressive stocks for the long position

- Top 10 Aggressive stocks for the short position

- Top 10 Conservative stocks for the long position

- Top 10 Conservative stocks for the short position

Package Name: Aggressive Stocks Forecast

Recommended Positions: Long & Short

Forecast Length: 7 Days (8/7/2019 – 8/14/2019)

I Know First Average: 5.74% (Long) & 16.11% (Short)

During the 7 Days forecast, the algorithm had predicted high returns for those seeking stock advice. The best performance in the short position came from DNR which registered a return of 2.16%. For the long positions the largest growth was registered by OMI with a return of 66.67%, during the same period. The package itself, had an overall average return of 5.74%, in the long position, providing a premium of 7.17% over the SP500’s return of -1.43%. With regards to the short position, the package had an overall average return of 16.11%, providing investors with a premium of 17.54% over S&P500’s return of -1.43%. The I Know First’s Stock Market Algorithm accurately forecasted 6 out of 10 stocks, for the long position, and 8 out of 10 stocks, for the short position for this 7 Days forecasted period.

Owens & Minor, Inc. (OMI), together with its subsidiaries, operates as a healthcare logistics company. It operates through two segments, Domestic and International. The company offers supply chain assistance to the providers of healthcare services; and the manufacturers of healthcare products, supplies, and devices. Its service portfolio consists of procurement, inventory management, delivery, and sourcing of products for the healthcare market. The company also provides supplier management, analytics, inventory management, outsourced resource management, clinical supply management, and business process consulting services; and warehousing and transportation solutions comprising storage, controlled-substance handling, cold-chain, emergency and export delivery, and pick and pack services; and other services, such as order-to-cash, re-labeling, customer service, and returns management services, as well as custom procedure trays. In addition, it engages in the third-party logistics and kitting businesses. The company’s portfolio of medical and surgical supplies comprises branded products purchased from manufacturers and proprietary private-label products. It serves hospitals, integrated healthcare systems, group purchasing organizations, the U.S. federal government, and biotechnology industries, as well as manufacturers of life-science and medical devices and supplies, including pharmaceuticals. The company has operations in the United States, the United Kingdom, France, Germany, and other European countries. It delivers its services through internal fleet, common carrier, or parcel services, as well as cold-chain delivery trucks. The company was founded in 1882 and is headquartered in Mechanicsville, Virginia.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

How to interpret this diagram:

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.