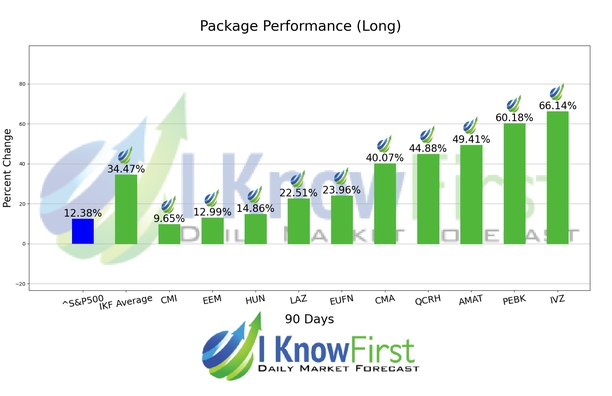

High Dividend Stocks Based on Genetic Algorithms: Returns up to 66.14% in 3 Months

High Dividend Stocks

This forecast is part of the Dividends Package, as one of I Know First’s quantitative investment solutions. We determine the best stocks carrying a dividend by screening our database daily using our advanced algorithm. The full Dividends Package includes a daily forecast for a total of 20 stocks with bullish and bearish signals:

- Top 10 Dividend stocks for the long position

- Top 10 Dividend stocks for the short position

Package Name: Dividend Stocks Forecast

Recommended Positions: Long

Forecast Length: 3 Months (9/22/20 – 12/22/20)

I Know First Average: 34.47%

For this 3 Months forecast the algorithm had successfully predicted 10 out of 10 movements. IVZ was the top performing prediction with a return of 66.14%. PEBK and AMAT followed with returns of 60.18% and 49.41% for the 3 Months period. The Dividend Stocks Forecast package had an overall average return of 34.47%, providing investors with a premium of 22.09% over the S&P 500’s return of 12.38%.

Invesco Ltd. is a publicly owned investment manager. The firm provides its services to retail clients, institutional clients, high-net worth clients, public entities, corporations, unions, non-profit organizations, endowments, foundations, pension funds, financial institutions, and sovereign wealth funds. It manages separate client-focused equity and fixed income portfolios. The firm also launches equity, fixed income, commodity, multi-asset, and balanced mutual funds for its clients. It launches equity, fixed income, multi-asset, and balanced exchange-traded funds. The firm also launches and manages private funds. It invests in the public equity and fixed income markets across the globe. The firm also invests in alternative markets, such as commodities and currencies. For the equity portion of its portfolio, it invests in growth and value stocks of large-cap, mid-cap, and small-cap companies. For the fixed income portion of its portfolio, the firm invests in convertibles, government bonds, municipal bonds, treasury securities, and cash. It also invests in short term and intermediate term bonds, investment grade and high yield bonds, taxable and tax-free bonds, senior secured loans, and structured securities such as asset-backed securities, mortgage-backed securities, and commercial mortgage-backed securities. The firm employs absolute return, global macro, and long/short strategies. It employs quantitative analysis to make its investments. The firm was formerly known as Invesco Plc (IVZ), AMVESCAP plc, Amvesco plc, Invesco PLC, Invesco MIM, and H. Lotery & Co. Ltd. Invesco Ltd. was founded in December 1935 and is based in Atlanta, Georgia with an additional office in Hamilton, Bermuda.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.