GRVY Stock Forecast: A Potential Multi-bagger with High Profitability

This GRVY Stock Forecast article was written by Yuwei Zhou – Financial Analyst at I Know First.

Highlight:

- GRVY Stock Forcast: Its revenue has raised 44.35% since 2018

- New Ragnarok IP signed with The Sandbox

- A 100%-owned subsidiary was established in Hong Kong in 2022

- Profitability performance is a multiple of the industry median

Overview

Gravity Co., Ltd. (NASDAQ: GRVY) is a globally known online game company that was founded in April of 2000, during the infancy of the Korean gaming industry. As a leader in the Industry, Gravity became the only domestic game company listed on NASDAQ directly. Gravity has developed MMORPG Ragnarok Online which has been serviced in domestic and worldwide market acquiring a wide range of players. Gravity also provides IPTV service games using Pororo characters and various genres of mobile titles. Furthermore, Gravity is continuing to grow its business reach as a global publishing business by expanding its service with Ragnarok Online IP-related games as well as other games of various genres and platforms. Gravity has developed and released the successful and well-known game Ragnarok Online throughout 56 countries, and now has over 55,000,000 users all over the world. The main geographic markets in terms of revenue are Thailand, Taiwan, Korea, and Japan. GRAVITY follows the One Source Multi Use strategy, which enables it to expand its business area from animation and character merchandising to mobile based on online games, publishing, and IPTV business, to implement a wide variety of entertainment content.

Rich Revenue Accelerates Launch of New Games to Conquer Business Territory

The revenue of GRVY has achieved three consecutive years of growth, a total of 44.35% in the three years, with an average annual growth rate of 14.8%. The main source of revenue was mobile games, but online games are developing rapidly these days. For the year 2022, Online game revenues for the second quarter of 2022 were KRW 24,827 million (US$ 19,113 thousand), representing a 15.8% increase in QoQ from KRW 21,447 million and a 10.9% increase YoY from KRW 22,380 million. This increase was mainly attributable to increased revenues from Ragnarok Online in Taiwan, the Philippines, Singapore, Malaysia, and Thailand.

Mobile game revenues were KRW 68,042 million (US$ 52,382 thousand) for the second quarter of 2022, representing a 7.6% increase in QoQ from KRW 63,241 million and a 23.4% increase YoY from KRW 55,140 million. The increase in QoQ resulted primarily increased revenues from Ragnarok Labyrinth NFT, which was launched on April 27, 2022, in Southeast Asia and Ragnarok Monster’s Arena launched on May 11, 2022, in Taiwan.

Other revenues were KRW 3,650 million (US$ 2,810 thousand) for the second quarter of 2022, representing a 6.9% decrease in QoQ from KRW 3,919 million and a 40.1% decrease YoY from KRW 6,091 million.

Ragnarok Online has celebrated its 20th anniversary in Korea in the second half of 2022 since the game was initially launched in Korea on August 1, 2002. Furthermore, the next generation, Ragnarok X, is Preparing to Launch in Korea in the fourth quarter of 2022. Gravity signed a Ragnarok IP partnership agreement with The Sandbox, a metaverse gaming platform, on April 1, 2022. GRVY will build Ragnarok LAND in the Sandbox’s Metaverse and will present various contents and NFT items based on Ragnarok IP. This business strategy will Provide users with New Experiences through Ragnarok IP. In January 2022, Gravity Game Vision Limited (“Gravity Game Vision”), a 100%-owned subsidiary, was established in Hong Kong. This subsidiary will support the launch of Ragnarok Origin in Taiwan, Hong Kong, and Macau in September. On September 22, 2022, GRVY launched Ragnarok Labyrinth NFT Official Global, which is another subsidiary in Indonesia, PT Gravity Game Link (“GGL”). Ragnarok Labyrinth NFT applies the P2E system to The Labyrinth of Ragnarok, a mobile Time Effective MMOPRG game, and the game is the first NFT title using Ragnarok IP.

High Profitability and Low-valued Price makes GRVY a potential multi-bagger

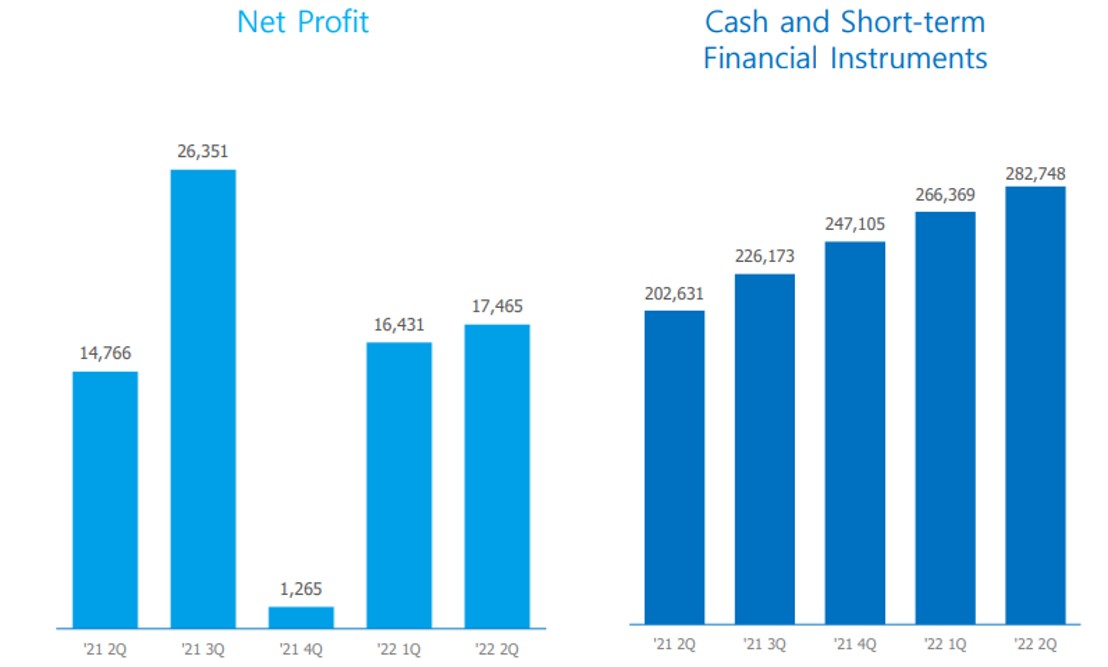

Although GRVY’s net income declined in Q4 ’21, cash and cash equivalents continued to grow steadily. The Cash-to-Debt ratio of GRVY is better than 99.83% of companies in the Interactive Media industry. This is a providence of the company’s excellent financing capacity and liquidity. These capacities are important sources of vitality, and crucial to sign new IPs and running services in potential markets. Don’t be worried about the decline in net profit in the 4th quarter of 2021, especially for long-time investors. It matched this company’s business cycle: net profit in the 4th quarter is much lower than in other quarters every year. This rule repeats again and again from the very beginning of the company’s history.

Unites: In Millions of Korean Won

According to Gurufocus, the 3-year EBITDA Growth Rate is 41,6%, ranked better than 76.20% of 395 companies in the Interactive Media industry. Meanwhile, the 3-year Book Growth Rate of GRVY is 45.2%, outperforming 83.30% of 479 companies in the same industry. The Equity-to-Asset ratio is 0.78, which is better than 72.65% of 607 comparable companies. Thus, the company’s growth potential is huge. The Piotroski F-Score of GRVY is 7 out of 9, which is a very healthy and safe institution compared to the companies with a similar market cap. The Altman Z-Score is 7.26 as of today, and the medium of GRVY’s Altman Z-Score range over the past 10 years is 3.22, so the Z-Score is strong now. Z is an important indicator to measure whether an enterprise is about to face a financial crisis, so it can be seen that GRVY’s financial situation is stable and safe. Next, let’s take DouYu International Holdings Limited (DOYU), PLAYSTUDIOS, Inc. (MYPS), Skillz Inc. (SKLZ), and DoubleDown Interactive Co., Ltd. (DDI) as comparable companies to evaluate financial competitiveness.

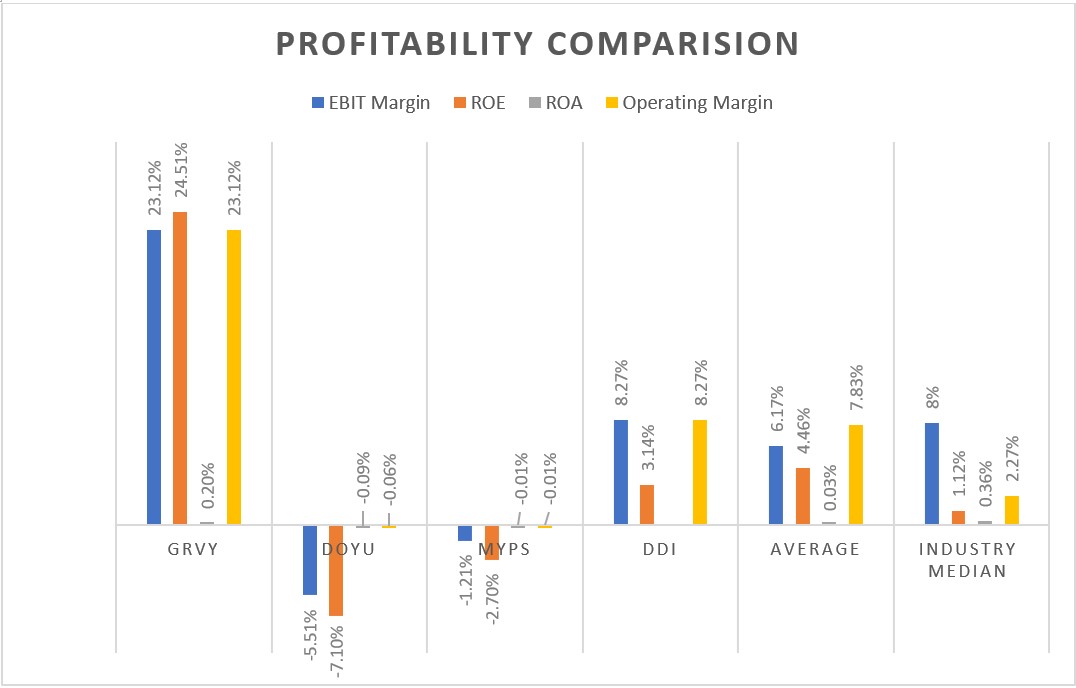

As the chart shows below, GRAY’s EBIT margin is 23.12%, which is better than 83.92% of companies in the same industry. While the industry median is 8%, GRVY’s performance is almost three times the median. The ratio of ROE is also outstanding to see, which is as high as 24.51% and far more than the vast majority of enterprises in the industry. ROA and Operating margin of GRVY are also impressive. These high competitive abilities of profitability ensure plenty of cash flow to feedback to shareholders and support R&D activities.

Let’s look at the next comparable companies: DOYU, SKLZ, MYPS, DDI, and GENTF. Currently, GRVY’s P/E and P/S ratios are lower than Average and Median values. Moreover, DOYU, SKLZ, and MYPS are not generated a positive net income. Combined with the profitable performance discussed above, this stock is still in a low-valued range. This can be tested by the institutional transactions as the following. Total institutional outflows (last 12 months) are 4.39M while inflows are 12.91M, which shows the market’s confidence in GRVY from the side of institutional investors.

Source: seekingalpha.com

(Figure: Valuation Ratios for GRVY and Its Peers)

GRVY Stock Forcast: Conclusion

I take a buy-side on GRVY stock. With the spread of 5G networks, online games will be the next generation of a method for people to maintain social contact. So that its revenue of it will increase at a high speed. The company’s early strategic layout, such as the accumulation of players, server building focused in Asia, and subsidiaries start-up, coupled with the rich cash flow guaranteed by GRVY’s strong profitability. These will push GRVY to the next level of development. At the same time, based on the above analysis, the company is still in a low valuation range, and buying now will pay off handsomely.

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the GRVY stock forecast. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

Past Success with GRVY Stock Forecast

I Know First has been bullish on the GRVY stock forecast in the past. On October 27, 2021, the I Know First algorithm issued a forecast for GRVY stock price and recommended GRVY as one of the best stocks to buy. The AI-driven GRVY stock prediction was successful on a 14 days time horizon resulting in more than 17.31%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.