GRBK Stock Forecast: Is There a Chance for Homebuilding Stocks?

This “GRBK Stock Forecast: Is there a chance for homebuilding stocks this year?” article was written by Zhou He – Financial Analyst at I Know First.

Highlights

- Green Brick Partners’ earnings per share soared from $2.44 to $4.65 last year.

- Green Brick Partners has just ventured into a new market in Austin.

- GRBK insiders are overwhelmingly buying the stock.

Overview

Green Brick Partners, Inc. (NYSE: GRBK) was founded in 2006 and is headquartered in Plano, Texas. GRBK operates a home building and land development company in the United States. It operates through the Builder operations Central, Builder operations Southeast and Land development divisions. The firm is engaged in the acquisition and development of land, titles, design, construction, title and mortgage servicing, marketing and sales of townhomes, terrace homes, single-family homes and luxury homes in residential complexes and master-planned communities. As of December 31, 2021, the company owned or controlled approximately 28,600 residential lots in the Dallas-Fort Worth, Atlanta metro area and Florida’s Treasure Coast markets. The company sells homes through sales representatives and independent realtors.

Is there still a risk to earnings growth?

Looking at the downturn in the real estate market, stock prices may stagnate in the short term. Rising interest rates have previously caused many homebuilders to fail. But GRBK’s expansion into Austin has investors believing they can grow long-term. One way to look at a company’s profit growth is to look at changes in its revenue and earnings before interest and tax (EBIT) margins. Shareholders of Green Brick Partners can take confidence in the fact that EBIT margins have risen from 13% to 17% and revenues are growing. And Green Brick Partners’ earnings per share soared from $2.44 to $4.65 last year. Both of these are great indicators to check for potential growth.

Green Brick Partners has just ventured into a new market in Austin, Texas, with sales expected in the spring. Higher average home prices in the region should lead to higher profits and revenue for the company in the coming quarters. Risks remain, however, as the housing market is underperforming, with affordability, inflation and the direction of future interest rates causing many buyers to be wary. Research shows that 92% of millennial homebuyers say inflation has affected their buying plans, but most are still pushing ahead. Some 36% of participants in the survey responded that they simply “spend more than expected.” Therefore, it is a good response in the development of new markets.

Green Brick posted record third-quarter results, with diluted EPS of $1.57, up 65.3% from last year. Total revenue was $407.9 million, up 19.2% from last year. Residential unit revenue was $396.7 million and net income attributable to Green Brick was $73.5 million. Residential construction gross margin increased 550 basis points to 32.4%, a record for any quarter. GRBK is a company whose shareholders are essentially paid through the land, as the stock does not pay a dividend and the proceeds are mostly used to acquire more land for development. This process of acquiring land, developing and selling homes for a profit and then repeating is increasingly working for companies. As a result it has been ranked as one of the fastest growing public housing builders.

Let’s see what trends the year ended September 30 reports show.

(Figure 1 – The Revenue Structure, Nine Months Ended on September 30 for 2021 – 2022)

In the eyes of most investors, inside information is an important direction of observation. Whether a company is positive can be referenced by insiders’ attitudes towards their own company’s stock. The good news is that GRBK insiders are overwhelmingly buying the stock, spending $746,000 on purchases over the past year. The largest single purchase came from Harry Brandler, the company’s independent director, who bought $499,000 of stock at about $19.97 each. The alignment of goals between the company and shareholders brings confidence and high hopes to investors.

GRBK stock is trading at a P/E ratio of 4.8. Let’s look at the next comparable companies: MHO, DFH, CCS, TPH, BZH, LEGH, HOV, etc. According to Figure 2, the DHI P/E ratio is higher than the Average and Median values across comparable companies.

(Figure2: P/E etc Ratio)

Let us look at GRBK’s performance across the Homebuilding & Construction Industry. According to GuruFocus, GRBK is one of the most profitable companies in the industry. GRBK’s ROA is the highest at 19.87 is better than 93.81% of companies in the industry. The Net Margin of 16.85% is higher than 83.64% of companies in the industry. ROE of 33.24% is better than 89.91% of companies. The Operating Margin of 20.51% is higher than 83.64% of companies in the industry. The Revenue Growth Rate is better than 93.2% of companies in the industry.

(Figure 2: GRBK vs Homebuilding & Construction Industry in TTM)

Let’s look at the company credit test and financial positions.

The Altman Z-score, which determines the result of a credit test, stays near the bored of the Grey and Safe zones. At the same time, GRBK looks interesting in terms of the Piotroski F-Score. Piotroski F-score is a number between 0 and 9 that is used to assess the soundness of a company’s financial position. A score of 7 may indicate that the company’s financial situation is a very healthy situation.

The Yahoo Finance coverage for the company is performed by 2 analysts: both take the hold position. The recommendation Rating is 3. The analysts’ community puts the average target price for the stock at $25.63 while it is traded at $30.23.

Conclusion

All that said, anyone interested in GRBK can put this stock on their watch list. It appears to be trading around industry price multiples at the moment, but EPS has been soaring with high growth rates. Company insiders have been buying more shares, suggesting confidence. Under the influence of the current macro-environment, GRBK is able to better cope with the changing market, which deserves our attention.

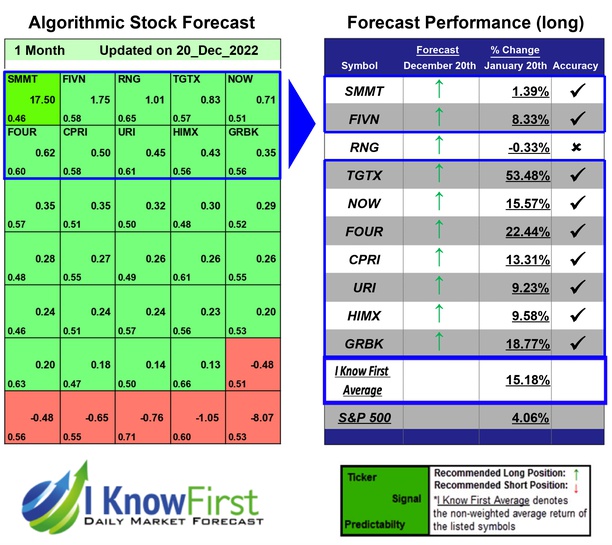

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

Past Success with GRBK Stock Forecast

I Know First has been bullish on the GRBK stock forecast in the past. On December 20th, 2022 the I Know First algorithm issued a forecast for GRBK stock price and recommended GRBK as one of the best stocks to buy. The AI-driven GRBK stock prediction was successful on a 3-month time horizon resulting in more than 18.77%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.