Google Stock Predictions: Google Will Continue M&A, Just Under A New Name

Google Stock Predictions

Summary

- Alphabet is a gateway drug to more acquisitions in the upcoming years.

- Short summary of the sort of companies Google has acquired this year, and will likely continue to go after in the near future.

- Algorithmic analysis indicates GOOG as a no go in the short term, but attractive long term.

The transition from acquisitions through Google to Alphabet

Despite focus on reduced spending, Google (NASDAQ: GOOG) still went ahead with some daring acquisitions this year. These include: Pixate, Timeful, Tilt Brush, Thrive Audio, Red Hot labs, Softcard, Odysee, and Launchpad Toys. Alphabet – Google’s new holding company – is now going to be the main acquisition vehicle, at least for major companies. The company has historically killed off all unsuccessful non-core products, which makes an acquisition under its existing umbrella much cleaner. Companies which merge directly into the core products such as Timeful integration into Google calendar will be swallowed up as they always were. However, while the technologies from products such as Tilt Brush might be integrated into the Google universe, they are certainly not core. Basically the company wants to flatten out the image below, with the entire “expand” and “experiment” layers to be split up horizontally under Alphabet.

Below some of the most recent acquisitions are listed. Well some have a clear way of generating revenue, other don’t. Google is in the habit of acquiring “cool” technologies and taking a leap of faith. This poses a serious debt service and financial engineering issue. One side is the assets, which is the huge steady revenue Google generated under its search engine advertisement operations. It has much stronger negotiation power with banks to attain near 0 interest rate loans without hundreds of risky acquisitions and venture projects. Believe it or not banks are not entrepreneurs, and solving aging or creating self-driving cars which is nothing less than an invitation for lawsuits, is not their cup of tea. Which brings us to the liabilities side with huge anti-trust lawsuits looming In Google might want to be just a search engine. Once Google is seen as a search engine and internet services company (and not an acquisition and innovation tech company) it will be left to do what it does best, be a cash cow. Meanwhile alphabet will be what we consider Google today, and deal with the matters liabilities and financial management across various separate entities the company holding manages. The most recent acquisitions should really be indicative of where Alphabet is going, and what Google is leaving behind, here is a brief overview of them.

Pixate

On July 21, 2015, Google acquired Pixate, a prototyping and design business now integrated into Google’s material design extension. Pixate allows even novice users to design app prototypes. Although Google previously acquired a more advanced app development company, RelativeWave, in November of 2014, Pixate operates a bit differently. Pixate’s user friendly interface makes it easier to transition an idea into an app prototype for those who are not technologically inclined. Creators can build the app on a computer by simply uploading photos, and dragging and dropping, and choosing transitions and other technical options from menus. To collaborate with other team members, the user uploads the prototype to a cloud and others can then experience how the app will look and operate.

Timeful

Acquired in May of 2015, Google will roll the functionality of Timeful into their current Google Inbox and Calendar apps. While the current synchronization between gmail and google calendars allows your calendar to pick up appointments, flights, and various other events from e-mails, the addition of Timeful’s technology will enhance these features. Timeful’s unique design allows the user to differentiate want to do’s from need to do’s on the user’s personal agenda while incorporating deadlines and goals. This will make google calendar an integral organizational app for even the most disorganized procrastinator.

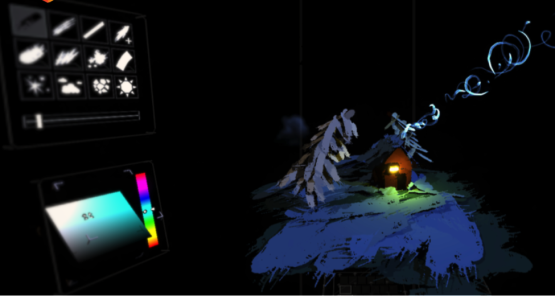

Tilt Brush

In April of 2015 Google acquired Skillman & Hackett as a means to get their popular art app, Tilt Brush. As the most recent addition to Google’s foray into the virtual reality world, Tilt Brush allows the user to create 3 dimensional drawings. With the option to export your artwork as a GIF, other users can watch the creation of previously created drawings come to life. Not only does Tilt Brush allow for 3D viewing by using Google Cardboard, it allows the artist to paint with more than just colors. Adding the option to draw with light and smoke in this 3 dimensional app makes the experience even more appealing.

April’s acquisition of Skillman & Hackett also added Thrive Audio to Google’s virtual reality portfolio. This sound app came from the engineering school at Trinity College in Dublin. Also for use with Google Cardboard, this positional sound app gives the listener realistic surround sound. These designers have managed to create audio that reacts in real time to the user’s movements. The ability to track head movements allows the listener to feel more immersed in the virtual reality they occupy.

Toro

In February, Google acquired Toro (formerly Red Hot Labs), a company that helps developers manage advertisements on Facebook. Now that Toro belongs to Google, they will continue to maintain current campaigns with Facebook, but will not create new campaigns for the Google competitor. The Toro service will help app developers optimize Google’s wireless advertising efforts. This mutually beneficial relationship gives more resources to each company while taking away from rival Facebook’s major revenue generator: advertising. As more people spend more time on more mobile devices, the ability to create, provide, and manage the best promotional and marketing campaigns will help Google reach out to even more consumers.

Softcard

February also saw the acquisition of Softcard to advance Google’s position in the mobile payment field, a field in which Apple currently dominates. Although the struggle of both Softcard and Google to enter the mobile payment market allowed Apple Pay to make a strong debut, Google Wallet has come a long way and can now rival Apple pay. The acquisition also comes with an agreement that Google Wallet will come preloaded on phones from 3 of the 4 major carriers. In the recent discussions of “bloatware” taking up too much space on phones, this may seem like poor planning, but it will help the app reach more consumers. The Near Field Communication (NFC) technology needed for mobile payments has yet to become a mainstream part of the market, but these companies are preparing for when it does.

Odysee

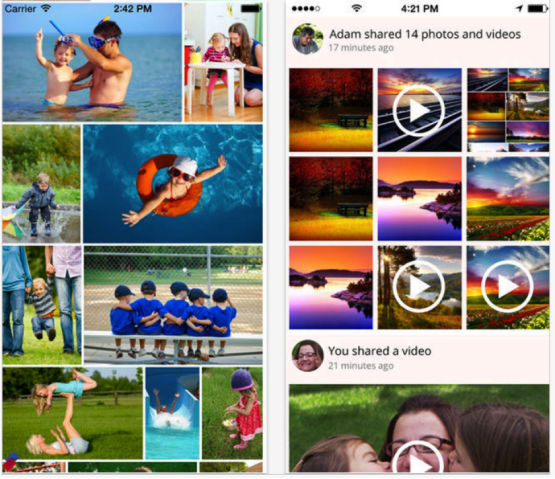

In an effort to differentiate its Photo sharing service, Google acquired Odysee in February of 2015. As Google Photos becomes independent of Google+, the application of Odysee’s technology will allow Google to offer additional features to give the user more control over photos and the way they share them, as well as the ability to store photos offline. Therefore, even though most services automatically back up photos and videos so users do not need to worry about losing them in the event of lost or stolen mobile devices, users can back them up to home computers so as to save costly cloud storage space.

Launchpad Toys

Google’s first acquisition of the year, Launchpad Toys, will attract young children to YouTube for Kids. The much acclaimed app gives children the ability to create stories, drawings, and even videos featuring themselves in a background they augmented. Children, parents, and teachers alike all enjoy the way in which this app has heralded the 21st century of storytelling. More than just staring blankly at a screen, this interactive app engages children and expands their creativity and imagination. This purchase came shortly after YouTube’s purchase of Videmaker in December of 2014 which allows collaboration via the cloud so a geographically distant company can edit and share a video in real time.

Algorithmic Analysis

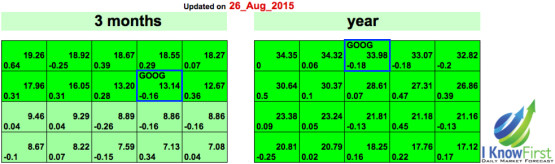

I Know First supplies financial services, mainly through stock forecasts via their predictivealgorithm. The algorithm incorporates a 15-year database, and utilizes it to predict the flow of money across 2000 markets. The algorithm has more data to forecast within the long term and, naturally, outputs a more accurate predication in that time frame. Having said that, intraday traders, along with short-term players, will also benefit by taking the algorithmic perspective into consideration.

The I Know First algorithm was able to correctly predict the behavior of Google’s stock around the time of the earnings report. Figure 2 is an I Know First algorithm prediction made on January 8th, 2015. The self-learning algorithm uses artificial inelegance, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets.

The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

Having explained how I Know First’s algorithm works, it is worthwhile to see if the algorithm agrees with the bullish fundamental analysis of the company. This forecast includes the three-month and one-year forecasts for Google from August 26th, 2015. In both forecasts, Google has a strong positive signal, indicating the algorithm is bullish for the stock.

Conclusion

One thing is certain, Alphabet is not there to contract this series of acquisitions, rather to expand. The former Google is not free to go shopping for any company it wants within its portfolio, not for revenue but rather intellectual property and talent. Before there were considerations such as core-function integration, company image, balance sheet requirements, and very importantly Sovereignty. Convincing a great CEO to join the Google umbrella and hope his company survives this merger is difficult. Now he can join the Alphabet group and stay as CEO under holding, allowing for little corporate structure re-adjustments.

After the S&P500 and NASDAQ have seen massive drops in the last couple trading days the market seems like a hostile place to be right now. Furthermore, our algorithmic money flow analysis at I Know First, which we base on advanced self-learning algorithms and our artificial neural networks picks up weak, yet still bearish signals in the next couple weeks. With that said the long term forecast is rather bullish, and as a long term value play GOOG makes an attractive value investment. In essence nothing but psychological perception has changed in the company, but this is usually all that is needed to make a good investment bad, and a bad investment good.