Google Stock Forecast: Is It a Place for Growth in the Inflation Time?

This Google Stock Forecast article was written by He Xu – Financial Analyst at I Know First

Summary

- GOOGL stock has gained 79.86% in 2021

- Google shows good profitability ability across the Interactive Media Industry with Net Margin and ROE of 29.51% and 32.05%, respectively.

- The Piotroski F-Score and Altmaz Z-Score provide a positive outlook for Google’s stocks.

Overview

Alphabet Inc. as a leader in the communication service industry was founded in 1998 and covers all avenues of modern life by providing various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America. It operates through Google Services, Google Cloud, and Other Bets segments. Shares of the Company’s common stock are listed on the Nasdaq Global Select Market under the symbol “GOOGL”. The company’s revenue increased by 41% to $257.64B and the net income increased by 89% to $76.03B for the fiscal year ended on December 31st, 2021. Currently, Google does not pay any dividends, which means that it wishes to continue its expansion into new ventures and has great development potential.

Is Huge Growth of Revenue During the Pandemic Sustainable?

Online activities were boosted during the pandemic. From school lessons and office work to physical exercise – more aspects of people’s daily social and professional lives are moving online. As a giant in the Internet industry, Google’s huge growth in revenue is inevitably related to the outbreak. To research details for a boost of GOOGL stock in 2021, I did Google’s revenue analysis. Google’s revenue sources are composed of Google (post-Alphabet), Google Cloud, and Other bets. Google (post-Alphabet) includes Advertising business (google Search & Other, Google Network Members’ Properties, YouTube Ads & Google Properties) and Google other business.

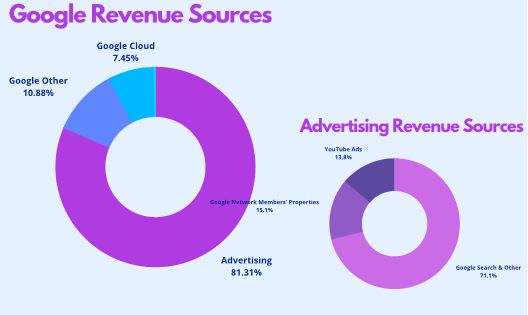

The pie charts show that 81.3% of Google’s revenue comes from its advertising business, among which Google Search & Other accounts for 71.1%, Google Network Members’ Properties accounts for 15.1%, and YouTube Ads accounts for 13.8%.

Total revenue of Google increased by 41.15% in 2021, mainly caused by the growth of its advertising business including Google Search (the growth rate of 43.14%), Other and Google Network Members’ Properties (the growth rate of 37.29%), and YouTube Ads (45.89%). Google Cloud has maintained high-speed growth (an average of 47.55%). More and more companies used Cloud to store data during the pandemic. Although Google Cloud Platform adoption still lags far behind Microsoft Azure and Amazon Web Services, Google is interweaving its advertising and cloud offerings to make them stronger together. In summary, the growth was driven by “broad-based strength in advertiser spend and strong consumer online activity in 2021. Businesses are spending money with Google to target consumers who are spending more time online.

In a conference call with analysts, Ruth Porat, Alphabet’s chief financial officer, said the company benefited during the quarter from “elevated online activity” but warned that the trend may not continue once lockdown restrictions are lifted and economies recover. Therefore, Google will earn more profits as long as people spend more time online although the whole society is facing high inflation, continued pandemic, and effects of the war. Moreover, the company has acquired firms Looker and Mandiant to strengthen Google Cloud’s data analytics and cybersecurity respectively.

I expect that the growth rates for Advertising and Cloud would still maintain at this high level or even better in 2022 if the pandemic continues. Of course, inflation takes the dominant position in the investment field now. To combat inflation the FED is increasing the interest rates that can hurt growing tech stocks by reducing the long-term estimates for a company’s earnings and free cash flow. (We discuss in detail the effect of an interest rate on the free cash flow of growth and value stocks in this article). The stock market is the market of expectations, and while the FED has started to increase the interest rate since March 2022, there had been expectations of increasing interest rates to combat inflation for a while before. We can see that Google’s stock has already decreased by 13% in 2022 to capture the effect of increasing interest rates. According to Macrotrends, GOOGL’s P/E ratio is 22.58 that less than the mean and median of 27.78 and 26.34, respectively. Moreover, the P/E ratio before the pandemic was 27.23 in December 2019.

Google Stock Forecast: Estimate Google’s Performance

Google has gained huge revenue during 2021, therefore we analyzed the ability of Google’s profitability by comparing it with the industry. Operating Margin of 30.55%, Net Margin of 29.51%, ROE of 32.05%, and ROA of 22.51% are better than over 80% of companies in the Interactive Media industry. Therefore, Google shows good profitability ability.

GOOGL looks intriguingly in terms of Piotroski F-Score and Altman Z-Score. Piotroski F-score is a number between 0 and 9 that is used to assess the soundness of a company’s financial position. A score of 8 may indicate that the company’s stock is undervalued and can be interpreted by investors as a good signal to buy the stock. The Altman Z-score is the result of a credit test that measures the likelihood of a publicly owned manufacturing company going bankrupt. It is also at a safe level for GOOGL.

In the chart, we can see that there is a flat price dynamic since January 2022. Three moving averages (the green line is MA-50 days; the yellow line is MA-100 days, and the red line is MA-200 days) are above the stock price. Meanwhile, the MA50 line goes from the top down to the MA100 line, which also shows a sell signal. However, the price continues to attack the lower Bollinger Bands and support level, this may indicate an upward shortly. If the price continues to go down and breaks the support level, this may indicate a formation of a bearish trend.

However, from a long-term perspective, Tipranks makes a strong buy recommendation over the next year. As Tipranks estimates, Google’s stock price will be between $3000 and $3900 with an average of $3487.41, which shows an upward sloping.

The Yahoo Finance coverage for the company is performed by 43 analysts, and 5 of them take a hold position while 13 and 25 analysts take Strong Buy and Buy positions on the stock respectively. The analysts’ community puts the average target price for the stock at $3446.70 while it is traded at $2534.60

We can see that GOOGL has beaten the previous EPS expectations 4 times in a row. GOOGL is going to provide the 1Q2022 financial statement to the public on April 26th, let’s expect that GOOGL will continue to beat EPS expectations.

Conclusion

GOOGL is a buy stock with good profitability. The company has formed a good revenue base during the pandemic that will allow the company to continue its growth despite the inflation threat and the increasing interest rates. GOOGL is going to publish the 1Q2022 financial statement on April 26th, 2022, previously, Google has beaten the EPS expectations for the past four quarters. Also, GOOGL looks promising in the context of its Piotroski F-Score with a rate of 8.

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the Google stock forecast. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

Past Success With Google Stock Forecast

I Know First has been bullish on the Google stock forecast in the past. On March 16th, 2022 the I Know First algorithm issued a forecast for GOOGL stock price and recommended Google as one of the best Mega Cap stocks to buy. The AI-driven GOOGL stock prediction was successful on a 14-day time horizon resulting in more than 9.86%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.