Gilead Sciences Stock Outlook: An Algorithmic Analysis (GILD)

Gilead Sciences Stock Outlook

I Know First supplies financial services, mainly through stock forecasts via their predictive algorithm. The algorithm incorporates a 15-year database, and utilizes it to predict the flow of money across 2000 markets. The self-learning algorithm uses artificial intelligence, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets.

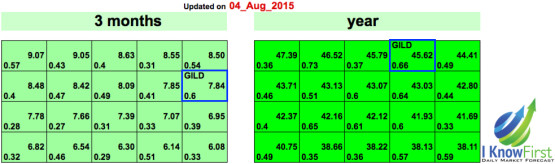

The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

I Know First published a bullish article on Gilead Sciences, a biotech firm that specializes in the Hepatitis C and HIV markets. Having explained how I Know First’s algorithm works, it is worthwhile to see if the algorithm agrees with the bullish fundamental analysis of the company. The three-month and one-year forecasts for Gilead Sciences are included.

Gilead Sciences is among the top stock picks for both time horizons. The stock has a strong, bullish signal for both, especially during the one-year time horizon. Over the predicted time horizons, the stock price will resume its surge from last year, as concerns over the company’s HCV drugs profitability are addressed. The company has a strong balance sheet and an experienced executive team that knows how to create value, making this stock a strong pick for long-term investors.

Positive signal strength does not mean investors should automatically buy the stock. Dr. Roitman, who created the algorithm, created rules for entry for a stock such as Gilead Sciences. Using this trading strategy, an investor should buy a stock if the last 5 signal strength’s average is positive and if the last closing price is above the 5-day moving average price. When both of these conditions are met, it is a good time to initiate a position in the stock.