Equity Valuation based on Data Mining: Yielding up to 57.84%

Equity Valuation

This equity valuation forecast is part of the “Risk-Conscious” package, as one of I Know First’s equity research solutions. We determine our aggressive stocks and conservative stock picks by screening our stock market algorithm daily for higher volatility stocks that present more opportunities but are also riskier. The full Risk-Conscious Package includes a daily forecast for a total of 40 stocks with four main categories:

- top ten aggressive stocks pick that best fit for long position

- top ten aggressive stocks pick that best fit for short position

- top ten conservative stocks pick that best fit for long position

- top ten conservative stocks pick that best fit for short position

Package Name: Risk-Conscious

Package Name: Risk-Conscious

Recommended Positions: Long

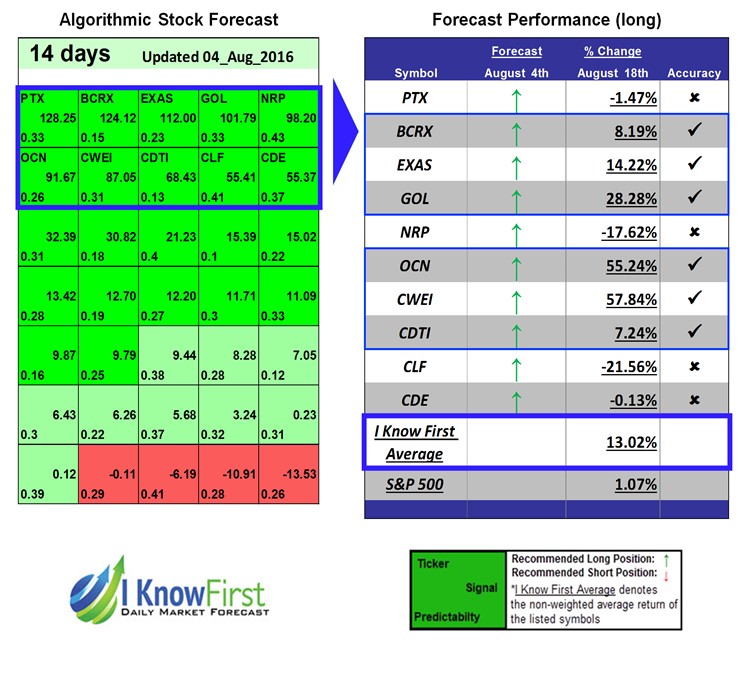

Forecast Length: 14 Days (08/04/16 – 08/18/16)

I Know First Average: 13.02%

In this forecast 6 out of 10 top stocks increased as the algorithm predicted. Clayton Williams Energy, Inc. (CWEI) returned 57.84%, making it the highest returning stock of this package. Other significant returns came from Ocwen Financial Corporation (OCN) and Gol Linhas Aereas Inteligentes SA (GOL) with 55.24% and 28.28%. The average return for this package was 13.02% as opposed to the S&P 500’s growth of 1.07% in the same time span.

Clayton Williams Energy, Inc. (CWEI) and its subsidiaries explore for and produce oil and natural gas. The Company’s activities are primarily located in Texas, Louisiana, and other southern states.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First algorithmic traders.

How to interpret this diagram

Please, note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.