Follow Up On The Stock Market Forecast For 2016 Based On A Predictive Algorithm

Pablo Akawie is a Financial Analyst Intern at I Know First.

Pablo Akawie is a Financial Analyst Intern at I Know First.

Follow Up On The Stock Market Forecast For 2016 Based On A Predictive Algorithm

Summary

- The Market In 2015

- Commodities and Gold Positioning In The Market

- US Economy and Global Influence

- The 2016 Predictions of The Global Financial Markets

2015 In A Nutshell

2015 may have been a turning point for markets. In November 2008, the Federal Reserve started with the first Quantitative Easing (QE), a monetary policy used to stimulate the economy, which was in severe crisis. The Central Bank was increasing the money supply, buying financial assets from commercial banks and other financial institutions, thus raising the prices of those assets and lowering their yield.

There were three periods of QE. During the first QE, the Fed injected 600 billion dollars into the US economy, 35 billion per month for 17 months. Two years later, the Fed injected 600 billion dollars more in 7 months with the second QE, 85 billion per month. And finally, in September 2012 the FED started with the third QE, injecting around 85 billion dollars per month until October 2014, which marked the end of QE3. The total amount added by the Fed to its balance sheet was more than 3.5 trillion dollars in 7 years.

From the lowest level (666 points) in March 2009 to the highest level in May 2015 (2134 points), the S&P 500 index increased 220% offering a good deal for investors. Those were very quiet years for investors because they were supported by the Federal Reserve’s purchases, which kept the prices of most assets around the world to constantly go up during the 7 years.

Now, it´s over. In December 2015, the Fed raised the interest rate for the first time since 2008 to a range of 0.25%-0.50% and is expected to raise it again this year. Historically, an increase in interest rates is bad for stock markets, and 2015 was a year when investors bet that it could happen. As markets try to anticipate policies, some assets showed strong movements during 2015, primarily currencies and commodities.

Strong dollar and weak commodities, key to understand 2015

In early 2015 we saw the US dollar strongly strengthen against other currencies due to the desire of international investors to take advantage of the interest rate hike. During first 15 days of January, the US dollar increased about 15%. A strong dollar is painful for commodities, so the price of most commodities went down during last year, this was most heavily seen in the prices of Oil. Therefore, a lot of companies that deal with commodities are in big trouble which is affecting all of the world’s markets.

Another important explanation of the weakness of commodities is China. China, the second-largest economy, is still showing economic data that is cause for concern. Its economy is slowing down faster than market expectations. To counter this situation, the government depreciates their currency and decreases interest rates. It is important to mention this because China is the biggest importer of commodities.

(Source: Yahoo Finance)

As you can see in the graph above, the first half of 2015 was incredible for China’s stock market, which gained more than 51%. In June, however, the bubble burst, which immediately affected all the stock markets negatively. China’s government had to interfere and offer liquidity to the market. Many analysts awarded the strong fall to the huge entry of inexperienced investors who had seen China’s big gains and wanted to join.

In addition, investors started to doubt the credibility of Chinese economic data. In August, Purchasing Manager´s Index (PMI) showed a contraction for the first time since 2012 and the services sector showed a strong deceleration in growth. These numbers combined with a fragile stock market could indicate a collapse in the economy.

During 2015, China’s economy grew 6.9%, a 25-year low. Some investors think that this number is fake and that the real is growth is only 4%. Analysts such as Jahangir Aziz, head of emerging Asia economic research at JPMorgan, said: “This is good. We’ve known for the last three years that the Chinese authorities are slowing down the economy. This economy is going to slow down”.

To understand why the oil, the most volatile commodity, is such a problem, it is important to discuss supply. As Cliff Krauss, National Business Correspondent at NY Times explained, US domestic production has nearly doubled over the last several years. Asian oil producers can’t sell their product to the USA and they are now suddenly competing for Asian markets, which leads to a drop in prices. Furthermore, other oil producing countries are also increasing their oil production, further increasing the oil supply.

(Source: finviz.com)

US economy situation

During January 2016, the Federal Reserve showed its Beige Book with “modest growth”. Reports from the twelve Federal Reserve Districts indicated that economic activity has expanded modestly in nine of the districts between the end of November 2015 and beginning January 2016. The growth of consumer spending ranged from slight to moderate in most districts (remember that consumption represents about 69% of US GDP). Auto sales were somewhat mixed, as activity has begun to drop off from the previously high levels in some Districts. Reports of tourism activity were also mixed.

Labor markets continued to improve with employment increases, but wage pressures remained relatively subdued. The US economy added 292,000 job in December 2015 more than expected by Reuters economists. The unemployment rate remained steady at 5%, a seven-and-a-half-year low, according to the US department of Labor. The US economy added 2.65 million jobs in 2015.

Concerns over the US came from inflation indices showing a little overall change in wages and prices, both have only increased minimally. Inflation and the labor market are the most important variables that Fed observes when deciding to increase the interest rate. The data could indicate that the fed will not increase the interest rate at next meeting in the end of January. As we mentioned, lower interest rates are good for stock markets, however, in the long run, they can lead to inflation.

Most manufacturing sectors show weakened activity, as the number of districts that show increases in manufacturing are declining. The data indicates that Low oil prices don’t really help the manufacturing sector and international demand is weakened by the strong dollar.

(Source: Bloomberg.com)

Stock market outlook 2016

According to Charles Schwab, an American brokerage, the US and global stocks will continue to experience bouts of volatility and pullbacks; but a major bearish market is likely to be avoided. Key determinants of the path that stocks will take include the policies of central banks, inflation, currency volatility and earnings/valuation.

David Kostin, Chief of US equity strategy at Goldman Sachs, holds a pessimistic view and maintains his 2016 year-end S&P 500 target of 2,100. The investment bank revealed one of the bleakest predictions for oil prices, establishing its target price to be $20 for 2016.

Dubravko Lakos-Brujas, Head of US Equity Strategy at JP Morgan, admits that while energy may be the highest risk-reward sector, he also sees it as a relative outperformer towards the end of 2016. The investment bank expects the S&P 500 climb up to 2,200 at the end of 2016.

Follow Up On 2016’s I Know First Algorithmic Predictions

I Know First utilizes an advanced algorithm based on artificial intelligence and machine learning to predict market performance for over 3,000 markets including stock forecasts, world indices, commodities, interest rates, ETFs, and currencies. The system follows the flow of money from one market into another.

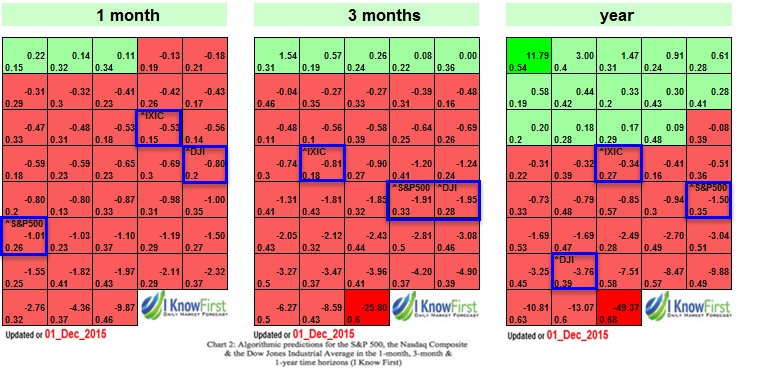

I Know First published an article predicting the 2016 bearish market movement on December 1st, 2015. The recent downtrend of the US Stock Exchange is a reflection of this bearish stock market forecast below, which started to fulfill its prediction in just a month and a few days after the article was published. Since this article the S&P500 fell by -10.63%, NASDAQ fell by -12.47% and Dow Jones fell by -11.02% as the algorithm correctly predicted.

A Closer Look

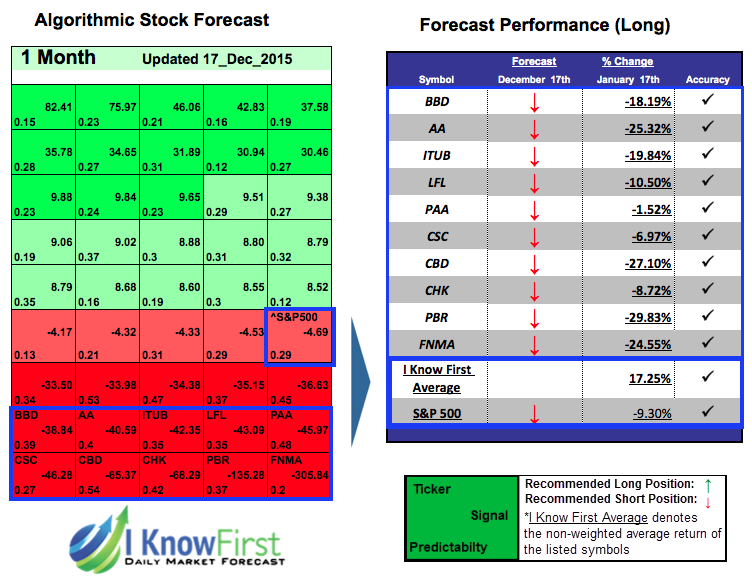

The algorithm predicted also predicted a bearish market for various indices as we can see under. The accuracy of the algorithm was 18 out of 20 bearish signals were predicted correctly. Bringing returns of up to 11.81% in a month.

We can also see stock forecasts from different time frames (14 Days, 1 Month and 3 months) which all were predicted to have bearish signals for the market direction. The S&P500 in all the three cases was predicted accurately by the algorithm, in addition, the top stocks that brought the best returns were the short positions of Freeport-McMoRan Inc (FCX) with 66.54%, Chesapeake Energy Corporation (CHK) with 57.37%, Petróleo Brasileiro S.A. – Petrobras (PBR) with 29.83%, Companhia Brasileira de Distribuicao (CBD) with 27.10%, Alcoa Inc. (AA) with25.32% and 29.62%. The I Know First Averages are all above the S&P500 of-7.09%, -9.30% and –9.05% with magnificent returns of 28.28%, 17.25% and17.42% in the predicted time horizons.

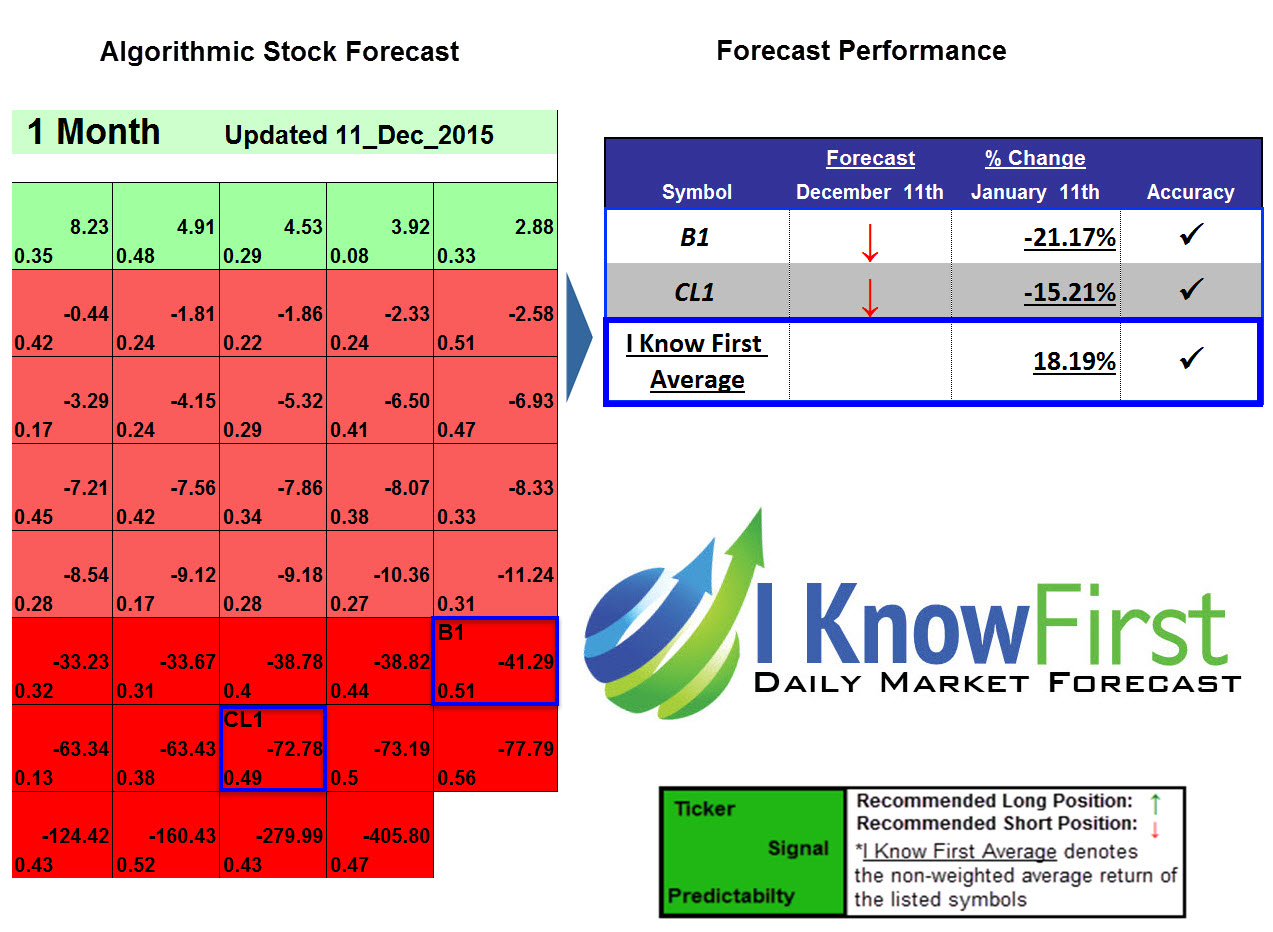

For Example previously I Know First predicted correctly the bearish forecast of the oil in the 1 month Crude Oil Forecast we observe CL1 with a bearish signal of -72.78 and a predictability of 0.49 it managed to bring returns of 15.21% as well as B1 with a signal of -41.29 and predictability of 0.51 managed to bring returns of 21.17% in just one month.

Conclusion

Due to the slowdown in China´s economy, geopolitical concerns, increases in the US interest rates and declining commodities prices, the US stock market started 2016 with the worst performance since 2008. As you can see, I Know First predicted this situation in The Stock Market Forecast For 2016 Based On A Predictive Algorithm and recommended to short indices as well as in other forecasts for commodities, stocks, But not everything is so bad, I Know First recommended also to go long for certain investments like in this forecast.

An explanation on how to read the forecast is further elaborated here.