DXC Stock Forecast: COVID-19 Affects the IT Sector

This DXC stock forecast article was written by Maria Grishaev, Analyst at I Know First.

This DXC stock forecast article was written by Maria Grishaev, Analyst at I Know First.

Executive Summary

- The DXC Technology stock lost 35.41% YTD, while the S&P500 index rose by 14%

- With relatively new management and recent big contract renewals, the company’s future is looking brighter

- Based on the Multiples Valuation model, my price target for DXC is $41, indicating a cautious buy recommendation.

Overview

DXC Technology (NYSE: DXC) is an American multinational corporation that provides B2B IT services and helps global companies run their mission-critical systems and operations while modernizing IT, optimizing data architectures, and ensuring security and scalability across public, private, and hybrid clouds.

The rapid decline in the stock price happened in February after the company reported sales and earnings declines in the 2020 third fiscal quarter. The sharp market declines that followed in March due to the uncertainty over the emerging pandemic didn’t help the stock price either.

Over the last year, the company’s new CEO announced a transformation journey to the “new DXC,” which is focused on its customers and its people. This included several new leadership appointments, including a new CFO and several executive vice presidents.

The company’s new strategy focuses on the Enterprise Technology Stack. To achieve it, DXC had sold in recent months several of its software business. The Healthcare Provider Software Business was sold for $525 Million in cash in July. In October the U.S. State and Local Health and Human Services business was sold for $5 billion. The company intends to strengthen its balance sheet and reduce debt.

Possible Growth Opportunities Ahead

The global COVID-19 pandemic has caused an acceleration of remote working and continued demand for cloud infrastructure services. This provides a big growth opportunity for the company as it attempts to gain new clients.

The company announced in recent weeks several major contract signs and renewals. The most recent one was announced this week – a 5-year renewal of its IT outsourcing contract with SEG Automotive Germany GmbH, a leading global supplier of hybrid e-machines, starter motors, and generators. Earlier this month, DCX announced an expanded strategic collaboration with Microsoft to deliver a solution and suite of services that will help companies to empower their employees with a modern workplace experience and to ensure customers’ employees can seamlessly and securely work anytime, anywhere, and on any device. Other renewals include Infinia ML, Topsail Re, Sabre, Western & Southern Financial Group, and EduCampus Services.

Indicators Show a BUY Signal

As we can see in the chart, the stock price crossed above the moving average for 200 days (the purple line) at the beginning of November. We can also see that the moving average for 50 days (the red line) crosses above the moving average for 200 days. It also indicates a trend shift up and is known as the “golden cross” that gives us a buy signal. These are signals for a potential change in trend that came true in this case as the stock rose from there.

Also, The Bollinger Bands®’ squeeze indicated a potential opportunity. A squeeze signals a period of low volatility and is considered by traders to be a potential sign of future increased volatility and possible trading opportunities. This can be seen happening here from July to September.

Multiples Valuation Analysis Results in Higher Target Price

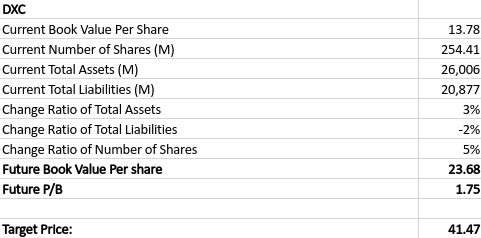

I estimated my own target stock price by using the Multiples Valuation model. I looked for DXC’s peer companies’ P/B quarterly growth ratios and calculated its average over the past five quarters. I got that the P/B average growth ratio is 6.5% per quarter.

Next, I checked in the latest financial report the total assets and liabilities of the company. I made a few assumptions about the future of the company based on what I wrote above. I assumed that the total assets will grow at a rate of 3%, while the liabilities will go down by 2% in the next year. These are reasonable numbers, given the already discussed business plan. I also assumed that the number of shares will rise by 5%. That in total brings us to a future book value per share of 23.68.

The current P/B of the company is 1.38. The expected future P/B is calculated by multiplying of the current P/B with 1 plus the P/B growth rate powered by 4 (as we forecast the price for the one year period). I got that the future P/B is 1.75.

In total, I received a target price of $41, which is 77% higher than the company’s current stock price and is similar to the stock price range back in 2019.

Conclusion

I take the buy-side on DXC stock. It is reasonable to expect further growth in the stock price in the long term as the company completes its transformation journey and improves its performance and balance sheet.

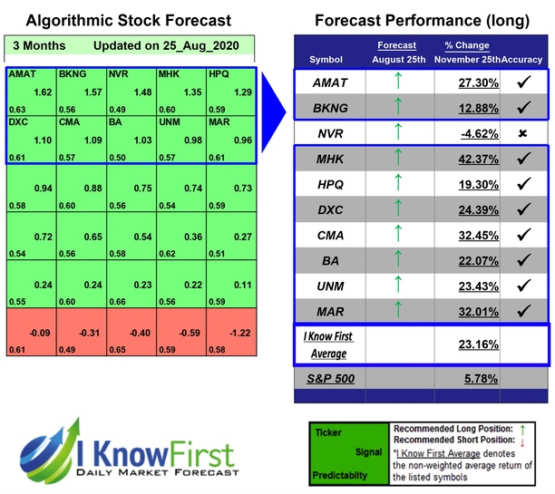

Please note that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts. The light green for the short-term forecasts is mildly bullish while the darker green is a strong bullish signal for the one-year forecast.

Past Success with DXC Stock Forecast

On November 5th, 2020 the I Know First algorithm recommended DXC as one of the Top S&P 500 stocks package. The AI-driven stock forecast was successful on the 30 days horizon resulting in a 30.83% gain since the forecast date.

Moreover, on August 25th, 2020 the I Know First algorithm recommended DXC as one of the Top S&P 500 Stocks package. The AI-driven stock forecast was successful on the 90 days horizon resulting in a 24.39% gain since the forecast date.

To subscribe today click here.

Please note – for trading decisions use the most recent forecast.