Drying Out Dark Pools and Forecasting Trading Volume

This article was written by Julia Masch, a Financial Analyst at I Know First.

Highlights:

- Trading Volume Definition

- Delving Into Dark Pools

- In The I Know First Pipeline: Forecasting Trade Volume

Trading volume of a stock is the quantity of shares or contracts exchanged over a given time period, typically one day. While this number may not seem very significant, it can show a stock’s momentum, confirm a current trend, and can help to indicate whether an investor should buy or sell a stock.

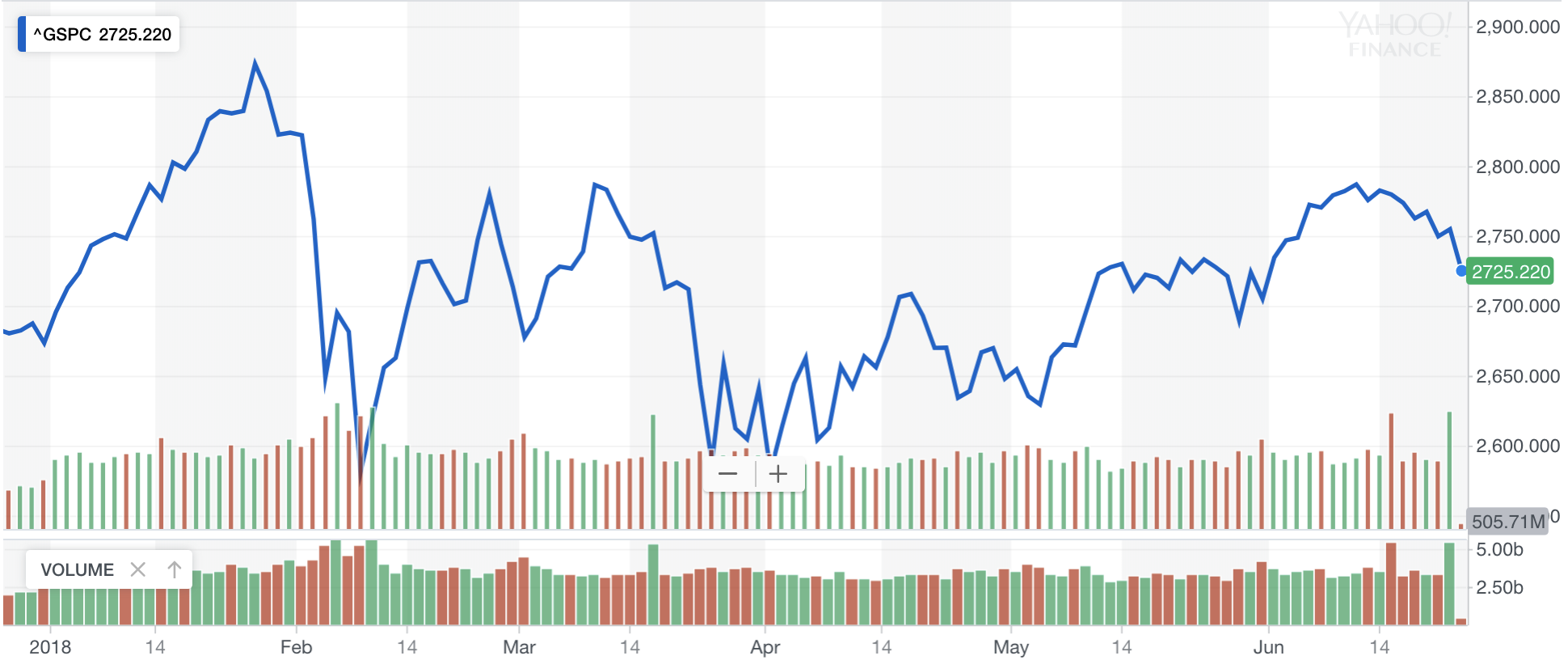

Stock Price & Daily Trade Volume For the S&P 500 (Source: Yahoo Finance)

Stock Price & Daily Trade Volume For the S&P 500 (Source: Yahoo Finance)

If an investor sees that trading volume has been increasing progressively over the past year and is now at the highest volume the company has experienced, this shows the stock is continuing on an upwards trend. On the other hand, low activity can also indicate low interest in the stock and may be a signal to sell that security. If there is no relationship between trading volume and stock price, this could be a sign of weakness in the stock a potential reversal of current momentum. Alternatively, one can also compare the daily trading volume with the average trading volume to come to a conclusion.

While trading volume can be a helpful factor in deciding whether to make a trade, it should be used in conjunction with other valuations of the stock. A possible way trading volume could mislead an investor is if a company releases a fantastic quarterly earnings report. After this release, there will be a huge spike in trading volume as various investors try to get in on the profit. If a clueless investor simply looks at the stock towards the end of the day and sees a higher trading volume and decides to invest, he may be buying an overvalued stock that has already made the majority of its gains from the aforementioned increase in trading volume. While the stock could still potentially increase, it is also possible stock price will fall as the hype surrounding the earnings report dies down. Therefore, it is important to look at other aspects of a stock like its price over the course of the day instead of focusing solely on trading volume.

Delving Into Dark Pools

While trading volume seems to be easily calculable, there are obstacles that make it not as simple as it seems. In the 1980s, the SEC allowed brokers to connect many buyers and sellers to facilitate the trading of large blocks of shares in private exchanges to avoid the transparency of a public exchange which could lead to stock volatility. These off the books block trades are known as dark pools and are only announced publicly after their completion when the stock price will not be affected anymore.

While this type of trading has existed for over 30 years, in the past 15 years it has gained popularity with the development of supercomputers and algorithms that can execute millions of trades in milliseconds based on marginal increases or decreases, also known as high-frequency trading (HFT). As HFT became more and more popular and made bigger and bigger transactions, these block trades would have to be split over multiple exchanges, but the massive quantity of trades would still alert other traders that something was occurring and lead to stock volatility. To ensure liquidity for these large trades, institutions began turning to dark pools to execute this type of large transaction. There has always been some non-public trading since bonds, currencies, and some other assets are not traded on open exchanges, but the inception of dark pools and implementation of HFT has exponentially increased the number of public trades occurring daily. In July 2017, more stocks changed hands in dark pools than on the NYSE.

While it is not very helpful for a common person, dark pools can be extremely beneficial for the parties involved. Primarily, dark pools reduce the impact of massive trades and thus significantly reduce volatility. Additionally, on a private exchange, there can be lower transaction costs for bulk trades. Furthermore, institutional sellers have a higher probability of finding a buyer willing to pay for the entire block of stock instead of splitting it. Finally, if able to avoid leaks, there can potentially by price improvement if the price used for the transaction is between the quoted bid price and quoted ask price.

Not everything about dark pools is ideal. Pool participants can also be negatively impacted by this kind of transaction. The opaqueness of dark pools means there is no way to confirm that a firm is paying the optimal price which can lead to buyers paying higher prices than necessary. On top of this, dark pools obscure conflicts of interest between brokers and buyers and brokers. Even more concerning is the fact that brokers can sell information about dark pool trades to high-frequency traders which makes these trades susceptible to predatory trading practices, thus leading to the volatility the seller attempted to avoid. While there are still larger trades occurring within dark pools, the average trade size is now only 200 eliminating the necessity of dark pools which are not necessary for smaller transactions.

(Source: Celent, Copyright © 2018, Celent, part of Oliver Wyman)

(Source: Celent, Copyright © 2018, Celent, part of Oliver Wyman)

The majority of dark pools are run by investment banks which already have a large advantage when it comes to trading and dark pools only further their advantage.

Drying Out Dark Pools

There has been a lot of controversy over dark pools lately. In December 2016, Deutsche Bank admitted to misleading clients about how their dark pool trades worked and agreed to pay $37 million in response. This is now the only big bank involved in dark pool scandals, Barclays and Credit Suisse were fined over $100 million for similar reasons. The SEC is considering implementing stricter regulations on dark pools similar to those recently established in Europe.

Earlier this year, the European Commission enacted a new version of Markets in Financial Instruments Directive (MiFID II) with stricter regulations on dark pools. Furthermore, on March 7, as part of MiFID II the European Securities and Markets Authority (ESMA) enacted a double volume cap to decrease the amount of trading under certain non-transparent circumstances. Since being implemented, MiFID II has led to a decrease of dark pool trading as companies are now using alternative methods such as block trading to change hands for large amounts of stocks. one of the new methods is using periodic auctions that obscure the transactions until a certain volume of trades have been reached. Turquoise Plato Block Discovery and Cboe Europe Periodic Auction Book have bot. However, MiFID II has not only had positive results; European markets are seeing an exodus of sell-side analysts and the quantity and quality of research on companies has been decreasing as a result. While banks will continue to look for workarounds to the new regulations, the quantity of dark pool trading has lessened since MiFID II has been enforced.

In The I Know First Pipeline: Forecasting Trading Volume

I Know First is currently in the process of adapting its self-learning algorithm to forecast trading volume across future time periods. This will allow subscribers to anticipate large movements in trade volume and beat the crowd. Additionally, it will aid investors in making decisions involving stocks and will allow them to see potential trends in advance. With MiFID II and the SEC considering enacting stricter regulations on dark pools, there will be more transparency about the amount of stocks trading hands and the I Know First machine learning algorithm can become even more accurate with its predictions.